Buy Kajaria Ceramics Ltd for the Target Rs. 1,451 by Motilal Oswal Financial Services Ltd

Flat tiles volume; healthy margins drive a PAT beat

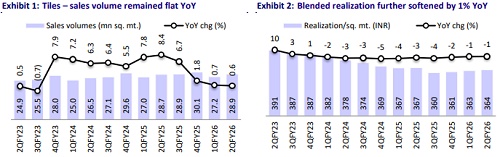

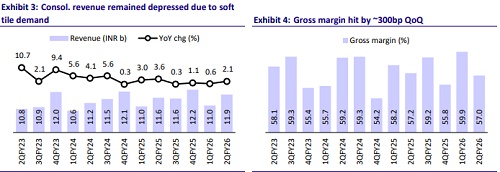

Tiles’ volume/revenue/EBITDA/PAT grew 1%/2%/31%/58% YoY in 2Q

* Kajaria Ceramics (KJC) reported another quarter of strong margins, whereas its tile volume and revenue were flat owing to soft demand conditions.

* Bathware and Adhesives’ revenue grew ~14% and ~77% YoY, respectively, and contributed ~11% to the total revenue.

* EBITDA margin surged 390bp YoY and 110bp QoQ to 18%, aided by softer gas costs and cost optimization measures. The extent of improvement was higher than our expectation of a 20bp QoQ expansion.

* PAT, up 58% YoY, was driven by higher EBITDA and other income (up 57% YoY).

* Net cash level improved INR1.7b to reach INR5.93b in 1HFY26, fueled by healthy operating performance.

Key highlights from the management commentary

* Despite soft demand, margins continued to expand in 2QFY26, aided by softer gas costs and cost optimization measures.

* KJC anticipates some volume growth in 3Q owing to the festive-driven demand.

* Management’s focus remains on healthy margins and cash flows, despite the soft demand environment.

* The company is undertaking various cost optimization measures, which will sustain margins at elevated levels. Key areas of cost restructuring include 1) re-engineering of packing boxes, 2) tightening the sourcing of outsourced products and raw materials, and 3) unification of the sales team for all tile verticals together.

* KJC has appointed a consultant to drive market share gains by rationalization of dealerships and channel expansion.

* Management would focus on driving project sales and strengthening market share in the retail channel.

* The price difference between KJC and Morbi players remained at ~20%.

* Tile exports from India marginally increased in 1HFY26 and are estimated to be ~INR180b in FY26.

Valuation & view: Assuming coverage with a BUY rating

* In line with soft demand and a healthy margin guidance, we expect 9%/10%/ 21%/36% CAGR in tiles’ volume/revenue/EBITDA/PAT over FY25-28 (FY19- 25: 6%/8%/5%/3%). We also project ~18% RoE, 25% RoCE, 36% RoIC, and more than INR5b annual FCF for the company.

* Despite operational challenges in the near term, structural drivers are intact in the medium to long term.

* We assume coverage on KJC with a BUY rating and a TP of INR1,451, based on 35x Sep’27 P/E (10-year average).

* Recovery in tile volumes and sustenance of high EBITDA margin (17%+) are the key near-term monitorables.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412