Sell MRPL Ltd For Target Rs. 105 by Motilal Oswal Financial Services Ltd

Earnings to remain weak amid a sluggish refining cycle

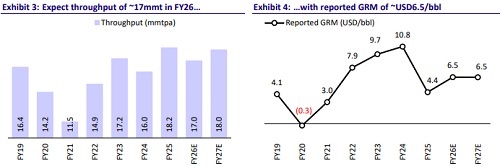

* MRPL’s 4QFY25 EBITDA beat our estimates by 34%, as reported GRM came in ~USD1/bbl above our estimates at USD6.2/bbl. Adjusting for inventory gain, core GRM stood at ~USD5.8/bbl. However, PAT was affected by a higher-thanestimated tax rate. Refining throughput was in line with our estimate at 4.6mmt.

* Singapore GRM has weakened further in Apr’25TD, averaging USD3/bbl (vs. USD3.2/bbl in 4QFY25). We have a bearish stance on refining over FY26-1HFY28 due to strong ~2.5-3mb/d net refinery capacity additions globally over CY24-26, demand concerns led by rising trade tensions, and possibilities of a global macroeconomic slowdown.

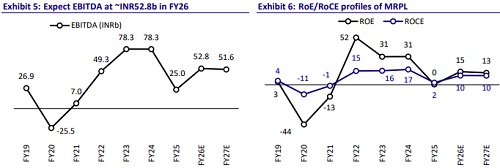

* MRPL currently trades at 6.5x 1yr. fwd. EV/EBITDA and 1.7x 1yr. fwd. P/B. We value the stock at 5x FY27E EBITDA of INR51.6b to arrive at our TP of INR105. Reiterate Sell.

GRMs to remain rangebound at USD6-6.5/bbl; planned shutdown ahead

* In the 4QFY25 earnings call, MRPL’s management guided GRMs to remain in the range of USD6.0-6.5 per bbl. Further, while current marketing margins are higher, the company expects INR3/lit net marketing margins for MS and HSD in the long term.

* While MPRL posted the highest-ever refinery throughput of 18.2mmt in FY25, FY26 throughput is likely to be ~17mmt, amid planned refinery shutdowns.

Robust retail outlet expansion; INR10b p.a. capex guided for FY26/27

* During FY25, the company achieved marketing volumes of 230tkl, driven by robust growth in HSD volumes. MRPL targets to achieve 300tkl+ volumes in FY26. Further, while 170+ retail outlets are operational currently, 150+ retail outlets are planned to be added in FY26.

* Management guided a capex of INR10b p.a. during FY26-27. About 50% of the capex shall be spent towards refineries (shutdown capex and replacements). The remaining 50% shall be spent on marketing, power infra, and other projects. The company shall continue to incur capex on valueadded products.

FY27 GRM estimate cut to USD6.5/bbl; FY26 throughput moderated

* We have a bearish stance on refining over FY26-1HFY28 due to strong ~2.5- 3mb/d net refinery capacity additions globally over CY24-26, demand concerns due to rising trade tensions, and possibilities of a global macroeconomic slowdown. We forecast SG GRM to average USD5/bbl in both FY26 and FY27. Hence, we cut our FY27 GRM assumption to USD6.5/bbl (USD7/bbl earlier). Further, we reduce MRPL’s FY26 throughput to 17mmt, accounting for planned maintenance (earlier: 18mmt).

* We believe that our FY26/FY27 GRM assumptions are at the higher end of what the company has delivered historically and provide further downside risk to our EBITDA estimates.

* Following this earnings revision, our revised TP stands at INR105, premised on 5x FY27E EV/EBITDA.

* We believe a strong FCF generation of ~NR76.6b over FY26-27 and a debt reduction will result in a decline in the net debt-to-equity ratio to 0.5x by endFY27 (vs. 1x on 31 Mar’25).

* However, at 1.7x FY26E P/B (FY26E RoE: 14.5%), we believe valuations for MRPL remain elevated.

Beat on EBITDA and PAT driven by higher-than-estimated GRM

* While MRPL’s 4QFY25 refining throughput was in line with our estimates at 4.6mmt, reported GRM came in above our estimates at USD6.2/bbl (our estimate of USD5.3/bbl).

* The resultant EBITDA stood 34% above our estimate at INR11.2b.

* PAT came in 103% above our estimate at INR3.6b.

* Profitability was also improved slightly by a forex gain of INR86m. However, the actual tax rate stood above our estimate.

* In FY25, net sales grew 5% to INR947b, while EBITDA/PAT stood at INR25b/INR506m (vs. INR78.3b/INR36b in FY24).

* Other highlights:

* The Distillate yield reached a new peak of 81.93%, representing an improvement over the previous high of 78.77% recorded in FY24.

* The highest-ever production of ATF/Benzene, at 2.72mmt/0.21mmt, was achieved during FY25, along with the record aromatic complex output of Reformate/95RON MS at 1.20mmt (previous best: 0.83mmt).

* Bitumen train and PFCC wet gas scrubber projects were commissioned during the year.

* The Devangonthi Marketing Terminal was commissioned, with dispatch of all three products (MS, HSD, and ATF) commencing during the year. Additionally, 66 new retail outlets (ROs) were commissioned, bringing the total to 167 ROs, including three new ROs in Tamil Nadu.

Valuation and view

* The stock is currently trading at an FY26E EV/EBITDA of 6.3x. Additionally, the dividend yield is expected to be a meager 1.7% in FY26 at the current price. Our GRM assumptions of USD6.5 per bbl for both FY26 and FY27 are also at the higher end of what the company has delivered historically.

* We value the stock at 5x FY27E EBITDA of INR51.6b to arrive at our TP of INR105. We reiterate our Sell rating on the stock, implying a 23% potential downside from the CMP.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412