Hotels Sector Update : Still more room to go by Kotak Institutional Equities

Still more room to go

The Indian hospitality sector has started FY2026 on a strong footing, with 1QFY26 RevPARs seeing double-digit growth despite the Indo-Pak conflict impacting demand for some days in May 2025. Hoteliers remain confident in the sustenance of the current cycle, reflected in the record signings of 46k keys in FY2025. India added 14k keys last year, taking the branded inventory to 195k keys. We look to build on FY2025’s ARR of Rs8.6k/day (+7% yoy) and occupancy of 68%, owing to favorable demand-supply dynamics; listed players are even better placed since most new hotel additions are focused on tier-2/3 cities, with a dominant share of mid-scale/economy hotels.

Favorable demand-supply dynamics continue to drive RevPAR improvement

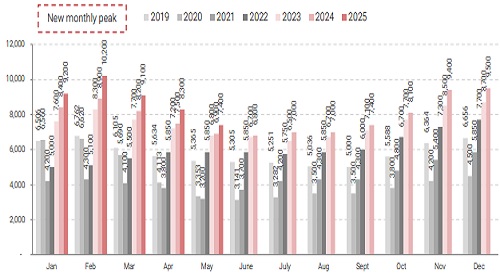

India continues to witness healthy double-digit yoy RevPAR growth in 1QFY26, led by better occupancy levels. We note that the current performance is also supported by a favorable base, as 1QFY25 had weak demand owing to severe weather conditions (heat wave) as well as the national elections. 1QFY26 has had its share of trouble, with the border tensions affecting demand for a few days in May 2025. Hoteliers have alluded to at least high-single-digit rate increase for their contracted business (corporates and crew), even as the uncontracted business (incl. retail) continues to do well. Accordingly, we expect to build further on the FY2025 room rates of Rs8.6k/day (+7% yoy) and occupancy of 68% (flat yoy). February 2025 (generally strong) was the strongest-ever month for Indian hospitality, with ARRs reaching a peak of Rs10,200/day.

New signing picking up, although commissioning has been measured so far

India signed 46k new keys in FY2025, building on the 35k keys signed in FY2024, while the actual supply addition was more measured at 14-15k keys in each of the last two years, taking the overall inventory to 195k keys as of March 2025. We highlight the long gestation period (4-5 years) and execution slippages that will likely keep incremental supply addition measured. We currently expect 6.7% supply CAGR for the industry over FY2025-30E, taking the total branded inventory to 270k keys, while we expect demand (room nights sold) to increase at 8.3% CAGR in the same period. Accordingly, we build in a 6.2% ARR CAGR over this period, with occupancy levels gradually inching closer to 73%.

New supply focused on midscale properties in tier-2/3 cities

The composition of the new supply is substantially in tier-2/3 cities, with limited supply growth in key towns such as Gurgaon at 5.5% (supply) CAGR, Bengaluru at 5%, Mumbai at 3.5%, Hyderabad at 3.4%, New Delhi at 2.1%, Pune at 1.7% and Chennai at 1.3%. Accordingly, listed hotel companies will likely continue to enjoy more favorable demand-supply dynamics in their key markets, with luxury supply even weaker at a mere 6%.

Healthy earnings performance in FY2025; stage set for FY2026 and beyond

Our coverage universe (IHCL, Lemon Tree, Chalet, Ventive, and SAMHI) reported strong earnings performance in FY2025, aided by healthy RevPAR improvement and key additions during the year. Cumulative EBITDA rose 26% yoy, led by IHCL, Chalet and SAMHI, while Ventive saw a tad lower growth. Our coverage added 1.1k owned and 1.8k managed keys (across IHCL and Lemon Tree) in 2025. Going forward, we expect the strong earnings momentum to sustain, aided by industry tailwinds leading to RevPAR improvement and key additions—we expect 20-30% EBITDA CAGR for most coverage companies over FY2025-28E. Valuations are full for most players, leaving stock performance dependent on higher-than-expected ARR improvement.

Average ADRs scaled new peak at Rs10,200/day in February 2025; growth remains healthy in 1QFY26 despite some border tensions

Above views are of the author and not of the website kindly read disclaimer