Buy Larsen & Toubro Ltd for the Target Rs.4,200 by Motilal Oswal Financial Services Ltd

Strong beginning for the year

LT’s 1QFY26 revenue/PAT came in 3%/8% above our estimates. Results indicate 1) sharp outperformance on core E&C order inflows at INR766b (our est. INR631b), driven by large order wins in Energy and Infrastructure segments in both domestic and international markets, 2) outperformance on execution with 19% YoY growth (our est. 13% growth), primarily driven by ramp-up in international projects, 3) sustainability of NWC at lower levels of 10.1% of sales and RoE improvement to 17%. However, EBITDA margin remained flat YoY for core E&C vs. our expectation of a gradual improvement. The order prospect pipeline grew 65% YoY to INR15t for the next nine months of FY26. Historically, LT had a hit ratio of 20-25% in the prospect pipeline, and if it maintains this hit rate, LT could grow its order inflows far more than its FY26 guidance of 10% YoY growth. In the GCC region, LT hopes to scale up in areas like renewable, clean energy and transmission projects and correspondingly scale up the execution of existing projects. We marginally increase core E&C revenue estimates and arrive at a revised SoTP-based PT of INR4,200 (from INR4,100 earlier), based on 28x two-year forward earnings for core business and a 25% holding company discount to subsidiaries.

Results ahead of our estimates

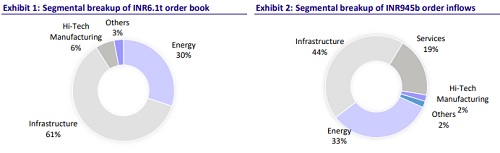

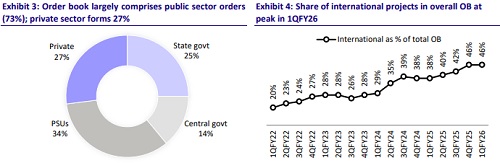

On a consolidated basis, revenue grew 16% YoY to INR637b, while EBITDA rose 13% YoY to INR63b for 1QFY26. Margin was down YoY at 9.9%, while PAT increased by 30% YoY to INR36b (8% beat). For core E&C, revenue/EBITDA growth stood at 19%/19% and EBITDA margin was flat YoY at 7.6%. Revenue growth for core E&C was led by 37% YoY growth in international projects, while domestic revenue growth stood at 6% YoY. NWC to sales improved YoY to 10.1% of sales and RoE improved to 17%. Order inflow grew 41% YoY to INR766b, driven by international geographies (+25% YoY) and large order wins in power BTG. Domestic inflow was up 22% YoY and international project inflow was up 69% YoY during the quarter. The order book was robust at INR6.1t (+24% YoY). The international segment now forms 46% of the overall order book. Within international, 92% comes from the Middle East.

Segmental revenues remained strong from Energy and Hi-Tech segments

* Infrastructure – Order inflow came in line with our estimates, while execution was a bit lower than our estimates. Margins stood at 5.7% vs. our estimate of 6%.

* Energy – Order inflow was sharply above our estimates, with large order wins from multiple BTG packages for carbon-lite business as well as from the Middle East. This segment’s revenue growth was strong at 47% YoY, and margins stood at 7.7% vs. 8.7% in 1QFY25 due to the project mix.

* Hi-Tech Manufacturing – Order inflow for this segment declined YoY due to a high base of orders for precision engineering and systems. Revenue growth was strong at 75% YoY, while margins declined YoY to 15.1% in 1QFY26 from 17.4% in 1QFY25.

* Others segment – Revenue growth was flat YoY at 1%, while EBITDA margin was high at 32.9% in 1QFY26 vs. 23.4% in 1QFY25 on higher sales from realty and a favorable revenue mix.

Prospect pipeline increased by 63% YoY to INR15t for 9MFY26

LT’s prospect pipeline for 9MFY26 stands at INR15t, up 63% YoY, due to a significant increase in Infrastructure and Energy segment prospects. The domestic prospect pipeline is at INR6t, while international stands at INR9t. Growth in international prospect pipeline is driven by areas like onshore, offshore, renewable, transmission and infrastructure. On domestic prospects, LT would be eyeing projects in renewable, power transmission, buildings and factories, metals and mining, etc. Among segments, infrastructure segment prospect pipeline stands at INR8t for 9MFY26 vs. INR6t given earlier for 9MFY25. Hydrocarbon prospect pipeline is also up sharply by more than 100% at INR5.8t vs. INR2.2t for 9MFY25. Historically, LT has a hit ratio of 20-25% in the prospect pipeline (Refer Exhibit 11), and if it maintains this rate, LT could grow its order inflows far more than the FY26 guidance of 10% YoY growth. Our assumption of 10% growth in order inflows for FY26 translates into a hit rate of nearly 17% for the year.

Accelerating green and energy transition initiatives

LT secured the largest green hydrogen supply tender in India and is actively involved in upcoming gas-to-power and clean energy projects through its green energy division. Notably, it has signed a BOT contract with IOCL Panipat for supplying green hydrogen. While green and clean energy is yet to materially impact revenue, it represents a growing INR0.2t prospect pipeline. International markets, particularly the Middle East, account for a bulk of these opportunities, including offshore wind and decarbonization-linked projects. These efforts align with LT’s broader strategy of transitioning toward sustainable infrastructure and future-ready technologies.

International projects have better NWC as compared to domestic

LT has been ramping up international project execution over past few years, which has resulted in NWC cycle coming down to 10.1% by 1QFY26 from 20% in FY22. We believe NWC will remain in a lower range owing to improved customer advances on international projects. Despite a changing business mix of LT in terms of a higher share of international projects in overall order inflows (57% share in FY25) and revenues (44% share in FY25) and a 90bp margin contraction over FY22-25, LT has managed to improve its return profile with efficient working capital.

Valuations and view

At the current price, for core E&C, LT is trading at 27x/22x P/E on FY26/27E earnings. We increase our revenue estimates for core E&C and continue to value the company at 28x P/E two-year forward earnings for core business and 25% holding company discount for subsidiaries. We maintain BUY with a revised TP of INR4,200 (INR4,100 earlier).

Key risks and concerns

A slowdown in order inflows, delays in the completion of mega and ultra-mega projects, a sharp rise in commodity prices, an increase in working capital, and increased competition are a few downside risks to our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412