Buy Dalmia Bharat Ltd for the Target Rs.2,660 by Motilal Oswal Financial Services Ltd

Margin improves due to price hikes and lower input costs

Anticipates industry volume growth at ~6-7% YoY in FY26

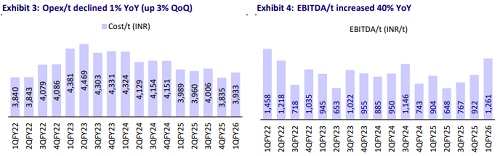

* Dalmia Bharat’s (DALBHARA) 1QFY26 EBITDA grew ~32% YoY to INR8.8b (9% beat, led by lower-than-estimated opex/t). EBITDA/t increased 40% YoY to INR1,261 (~12% above our estimate), and OPM expanded 5.8pp/4.9pp YoY/ QoQ to ~24% (vs. est. ~22%). Adjusted profit (adjusted for reversal of provisions) surged ~66% YoY to INR3.7b (~15% above our estimates).

* Management indicated cement demand growth of ~6-7% YoY in FY26, led by increased government spending and a recovery in the housing sector, despite a soft start to 1Q. Cement prices in its core markets have seen a healthy recovery and held steady despite the monsoon season. The company believes prices will hold well at these levels in the near term. Management also laid out its (clinker-backed) capacity expansion plan of 14.0-14.5mtpa across the South and Northeast markets to increase its grinding capacity to ~64mtpa by FY28 from 49.5mtpa currently. DALBHARA reiterated its aspiration to become a pan-India player in the medium to longer term.

* We raise our EBITDA estimate by ~6% for FY26, while we maintain the same for FY27. We also introduce our FY28 estimates with this note. We value the stock at 13x Jun’27E EV/EBITDA to arrive at our TP of INR2,660. Reiterate BUY.

EBITDA/t improves 40% YoY to INR1,261 (vs. est. INR1,126)

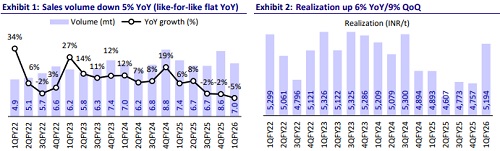

* DALBHARA’s consolidated revenue/EBITDA/adj. PAT stood at INR36.4b/ INR8.8b/INR3.7b (flat/+32%/+66% YoY and -3%/+9%/+15% vs. our estimate) in 1QFY26. Sales volume declined ~5% YoY to 7.0mt. However, adjusted for the JPA volume of 0.4mt in the base, volume was flat YoY. Realization improved ~6%/9% YoY/QoQ to INR5,194/t.

* Opex/t declined 1% YoY, led by ~7% reduction in variable costs/t. Other expenses/Staff costs/Freight costs per ton increased ~7%/5%/1% YoY. OPM expanded 5.8pp YoY to ~24%, and EBITDA/t increased 40% YoY to INR1,261. Depreciation/interest cost increased ~2%/14% YoY, whereas other income declined ~2% YoY. ETR stood at 24.5% vs. 16.0% in 1QFY25.

Highlights from the management commentary

* DALBHARA is consistently working on brand building, deepening the distribution network, and improving price positioning. The company’s NSR has improved ~9% QoQ in 1FY26. In the near term, management will continue to balance volume growth and profitability.

* Management is committed to a cost reduction of INR150-200/t over the next two years. It believes cost savings from 1) renewable energy will kick in from 2HFY26, and 2) logistics optimization will accrue from 4QFY26.

* Capex is pegged at INR40b for FY26/FY27 each (incurred INR6.12b in 1QFY26); of this, ~70-75% will be towards growth and expansions, while the rest will be for renewable energy, maintenance, and cost efficiency measures.

Valuation and view

* DALBHARA’s operating performance was above our estimates, led by better cost control. Though volumes were slightly below estimates. We believe the resilient pricing in its core markets (East and South) and a likely recovery in cement demand post-monsoon will help the company drive healthy OPM. Further, the company announced expansion plans to fuel its medium-tolong-term growth and remain competitive in its core markets.

* We estimate a revenue/EBITDA/PAT CAGR of 10%/22%/31% over FY25-28. We also estimate a volume CAGR of ~7% over FY25-28 and an EBITDA/t of INR1,130/ INR1,170/INR1,210 in FY26/FY27/FY28E vs. INR820 in FY25E (avg. EBITDA/t of INR1,070 over FY20-24). At CMP, the stock is trading attractively at 12x/11x FY26E/FY27E EV/EBITDA and USD101/USD91 EV/t. We value DALBHARA at 13x Jun’27E EV/EBITDA to arrive at our TP of INR2,660. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412