Buy Kolte Patil Developers Ltd for the Target Rs. 488 by Motilal Oswal Financial Services Ltd

Operations lag as new management yet to take full control

Operational update

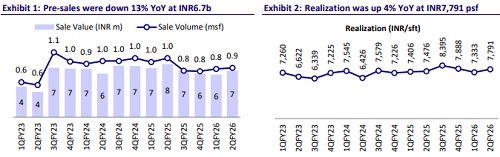

* KPDL achieved presales of INR6.7b in 2QFY26, down 13% YoY and up 9% QoQ (41% below our estimate), due to the absence of launches in the quarter. In 1HFY26, presales were at INR12.9b, down 13% YoY.

* Area sold in 2Q was 0.86msf, down 17% YoY but up 2% QoQ (45% below our estimate). In 1H, volumes were at 1.7msf, down 15% YoY.

* KPDL’s flagship integrated township project, Life Republic (LR), registered sales volumes of 0.51msf in 2Q and 1.03msf in 1H.

* Average sales realization stood at INR7,791/sqft, up 4% YoY and 6% QoQ. In 1HFY26, realizations were at INR7,565/sqft, up 2% YoY.

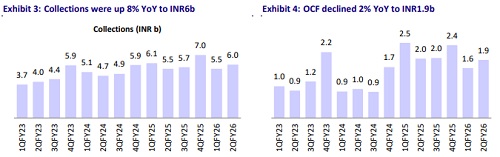

* Collections were at INR6b, up 8% YoY and 8% QoQ (19% below estimates). In 1HFY26, they were at INR11.5b, down 1% YoY.

* In Oct’25, KPDL acquired 7.5 acres of land in Bhugaon, Pune, with an estimated saleable area of ~1.9msf with a GDV of INR14b.

* Operating cash flow stood at INR1.9b, down 2% YoY. In 1HFY26, it stood at INR3.6b, down 20% YoY.

* KPDL’s debt-to-equity ratio stood at 0.13x as of 2Q end. Excluding zero-coupon bond NCDs, the company was net cash at 0.3x.

* P&L performance: 2Q revenue stood at INR1.4b, -55% YoY/+68% QoQ (80% miss). In 1HFY26, revenue was INR2.2b, down 66% YoY.

* 2Q EBITDA loss stood at INR372m vs. profit of INR162m YoY. In 1HFY26, EBITDA loss was INR632m vs. profit of INR440m YoY.

* 2Q PAT loss came in at INR104m vs. profit of INR97m YoY. In 1HFY26, PAT loss stood at INR274m vs. profit of INR160m YoY.

Key highlights from presentation

* Business development activity has gained strong traction, and the momentum is expected to accelerate further in FY26. In 2Q, KPDL acquired 7.5 acres of land in Bhugaon, Pune, with an estimated saleable area of ~1.9msf with a GDV of INR14b.

* Completions were at ~1msf in 2QFY26.

* Launches: There were no new launches in 2Q. The launch of Laxmi Ratan - Versova in Mumbai is expected in FY26. In Pune, NIBM and Wadgaon project (divided into three to four phases) with Phase 1 of 1.5msf are scheduled to be launched this year. Overall, Pune is expected to see 5-5.5msf of launches (INR40b). In total, 6-7msf of area is planned for launch this year (INR50-52b). Other Mumbai projects—Jal Mangal Deep Goregaon, Vishwakarma Nagar, and Jal Nidhi project—are currently in approval stages.

* Unsold inventory currently stands at 2.9msf, of which LR contributes 1.6msf.

* Total remaining GDV potential of ongoing, unsold and upcoming inventory stands at INR253b in Pune, INR39b in MMR and INR2b in Bengaluru.

* Moreover, LR contributed 54% to total pre-sales for 2QFY26.

Valuation and view

* KPDL has reported stagnant pre-sales for the last few quarters. Yet, we expect the company to post a 15% CAGR in pre-sales over FY25-28E. We maintain our BUY rating with a revised TP of INR488, indicating a potential upside of 20%.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412