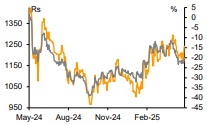

Reduce Global Health Ltd For Target Rs. 1,175 By Emkay Global Financial Services Ltd

Q4FY25: In-line performance

Global Health (Medanta)’s Q4FY25 print was in line with street/our estimates. The Developing portfolio continued its healthy trajectory, as OBD grew 36% YoY (favorable base) while ARPOBs fell 7% on higher contribution of schemebased patients in both—Lucknow and Patna units. Owing to capacity constraint in mature units, the Developing portfolio is likely to contribute bulk of the growth ahead. We expect flat margins overall in FY26, as operating leverage due to ramp up in new units is offset by commissioning of the Noida unit (in Q2FY26). Lumpy bed adds (~2,000 in FY29), owing to the greenfield nature of the expansion, could pose execution-related risks; this would thereby induce volatility in both, growth and profitability, in our view. We expect revenue CAGR of 15% in FY25-28E, as Medanta adds ~33% of its existing bed capacity in coming 2Y. We nudge up Mar-26E TP by ~7% to Rs1,175, based on 25x Mar27E pre IndAS EV/EBITDA (in line with the sector’s) and maintain REDUCE.

Developing portfolio delivers on a favorable base

Medanta reported an in-line set of numbers in Q4FY25, with revenue at Rs9.3bn (+15% YoY). EBITDA was up 25% YoY, with an incremental 200bps YoY expansion and margin at 24.1%. PAT came in at Rs1bn (-20% YoY), due to a one-off impact of the Rs500mn stamp duty due to be paid on merger of its subsidiary with the holding company. Overall ARPOB registered muted growth YoY, with the Developing portfolio’s ARPOBs down 7% YoY. Group OBD increased 13% on the back of ramp up of developing facilities (+36% growth), while OBD in the mature portfolio was muted (+2% YoY). Overall IPD/OPD volumes were up 15%/13% YoY, respectively. International patient revenue was Rs557mn (+17% YoY).

Earnings call highlights

1) New projects: The new Ranchi hospital (110 beds) is expected to be operational in Q1FY26. Preparation of architectural drawings ongoing at its Mumbai (500 beds) and Pritampura (~750 beds) hospitals, which are likely to take 3Y to become operational. Land at Guwahati acquired for ~Rs350mn, for building a new hospital with 400 beds; this is also expected to take over 3 years to commission. 2) The company undertook a nominal tariff hike in its Gurgaon unit, and will be implementing a nominal hike (single digit) at its Lucknow and Patna units (one at a time) in FY26. 3) The merger with MHPL brings in export benefits under the EPCG scheme for the Lucknow unit, reduction in compliance costs, and utilization of Lucknow FCF for the entire company without tax incidence. 4) The management is confident of ramping up its Noida unit on the back of a densely populated addressable market, alongside proximity to Agra, Bareilly, Saharanpur, and Meerut. It also believes that Noida can become a medical hub in coming years, similar to its Lucknow and Kanpur markets. 5) Payor mix for the Developing portfolio is cash/TPA at 90%, with the Lucknow unit now empaneled via ABHA and CGHS schemes.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)

2.jpg)