Sell MRPL Ltd for the Target Rs.100 by Motilal Oswal Financial Services Ltd

Plant shutdown and inventory losses weigh on 1Q

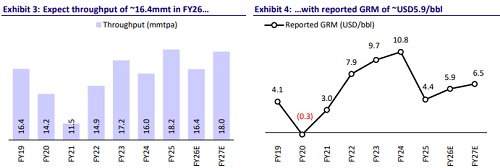

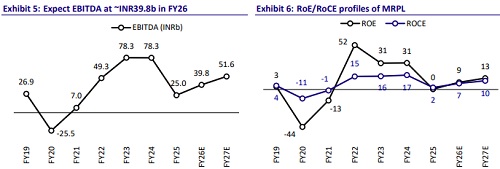

* MRPL’s 1QFY26 EBITDA came in significantly below our estimate, as its reported GRM of ~USD3.9/bbl was lower than our estimate of USD7.5/bbl. Adjusting for inventory gains, core GRM stood at ~USD5.9/bbl. MRPL reported a net loss of INR2.7b, as interest expenses stood above estimate and other income was below estimate.

* Singapore GRM remains range-bound, averaging USD4.7/bbl in Jul’25 (vs. USD5.7/bbl in 1QFY26). We have a neutral stance on refining over FY26- 1HFY28 due to strong net refinery capacity additions globally over CY25-26, demand concerns led by rising trade tensions, and possibilities of a global macroeconomic slowdown.

* MRPL currently trades at 6.3x 1yr. fwd. EV/EBITDA and 1.6x 1yr. fwd. P/B. We value the stock at 5x FY27E EBITDA of INR51.6b to arrive at our TP of INR100. Reiterate Sell.

Key takeaways from the earnings call

* As per management, without the impact of shutdown and inventory losses, 1Q GRM would have been around USD8/bbl (inventory loss impact USD2/bbl and shutdown impact USD2/bbl). Management expects GRM to be in highsingle digits in 2Q, supported by stronger middle distillate cracks (~50% of product slate).

* FY26 capex is expected to be INR10b (INR5.4b incurred in 1Q).

* Retail operations contributed margins of INR0.6b during the quarter. MRPL plans to add ~100 retail outlets in FY26, targeting to reach around 300 total outlets. The company targets to achieve retail sales volume of 300+/500tkl for FY26/27 (68tkl in 1QFY26).

* The petrochemicals complex operating in reformate mode contributed about USD0.50/bbl to the overall refining margin.

1QFY26 miss led by lower-than-estimated GRM

* MRPL’s 1QFY26 refining throughput stood below our estimates at 3.5mmt. Reported GRM also came in significantly below our estimates at USD3.9/bbl (our estimate of USD7.5/bbl).

* The resultant EBITDA stood 86% below our estimate at INR2b. ? MRPL reported a net loss of INR2.7b, as interest expenses stood above estimate and other income stood below estimate.

* Profitability was impacted by a forex loss of INR180m.

* During the current quarter, the company reviewed and revised its accounting policy for PPE concerning corporate environment responsibility (CER) obligations related to specified projects. This change led to a net increase of INR61m in loss before tax.

* Shutdown of major units in the Phase-2 complex has been completed.

Valuation and view

* The stock is currently trading at FY26E EV/EBITDA of 6.3x. Additionally, the dividend yield is expected to be a meager 1.7% in FY27 at the current price. Our GRM assumptions of USD5.9/6.5 per bbl for FY26/27 are also at the higher end of what the company has delivered historically.

* We value the stock at 5x FY27E EBITDA of INR51.6b to arrive at our TP of INR100. We reiterate our Sell rating on the stock, implying a 29% potential downside from the CMP.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412