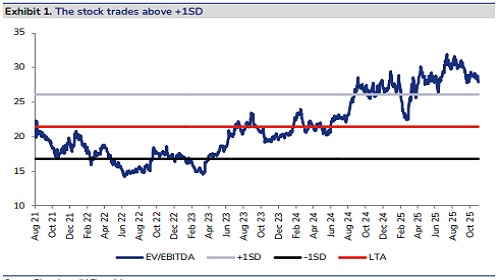

Buy Krishna Institute of Medical Sciences Ltd For Target Rs. 857 By JM Financial Services Ltd

KIMS reported a decent growth (24% YoY) in 2Q, despite being a traditionally weak quarter for the company. This growth was led by mainly Maharashtra cluster which grew 86% YoY with new Thane unit and the addition of three Kerala units during the year. The company also reported healthy growth in AP (+16% YoY) and Telangana (+10% YoY). EBITDA margins at 21.2% were down 682bps YoY, with ~650bps negative impact of newly commissioned 4 to 5 facilities over last few months. PAT too declined 38% YoY. On an operational front, ARPOBs grew 10% YoY and ALOS improved 3% in 2Q. OBDs increased 10% YoY despite occupancies declining 330bps (53.5%) as op beds expanded +16% YoY. Volumes continued to be robust at +15%/+25% for IP/OP respectively. We expect FY26 will be a low margin year, but also anticipate that margins to bounce back in FY27 led by rampup of new assets - Two bangalore, Thane, Nashik and Kerala units. Overall, we expect KIMS to be one of the fastest-growing hospital chains in India, with revenue/EBITDA CAGRs of 29%/32% over FY25-28E. We believe that; (1)The ramp-up of high ARPOB regions like Thane and Bangalore, and (2) improving case mix in AP and Telangana - should improve EBITDA per occupied bed for the company. This would positively influence the valuation. We maintain BUY with Sep"26 TP of INR 857

* Insurance empanelment at new facilities to be wrapped up by 4Q: Insurance empanelment with all top five insurers is progressing and is expected to be completed for all new hospitals by Q4. Insurance empanelment in Thane has started, with one out of five major insurers already onboard, and completion targeted by Q4. In Nashik, two out of five empanelment are completed and the remaining are expected to be closed by year-end.

* CGHS benefits in core cluster: Around 10% of revenues in Maharashtra, Andhra Pradesh, and Telangana come from CGHS business. The CGHS price increase is expected to provide margin benefits starting Q4 FY26. Approximately 60% of incremental revenue, estimated at around INR9mn, should flow through to EBITDA, helping offset the drag from newer hospitals.

* Telangana- Awaiting the new Kondapur asset: Management reiterated that growth will continue in the high single-digit range, in line with historical guidance. Kondapur is seeing strong demand and currently facing bed constraints, leading to patient loss. The company is confident that the new 750–800 bed hospital will ramp up well over the next three to four years, supported by its large format and strong catchment. Although Gachibowli and Kondapur are only 4 km apart, both hospitals serve different catchment areas, reducing the risk of cannibalization. During the first year of Kondapur’s expansion, cost levels will remain dynamic due to onboarding of new specialties such as oncology and transplants. However, the company expects to maintain EBITDA margins in the high-20% range. The newly added bed capacity in Kondapur will be fully commissioned over the next six months. Secunderabad’s rehabilitation will add a further 150–200 beds, strengthening future growth visibility.

* AP- New specialities to drive improved growth: There remains significant growth opportunity in the region, supported by expansion into oncology and mother-and-child services. Management expects growth in the mid-teens, with both IP and OP volumes continuing to increase steadily. The Srikakulam facility is ramping up well with the addition of 150 beds, and margin erosion at Vizag has reduced to a negligible level. These developments have contributed to an improvement in cluster margins. The company believes that margins in the 25–28% range are sustainable. Additionally, the CGHS price increase of 20% on revenues will support further profitability.

* Thane- Margins to improve with scale: Thane hospital ramp-up is progressing, with 80–90 beds occupied in October. Since the hospital was operational for only 45 days in Q2, margins were impacted by a fixed monthly cost of INR120mn and variable cost of about INR30mn on 130 operational beds. As more beds open in phases, margins may remain subdued initially, but the cost impact will gradually dilute. A large part of the doctor cost has already been absorbed to support future bed additions. Thane is expected to break even in the next two months. The full capex for 300 beds is already incurred, and operational capacity will scale up over time.

* Nashik- Awaiting for CGHS licences: Nashik has been operational for one year, though rampup has been slow. The local market has a high dependence on CGHS and related schemes, contributing 35–40% of hospital business. The 17-2B license is expected in the next two months, after which growth should improve as doctors gain confidence. Currently, the payor mix includes 30% cash and 40% insurance, and credit exposure concerns are influencing doctor preferences. Nagpur and Nashik are expected to achieve ARPOB levels similar to each other, consistent with typical tier-2 markets. These locations will likely have around 20% CGHS contribution compared to the lower 5–10% levels in Thane and Bangalore.

* Bangalore- Aiming to break through competitive barriers: Mahadevpuram, which has been operational for two months, is progressing well. The next two quarters will be important to stabilize its performance. In Bangalore, the competitive intensity remains high with large players present in the market. KIMS expects to perform better by leveraging its strong talent pool and by addressing the distinct dynamics of each micro-market within the city.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361