Buy Indian Hotels Ltd for the Target Rs. 940 by Motilal Oswal Financial Services Ltd

Ending FY25 on strong footing; outlook remains positive

Operating performance in line with our estimate

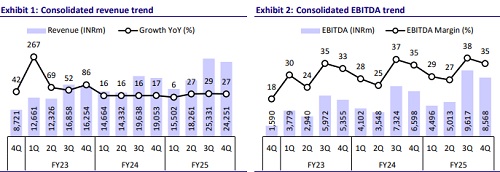

* Indian Hotels (IH) reported strong consolidated revenue growth of 27% YoY in 4QFY25, led by healthy RevPAR growth of 16% (ARR up 14% and OR up 100bp YoY) in its standalone business. Like-for-like consol hotel revenue/ TajSats growth stood at ~13% each YoY. Management contract revenue rose 10% YoY to INR1.6b.

* IH maintains its double-digit revenue guidance, supported by strong structural tailwinds in the industry, with demand consistently outpacing supply. Growth is further driven by rising Foreign Tourist Arrivals (FTAs), increased MICE activity, expanding leisure tourism, and IH’s robust development pipeline. We expect IH to continue its upward trajectory, with revenue/EBITDA/adj. PAT CAGR of 16%/22%/22% over FY25-27E

* We broadly maintain our FY26/FY27 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR940.

New and reimagined business propel operating performance

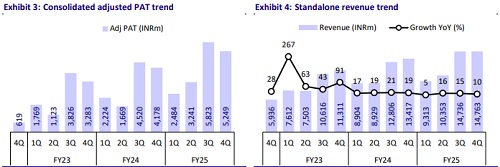

* 4Q consolidated revenue/EBITDA/adj. PAT grew 27%/30%/26% YoY to INR24.3b/INR8.6b/INR5.2b (all in line with estimates).

* Standalone revenue/EBITDA rose 10%/16% YoY to INR14.8b/INR6.8b, aided by OR growth (up 100bp YoY to 80%) and an increase in ARR (up 14% YoY to INR21,013). RevPar grew 16% YoY to INR16,831.

* For subsidiaries (consol. less standalone; including TajSATS), sales/EBITDA grew 68%/2.4x YoY to INR9.5b/INR1.8b.

* IH’s new business verticals, comprising Ginger, Qmin, and amã Stays & Trails, grew 40% YoY to INR6b in FY25, while TajSATs posted 17% YoY growth to INR10.5b. Chambers reported revenue of INR1.5b (+25% YoY).

* FY25 consolidated Revenue/EBITDA/Adj PAT grew 23%/28%/33% to INR83.3b/INR27.7b/INR16.8b. CFO for FY25 was INR21.9b vs INR19.4b in FY24

Highlights from the management commentary

* Demand: The company is well-positioned to sustain double-digit revenue growth, led by strong same-store performance, continued momentum in new businesses, and the launch of 30 new hotels. The company is witnessing healthy 17% growth in YTD FY26 evenly spread across cities. Management expects the sector to grow by double digits in 1HFY26 on a low base.

* Taj Bandstand: The asset will be housed under a subsidiary. Expected road connectivity between Taj Lands End and Taj Bandstand to the Sea Link will boost accessibility and enhance the property’s value. Regulatory approvals are expected soon, with construction likely to commence in the latter half of FY26.

* Capex: IHCL plans to invest over INR12b in FY26 toward a comprehensive asset management and upgrade program, greenfield developments, and enhanced digital capabilities, with a key focus on the iconic Taj brand. Of the above capex, ~60-65% may be incurred toward renovation while the remainder may be incurred toward greenfield projects.

Valuation and view

* The outlook continues to remain strong for IH, led by healthy traction in both the core business and as well as the new and reimagined businesses.

* We expect the strong momentum to continue in the medium term, led by: 1) significant potential in FTA growth, 2) over 70 wedding dates spread evenly through the year, 3) a strong room addition pipeline in management hotels (15,900 rooms), 4) large planned renovations in key assets such as Taj Palace (Delhi), Fort Aguarda in Goa, St James in the UK, and Taj Calcutta, and 5) increased domestic travel led by social events.

* We broadly maintain our FY25/FY26/FY27 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR940.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412