Neutral Zen Technologies Ltd for the Target Rs.1,650 by Motilal Oswal Financial Services Ltd

Soft start to the year

ZEN posted weak numbers in 1QFY26, with a miss on revenue and PAT. ZEN’s execution was impacted by design changes in an existing project and lower-thanexpected order inflows so far in FY26. The company expects inflows to start ramping up from 2QFY26, thereby supporting execution. To bake in lower inflows and execution in 1QFY26, we cut our estimates by 22%/18% for FY26/FY27 and revise the TP to INR1,650 (from INR1,850), based on 30x Sep’27E EPS. The stock is currently trading at a P/E of 56.7x/36.2x/27.6x on FY26/27/28E EPS. Our estimates bake in a CAGR of 25%/28% in revenue/PAT over FY25-28 with strong EBITDA margin of 37%. We maintain our Neutral stance on the stock and would look for order inflow announcements for further sustainability of revenues going forward.

Weak set of results

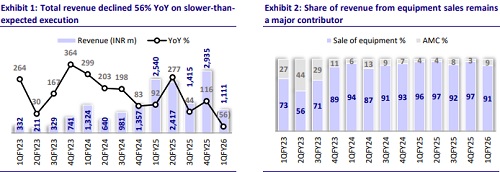

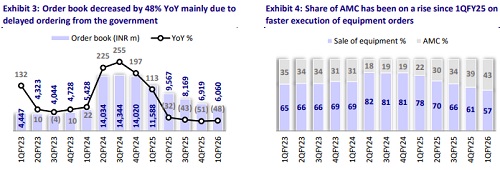

ZEN reported weak results in 1QFY26, with a miss on revenue and PAT. Revenue declined 56% YoY to INR1.1b, due to design modifications in a major equipment order, resulting in deferment of INR500-700m in revenue. Gross margins were 90bp below our expectation at 55.1% vs. our estimate of 56%. Absolute EBITDA fell by 63% YoY to INR380m, resulting in PAT of INR371m, which was aided by higher other income. PAT margin expanded 420bp YoY to 33.4% vs. our est. of 31.4%. As of Jun’25, the standalone order book stood at ~INR6.1b. During the quarter, ZEN acquired shares representing 76% of the total paid-up share capital of TISA Aerospace for a consideration of INR65.6m.

Awaiting procurement normalization

The standalone order book stood at INR6.1b, while subsidiaries contributed INR1.5b to the consolidated order book. Within the standalone segment, INR2.6b was attributed to AMC and the remaining INR3.5b represented equipment orders, which included both simulators and anti-drone systems. Specifically, simulator orders were valued at ~INR2.8b and anti-drone systems at ~INR640m. Management highlighted the possibility of a simulator order worth INR6.5b in 2QFY26, which could materially enhance execution visibility in 2HFY26. However, the current moderation in order inflows reflects a temporary delay in standard procurement activity, as the government remains focused on emergency purchases after Operation Sindoor. While we remain constructive on ZEN’s long-term positioning in high-impact defense domains, the near-term softness in order momentum and execution warrants a cautious stance. We await order inflow announcements over the next couple of quarters for greater visibility on earnings.

Strengthening indigenous IP play with strategic acquisitions.

In Jun’25, ZEN acquired a 76% stake in TISA Aerospace for INR65.6m, marking its entry into the high-growth loitering munitions (kamikaze drones) segment. TISA has previously delivered systems to DRDO and is currently developing multiple variants for the Indian Army. This acquisition complements ZEN’s expertise in anti-drone systems and propulsion, enabling the company to accelerate the development of next-generation loitering munitions. ZEN is also actively investing in product upgrades, targeting commercialization within 12-18 months. The move aligns with ZEN’s strategy of owning indigenous IP in critical defense technologies, enhancing its relevance in modern warfare and broadening its portfolio

Guidance and other updates

Despite a slow start to FY26, management maintains its previous guidance of 50% CAGR in revenue, achieving cumulative revenue of INR60b over FY26-28, with EBITDA margin/PAT margin of 35%/25% across the years. Management expects this to be supported by 1) pick-up of regular procurement cycle; 2) finalization of emergency procurement orders; 3) increased exports across Africa, the Middle East, the US & Latin America, CIS countries, Southeast Asia, and NATO-aligned countries; and 4) inorganic growth led by execution ramp-up of its subsidiaries (revenue of INR1.7b expected from US-based ARI and INR800m from other subsidiaries such as UTS).

Financial outlook

We trim our estimates by 22%/18% for FY26/27 to factor in the impact of the current temporary slowdown on near-term execution. We expect a CAGR of 25%/29%/28% in revenue/EBITDA/PAT during FY25-28. This will be supported by 1) finalization of orders across simulators and anti-drones; 2) EBITDA margin of ~37% for FY26-FY28, and 3) control over working capital due to improved collections.

Valuation and view

The stock currently trades at 56.7x/36.2x/27.6x P/E on FY26/27/28E earnings. While we remain positive about the company and its ability to capitalize on upcoming demand for simulators and anti-drones, our estimates and current valuations capture the positives related to upcoming orders and correspondingly a 28% PAT CAGR over FY25-28. We factor in 1Q performance and arrive at a revised TP of INR1,650 (from INR1,850 earlier), based on 30x Sep’27E earnings. Reiterate Neutral.

Key risks and concerns

Any slowdown in procurement from the defense industry, especially for simulators, can expose the company to the risk of reduced order inflows and hinder its growth. ZEN is also exposed to foreign currency risks for its export revenue. High working capital can also pose risks to cash flows, as historically, its working capital has remained high due to issues related to high debtors and high inventories. This is likely to come down due to improved collections and lower inventory, as per management. However, any delays in the same can affect cash flows for FY26

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412