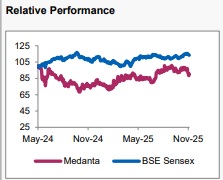

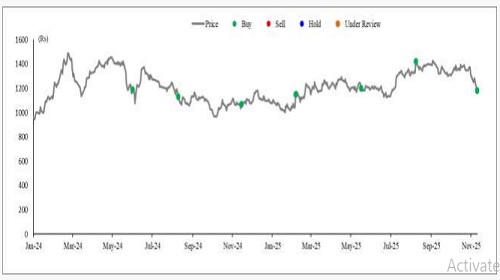

Buy Global Health Ltd For Target Rs. 1,400 - Axis Securities Ltd

Strengthening Network with Noida Launch

Est. Vs. Actual for Q2FY26: Revenue: INLINE ; EBITDA Margin: MISS; PAT: INLINE

Changes in Estimates Post Q2FY26:

FY26E/FY27E: Revenue: -1.9%/-0.8%; EBITDA Abs: -4.7%/-3.3%; PAT: -6.1%/-4.4%

Recommendation Rationale

* Steady Q2FY26 Performance: Medanta delivered a broadly in-line performance in Q2FY26, with revenue of Rs 1,099 Cr, up 15% YoY and 6.6% QoQ. Growth was largely driven by an 8% YoY increase in occupied beds and ARPOB growth of 5.5%. Reported occupancy stabilised at 64% despite new capacity additions in Ranchi and the commencement of operations at Noida. ARPOB stood at Rs 65,570.

* Margins Moderated on Noida Ramp-up: The company reported EBITDA of Rs 231 Cr and margins of 21.0%, down 350 bps and 100 bps YoY/QoQ, impacted by the Newly opened Noida Hospital. It reported Rs 20 Cr EBITDA loss and an additional manpower cost in the Mature Hospital. Excluding Noida, revenue stood at Rs 1,095 Cr with an adjusted EBITDA margin of 22.9%. Reported PAT stood at Rs 158 Cr, up 21% YoY but flat sequentially.

* Network Expansion with Noida: Medanta continued to scale its network during the quarter. The Noida Phase-1 facility ramped to ~300 beds, with 226 beds operational initially, and the Ranchi unit added 110 O&M Beds as part of its expansion in H1. While the Noida unit contributed to an EBITDA loss during the early ramp-up phase, we expect break-even over the next 12 months as occupancy improves toward ~45% and ARPOB stabilises to around Rs 55,000.

Sector Outlook: Positive

Company Outlook & Guidance: Management expects ARPOB growth for mature hospitals to remain in the 3–7% annual range, driven by case mix enrichment and higher complexity rather than tariff hikes. In developing hospitals, ARPOB may show quarterly fluctuations, but the longterm trend is expected to be slightly above inflation, aided by continued ALOS optimisation. The international patient mix in Gurgaon stands at 11–12%, with the Noida facility also anticipated to attract overseas patients. Management believes peak sustainable midnight occupancy for complex-care hospitals is around 70–75%, with a focus on throughput and case mix quality over occupancy levels. The company maintains a strong balance sheet and plans to deploy capital towards greenfield builds, advanced medical technology investments, and selective acquisitions or O&M contracts aligned with Medanta’s quality standards, strategic geographies, and return expectations.

Current Valuation: EV/EBITDA 28x for H1FY28E EBITDA (Earlier 30x/H1FY28E)

Current TP: Rs 1,400/share (Earlier TP: Rs 1,550/share)

Recommendation: BUY

Financial Performance

Medanta reported revenue of Rs 1,099 Cr, up 14.9% YoY and 6.6% QoQ, beating estimates by 4%. Growth was supported by a 5.5% YoY increase in ARPOB, which stabilised at Rs 65,570, and an 8% YoY rise in occupied bed days. Reported occupancy stood at ~64%, despite new bed additions in Noida and Ranchi.

EBITDA came in at Rs 231 Cr, down 1.5% YoY and 1.7% QoQ, with margins at 21.0% (-350 bps YoY, -101 bps QoQ), impacted by annual salary increments and pre-operating costs for Noida. Net profit was Rs 158 Cr, up 10.3% YoY.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633