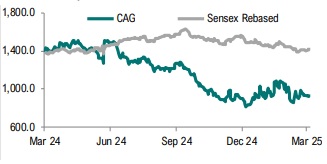

Buy CreditAccess Grameen Ltd For Target Rs. 1,130 By Geojit Financial Services Ltd Ltd For Target Rs. 1,067 By Geojit Financial Services Ltd

Early signs of stabilizing asset quality...

CreditAccess Grameen Ltd. (CAGL) is one of the leading microfinance NBFCs in India with a strong focus on group lending and retail finance. The majority of its operations are in South India.

* The Net Loan portfolio grew at a subdued rate of 4.4% YoY, the lowest in the past 14 quarters, reaching Rs.23,071cr. The loan portfolio has been declining for the last 3 consecutive quarters. Additionally, disbursements decreased by 4.9% YoY to Rs.5,085cr.

* After 8 months of contraction, AUM growth resumed in December 2024. The monthly disbursement rate, which was at 50-60% of the normal trend from July to November, crossed 80% in December 2024 and 90% in January 2025.

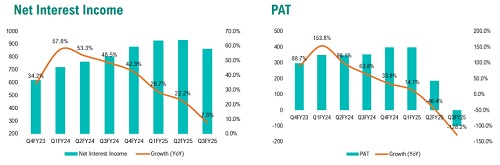

* Net Interest Income (NII) growth decelerated to 7.5% YoY from 48.5% in Q3FY24, reaching Rs. 863 cr. The Net Interest Margin (NIM) has fallen by 100 bps, bringing it down to 12.5% compared to Q3FY24.

* With operating expenses growing at 12.8% YoY to Rs.297.2cr and a reduction in fee and other income, the cost-to-income ratio increased to 31.3% from 29.5% in Q3FY24. The company reported a quarterly loss of Rs. 99.52 cr, as provisions have increased by 495.8% YoY, as the company focuses on accelerated write-offs to address delinquent accounts.

* The GNPA and NNPA increased to 3.99% and 1.28%, respectively, from 0.97% and 0.29% in Q3FY24, indicating significant deterioration across all PAR buckets. Although collection efficiency declined in Q3FY25, it was over 99.2% in December 2024 and has been improving in CY25

Outlook & Valuation

Although the management has reduced the growth guidance for FY25, there are early signs of stabilization in asset quality deterioration across most states, except Karnataka and Tamil Nadu. The implementation of the Karnataka Ordinance in February 2025 initially disrupted collection efficiency. However, it was later clarified that RBI-regulated MFIs were exempt from the ordinance provisions. With the business ramping up to its previous growth trajectory, we remain optimistic about the company's future prospects. Therefore, we are upgrading our rating to Buy with a target price of Rs. 1,130, based on 1.8x FY26E BVPS.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

.jpeg)