Buy Tata Consumer Products Ltd for the Target Rs. 1,450 by Motilal Oswal Financial Services Ltd

Healthy revenue growth across segments

Operating performance beats estimates

* Tata Consumer Products (TATACONS) reported ~8% YoY growth in EBIT, marking a recovery after three consecutive quarters of decline. The improvement was driven by strong performance in the India Branded business, which reported 47% YoY growth in EBIT. It was partially offset by a decline of 12% and 28% YoY in the International Beverages and NonBranded businesses, respectively.

* The core India business witnessed the second consecutive quarter of double-digit growth in both tea and salt. Tea business revenue grew 12% with 5% volume growth, while salt revenue grew 16% YoY with 6% volume growth.

* We expect margins to expand in 2HFY26, led by softening tea prices, improving product mix in the tea business (higher sales of premium tea); and the scale-up of the growth business (includes RTD, Tata Sampann, Capital and Organic India; 30% of revenue contribution in 2Q).

* We maintain our FY26/FY27/FY28 earnings estimates and reiterate BUY with an SoTP-based TP of INR1,450.

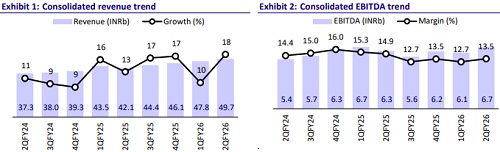

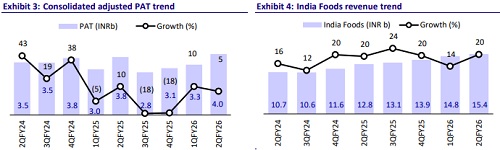

Resilient performance driven by branded and growth portfolios

* Consolidated revenue in 2Q grew 18% YoY to ~INR50b (est. INR48b). EBITDA margin contracted 130bp YoY to 13.5% (est. 13.2%) due to volatility in coffee prices and tariffs, leading to pressure on the international market. EBITDA grew 7% YoY to INR6.7b (est. INR6.3b). Adj. PAT grew 5% YoY to INR4b (est. INR3.7b).

* Indian branded business revenue grew 18% YoY to INR31.2b, led by revenue growth of 15%/20% YoY in the Indian branded beverage/Indian food businesses to INR15.8b/INR15.4b. EBIT grew ~9% YoY to INR5.1b.

* RTD segment (NourishCo) revenue rose ~25% YoY to ~INR1.9b, while volumes recorded a moderate growth of 31%, despite headwinds from unseasonal rains and heightened competitive intensity.

* Growth businesses (including RTD, Capital Foods, and Organic India) reported strong growth this quarter (27% YoY), led by robust growth in RTD (up 25%). Organic India and Capital Foods grew 16% YoY on a combined basis.

* International branded beverages revenue grew 15% YoY to ~INR12.9b, EBIT declined 12% YoY to ~INR1.5b, and EBIT margins stood at 11.5% (down 350bp YoY). Non-branded business revenue increased 28% YoY to ~INR5.9b, while EBIT declined 28% YoY to INR760m.

* In 1HFY26, revenue/adj PAT grew 14%/7% YoY to INR97.4b/INR7.4b, while EBITDA declined by 1% to INR12.8b. ? Gross debt stood at INR5.8b as of Sep’25 vs. INR5.4b as of Mar’25. Further, CFO stood at ~INR2b as of Sep’25 vs. INR2.9b as of Sept’24.

Highlights from the management commentary

* International Business: The international segment grew 9% YoY but margins were impacted by coffee price volatility and Brazil tariffs. Management expects normalization in coffee costs and benefits from upcoming price hikes to support gradual margin recovery over the next 1-2 quarters.

* Core India business: The India branded portfolio maintained strong momentum, delivering double-digit growth in tea and salt for the second consecutive quarter. Softening tea prices, improved product mix in premium tea, and enhanced distribution reach should drive margin expansion in 2H.

* RTD: Despite headwinds from unseasonal rains and heightened competitive intensity, the segment reported a strong performance. Sales growth is expected to pick up in 2H, in line with the anticipated volume growth.

Valuation and view

* We expect TATACONS to maintain its growth momentum, aided by growth in the core India business on the back of new product launches and volume growth in the tea business. Tea gross margins are expected to remain stable at 34-36%. Growth businesses are expected to maintain their strong momentum after the temporary headwinds caused by the GST rate cuts are normalized in 2HFY26.

* We expect TATACONS to clock a CAGR of 9%/12%/16% in revenue/EBITDA/PAT during FY25-28. Reiterate BUY with an SoTP-based TP of INR1,450.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412