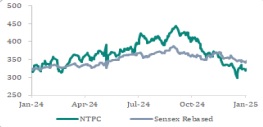

Buy NTPC Limited For Target Rs. 358 By Geojit Financial Services Ltd

Capacity expansion to drive growth

NTPC Ltd owns and operates electricity generation plants that supply power to state electricity boards in India. The company generates power from coal, gas, liquid fuel, hydro, solar, nuclear, wind, and other renewable sources. NTPC has an installed capacity of ~76.5 gigawatt (GW).

* Consolidated revenue from operations grew 5.2% YoY to Rs. 45,053cr in Q3FY25, driven by the strong performance of the generation segment, which accounted for 96.7% of total revenue and registered a growth of 5.6% YoY.

* NTPC’s gross power generation rose to 91.25 billion units (BU) in Q3FY25 from 89.46 BU in Q3FY24, reflecting a steady growth in electricity production.

* NTPC’s coal production saw a significant rise of 35.7%, reaching 10.98 million metric tonnes (MMT), as against 8.09 MMT in the year-ago period.

* EBITDA surged 17.3% YoY to Rs. 14,212cr, driven by a significant 21.6% YoY reduction in other expenses.

* As a result, NTPC’s EBITDA margin improved 320bps YoY to 31.5% in Q3FY25, indicating improved operational efficiency.

* Consolidated PAT declined a slight 0.8%, settling at Rs. 5,170cr, primarily impacted by elevated tax liabilities.

Outlook & Valuation

NTPC is well-positioned for sustained growth, driven by its strategic plans and investments. The company has set an ambitious target to reach 60 GW of renewable energy capacity by 2032 and entered several joint ventures contracts with the potential to develop sustainable new capacity, positioning itself for significant growth in the coming years. Besides, the listing of NTPC Green Energy Ltd also marks a milestone in the company’s growth trajectory. With consistent growth and strategic focus on capacity expansion, NTPC is poised for long-term sustainable growth. Therefore, we upgrade our rating on the stock to BUY based on 9.2x FY27E EV/EBITDA with a rolled forward target price of Rs. 358.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345