Aluminium futures trade higher on firm demand

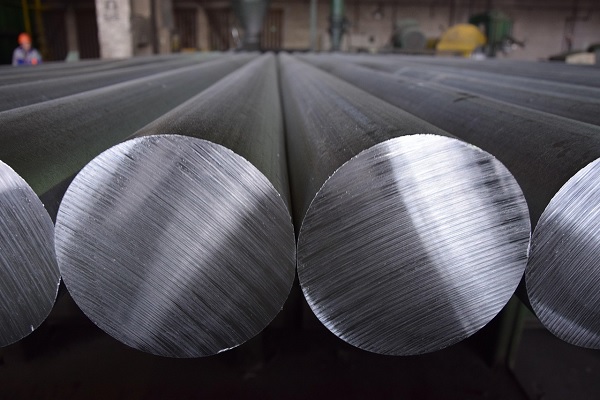

Aluminium futures traded higher on MCX, whetted by the accumulation of portfolios tracking firm demand from domestic as well as international markets. Tighter supply for manufacturers and narrowed inventory positions also fuelled the upward trend. Meanwhile, peaked energy costs, bauxite sourcing difficulties, equipment failure, and geopolitical risks suspended key smelters in other countries including Iceland, Mozambique, and Australia.

The contract for January delivery was trading at Rs 317.90 up 0.16% or Rs 0.50 from its previous closing of Rs 317.40. The open interest of the contract stood at 3157 lots.

The contract for February delivery was trading at Rs 322.95 up by 0.40 % or Rs 1.30 from its previous closing of Rs 321.65. The open interest of the contract stood at 2497 lots on MCX.