Buy Dr. Agarwal’s Health Care Ltd for the Target Rs. 460 by Motilal Oswal Financial Services Ltd

Ends FY25 on strong operational performance

55 new centers planned for FY26

* Dr. Agarwal’s Health Care (DAHL) delivered in-line Revenue/EBITDA for the quarter. However, there was a miss on earnings due to higher-thanexpected interest outgo for the quarter.

* DAHL is on a robust growth path, driven by increased traction at existing/mature facilities and the addition of new facilities (17 added in 4QFY25).

* DAHL delivered 17% YoY growth in surgeries conducted during 4QFY25. Interestingly, refractive surgeries almost doubled to 4,882, offering significantly higher realizations compared to cataract surgeries.

* DAHL has crossed the milestone of 100 mature facilities (operational for 3+ years) as of the end of FY25.

* We largely maintain our estimates for FY26/FY27. We value DAHL on an SOTP basis (22x EV/EBITDA for the surgery business, 14x EV/EBITDA for the opticals business, 12x EV/EBITDA for the pharmacy business, adj for a stake in Dr. Agarwal eye hospital/Thind hospital) and arrive at a TP of INR460.

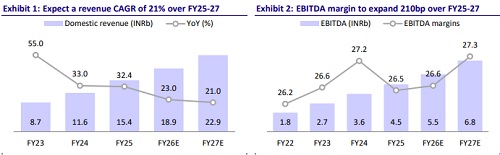

* We expect DAHL to deliver 21%/23%/37% CAGR in revenue/EBITDA/PAT over FY25-27, driven by superior execution in eye surgeries, increasing share of higher realization surgeries, and the addition of newer facilities to expand its reach/enter new regions. The hub-and-spoke model is enabling calibrated investments into micro-markets, helping DAHL outperform the industry. The company continues to pursue inorganic opportunities for faster in-roads into newer markets and is selectively relocating mature facilities to cater to higher demand. Reiterate BUY.

Strong revenue growth; margin tapers on high opex

* DAHL’s 4QFY25 revenue grew 31.9% YoY to INR4.6b (our est: INR4.5b).

* Geography-wise, the Indian business grew 34.2% YoY to INR4.1b. International revenue grew 16% YoY to INR472m for the quarter.

* Mature facilities’ revenue grew 28.9% YoY to INR3.3b for the quarter, while new facilities’ revenue grew 40% YoY to INR1.3b.

* EBITDA margin contracted 180bp YoY to 28.9% (our est: 29.7%), largely due to higher opex (employee cost/other expenses up 70bp/160bp YoY as a % of sales).

* As a result, EBITDA grew 24.2% YoY to INR1.3b (in line).

* DAHL recorded an impairment related to goodwill on a business combination worth INR30m.

* Adjusting for the same, PAT declined 7.4% YoY to INR358m.

* During FY25, Revenue/ EBITDA grew 28.4%/25.1% YoY to INR17b/INR4.5b. PAT was flat YoY at INR830m.

Highlights from the management commentary

* DAHL has guided for Revenue/PAT YoY growth of 20%/35%+ in FY26.

* The same center YoY growth was 14-15% for FY25.

* Average revenue per mature facility in India grew 15% YoY in FY25.

* DAHL will be adding 55 new facilities in FY26.

* About 3 tertiary, 27 secondary, and 25 primary centers will be added in FY26 on an organic basis.

* DAHL entered the Delhi market by establishing a state-of-the-art facility spanning 9,000 sq. ft. The tertiary facility offers a complete spectrum of eye care services under one roof.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)