Buy LTIMindtree Ltd for the Target Rs. 6,650 by Motilal Oswal Financial Services Ltd

Kick-starting progress

Breakthrough quarter on growth and margins

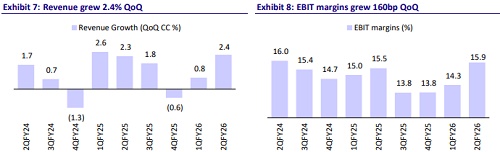

* LTIMindtree (LTIM) reported revenue of USD1.1b in 2QFY26, up 2.4% QoQ CC, above our estimate of 2.0% QoQ CC growth. EBIT margin at 15.9% was above our estimate of 14.9%. PAT stood at INR13.8b, up 10.1% QoQ/10.4% YoY and in line with our estimate of INR13b.

* In INR terms, revenue/EBIT/PAT grew 8.9%/8.0%/10.4% YoY in 1HFY26. In 2HFY26, we expect revenue/EBIT/PAT to grow 11.5%/28.4%/29.4% YoY. With improving revenue visibility and earnings growth potential of 13-15% over the medium term, we upgrade our estimates by 5.1%/3.8% for FY26/FY27. We value LTIM at 31x Jun’27E EPS with a TP of INR6,650, implying an 18% upside potential.

Our view: Growth momentum finds its footing

* Revenue visibility strong for the next three quarters: Management guided for sustained revenue momentum over the next two quarters. A 2.5% CQGR in 2H is expected to bring LTIM’s USD growth exit rate closer to 9%. If the deal win momentum continues, we expect this pace to sustain into FY27E as well; we expect a double-digit growth rate in FY27.

* Margin improvement ahead of expectations: EBIT margin stood at 15.9%, up 160 bps QoQ, ahead of management expectations. The improvement was driven by the ‘Fit4Future’ program (contributing ~80 bps) and currency tailwinds (another 80 bps). Management also guided for a further margin expansion in 3Q. We expect margins to expand by 100/30bps in FY26/FY27.

* Strong deal win performance: Since Mr. Venu has taken over, LTIM's large deal wins have certainly received a shot in the arm, and we saw further evidence of that this quarter. Deal TCV at USD1.59b was up 22% YoY. The new management is doing a commendable job and improving win rates in an uncertain macro.

* In summary, revenue growth has regained momentum, and margin expansion now seems sustainable. This could lead to earnings growth of 13- 15% over the medium term, leading to a potential re-rating.

Valuation and changes to our estimates

* We reiterate our BUY rating on LTIM, supported by its capabilities in data engineering and ERP modernization. The company’s broad-based vertical momentum and sustained deal pipeline support our confidence in ~6% CC revenue growth for FY26E. Margin performance has been ahead of expectations, aided by the ‘Fit4Future’ program, and we expect further expansion over 2H. With improving revenue visibility and earnings growth potential of 13-15% over the medium term, we upgrade our estimates by 5.1%/3.8% for FY26/FY27. We value LTIM at 31x Jun’27E EPS, arriving at a TP of INR6,650, implying ~18% upside

Beat on revenue and margins; Consumer and Healthcare-led vertical growth

* Revenue stood at USD1.1b, up 2.4% QoQ CC above our estimate of 2.0% QoQ CC growth. Reported USD revenue rose 2.3%/4.8% QoQ /YoY.

* Order inflows stood at USD 1.59b, up 22% YoY.

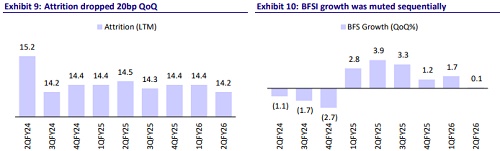

* Consumer Business, Healthcare, and Life Sciences grew 9.1%/10.2% QoQ. BFSI and Technology were flat QoQ.

* EBIT margin at 15.9% was above our estimate of 14.9%.

* Employee metrics: Software headcount increased ~2,600 (3% QoQ), utilization was flat QoQ at 88.1%, while attrition declined 20bp QoQ at 14.2%.

* PAT came in at INR13.8b, up 10.1% QoQ/10.4% YoY and above our estimates of INR13b.

Key highlights from the management commentary

* LTIM remains confident of sustaining growth momentum through 2H, aided by its large deal pipeline and ongoing transformation programs.

* Management highlighted that legacy modernization is witnessing renewed client interest. Market priorities have shifted—clients now seek modernization of data, technology, and infrastructure through vendor consolidation-led large deals.

* The company expects revenue growth to accelerate in the coming quarters and aims to achieve high single-digit to low double-digit growth by FY26-end (in USD terms).

* Total order inflow stood at USD1.59b, up 22% YoY, marking the fourth consecutive quarter of TCV exceeding USD1.5b. The BFSI vertical was a key contributor to the deal momentum.

* LTIM also secured a significant government contract with the Department of Direct Taxes to modernize the ‘PAN 2.0’ infrastructure, which has already begun ramping up and will scale further in 3QFY26.

* Wage hikes are being staggered across two quarters (January and April 2026). The company emphasized cross-skilling and upskilling initiatives instead of a single annual hike cycle.

* Management reiterated confidence in further margin expansion in the coming quarters despite seasonal headwinds.

* Most new deals continue to leverage vendor consolidation opportunities, though net-new deal activity also remains healthy.

* Large accounts are undergoing AI-led recalibration, where productivity commitments are built into contracts. Management emphasized that productivity is now the ‘new normal’ until the industry transitions to the next phase of growth.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)