Buy Coal India Ltd for the Target Rs. 480 by Motilal Oswal Financial Services Ltd

In-line performance; higher other income drives APAT beat

* 4QFY25 revenue came in at INR378b (-1% YoY and +3% QoQ), in line with our estimate of INR383b.

* Adj. EBITDA (excluding OBR) stood at INR112b (+5% YoY and -2% QoQ) and was in line with our est. EBITDA/t stood at INR557 (+6% YoY and -6% QoQ).

* APAT came in at INR96b (+12% YoY and 13% QoQ) against our est. of INR87b. APAT was supported by high other income.

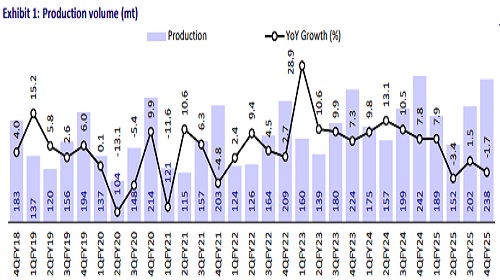

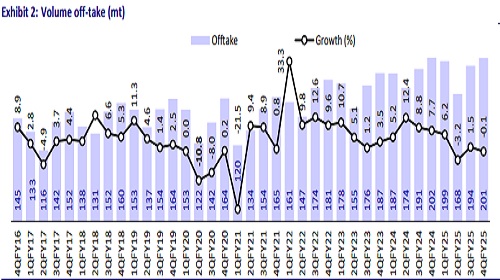

* 4Q production stood at 238mt (-2% YoY/+18% QoQ) and offtake stood at 201mt (flat YoY/+4% QoQ). In 4Q, FSA revenue stood at INR270b (flat YoY) with volume of 175mt (flat YoY) and ASP of INR1,547/t (flat YoY). E-auction revenue came in at INR56b (-2% YoY), led by e-auction volume of 22mt (-4% YoY) and ASP of INR2,615/t (+3% YoY), translating into 69% premium to FSA.

* In FY25, revenue stood flat YoY at INR1433b, while adj. EBITDA declined 3% YoY to INR430b. Adj. PAT declined 5% YoY to INR354b.

* FY25 production volume stood at 781mt (+1% YoY) and offtake at 763mt (+1% YoY).

* The company declared a final dividend of INR5.15 per share, with a total dividend payout of INR26.5 per share in FY25.

* COAL commissioned a 50 MW solar power plant at Nigahi in NCL in Nov’24 and started operations from Apr’25 at the largest non-coking coal washery (Valley Washery at MCL) of 10mtpa.

* The company has incorporated a new subsidiary, Coal Gas India, on 25th Mar’25, marking its foray into the coal-to-chemical segment. The venture is a collaboration with GAIL (India) with a shareholding structure of 51% (COAL) and 49% (GAIL). The venture aims to establish a state-of-the-art coalto-synthetic natural gas (SNG) plant in the ECL command area.

Valuation and view

* COAL delivered a decent performance in 4QFY25 after a muted show in 1HFY25. The e-auction premiums softened during FY25, which got offset by better e-auction volume (~10% share to total sales volume).

* The company’s focus on increasing coal-washer capacity will improve its market share in domestic coking/non-coking coal. Further, management is focusing on the expansion of coal mines, which would be funded via internal accruals, or COAL might borrow to undertake certain projects.

* For FY26/FY27, we largely maintain our estimates and expect volumes to improve, which would boost earnings performance. The e-auction premium is expected to remain stable at 70% going ahead.

* We expect COAL to clock an 8% volume CAGR during FY25-27. This would translate into 11% revenue and 14% EBITDA CAGRs. At CMP, the stock is trading at 3.3x FY27E EV/EBITDA. We reiterate our BUY rating with a TP of INR480 (premised on 4.5x on FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412