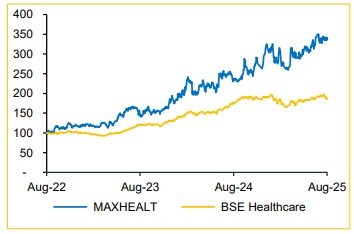

Reduce MAXHEALT Ltd for the Target Rs.1,160 by Choice Broking Ltd

High Capex Likely to Pressure Profitability:

MAXHEALT plans to add ~1,500 beds (1,000 brownfield, 500 greenfield) in FY26, expanding capacity by over 25%. Key projects such as Nanavati, Max Smart Saket and Gurugram are in advanced stages of completion. Brownfield assets typically reach optimal occupancy in ~18 months, with oncology and international patient segments expected to be major growth drivers despite short-term margin pressure.

View and Valuation: We have introduced FY28E projections and forecast revenue/EBITDA/PAT to expand at a CAGR of 26.9%/30.1%/30.4% over FY25– 28E. Valuing the stock on an average of FY27-28E SoTP valuation, we arrive at a revised target price of INR 1,160 (earlier INR 965), change our rating to REDUCE (from SELL). We value Hospitals at 26x EV/EBITDA, 15x to Max Lab and 3x to Max Home (refer Exhibit 2).

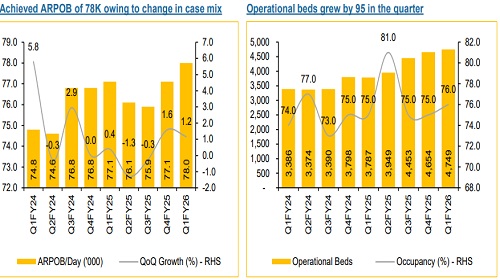

Strong YoY growth, propelled by a rise in OBDs (Occupied Bed Days)

* Revenue grew by 26.9% YoY / 6.5% QoQ to INR 24.5Bn (in line with CIE estimate: INR 24.9Bn), driven by change in case mix.

* EBITDA rose 22.5% YoY and flat on QoQ to INR 6.1 Bn; margins contracted by 90bps YoY and 168bps QoQ to 24.7% (vs. CIE estimate: 25.7%).

* APAT grew by 17.2% YoY and de-grew by 7.3% QoQ to INR 3.6Bn (vs. CIE estimate: INR 4.1Bn), with a PAT margin of 14%.

MAXHEALT to add ~3,300 beds over the next 3 years

The company plans to add ~3,300 beds, through an extensive expansion strategy and targeting a ~58% increase in capacity over the next 3 years.

* FY26: ~1,500 beds are expected to be added through ongoing expansion at key facilities, including Nanavati, Saket Smart, Mohali and Phase 1 of the Gurugram project, along with smaller-scale expansion across existing hospitals.

* FY27: Cumulatively, ~700 beds will be added during Phase 2 of the Gurugram project, Patparganj facility and other locations.

* FY28: In addition to these, the company is also pursuing an asset-light model through built-to-suit agreements. There are plans to commission a 500-bed hospital in Thane, 400 beds in Mohali and O&M of a 200-bed hospital in Pitampura, all situated in high-growth micro-markets, expected to be operational by FY28.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131