Buy Jindal Steel Ltd for the Target Rs. 1,200 by Motilal Oswal Financial Services Ltd

New capacity addition to drive earnings

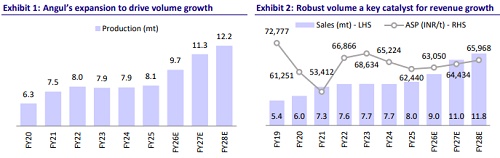

* Jindal Steel (JINDALST) has successfully commissioned a new 3mtpa of crude steel capacity at its Angul plant, expanding the plant’s total steelmaking capacity to 9mtpa. Another 3mtpa expansion at Angul is scheduled for commissioning in FY26, which will bring JINDALST’s total capacity to 15.6mtpa (vs 9.6mtpa). This expansion will position JINDALST as the fourth-largest steel producer in India. Supported by the incremental capacity and improving domestic demand, we expect the company to witness ~14% CAGR in volume. Coupled with steady NSR growth, revenue is projected to witness a 17% CAGR over FY25-28.

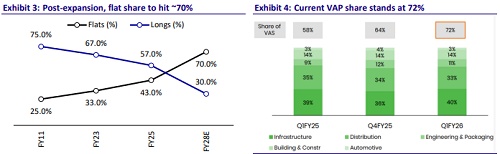

* JINDALST’s VAP share stands at ~72% as of 1QFY26, and in the near term, this may moderate to ~50% with the addition of new steel capacity. However, the commissioning of the CRM complex and VAP enhancement projects will favorably improve the product mix.

* JINDALST is implementing several cost-effective measures to boost operating margins, including: 1) strengthening raw material integration, 2) increasing the captive power share, 3) raising the flat steel mix to ~70%, and 4) focusing on VAP. Beyond the Angul expansion, the company has planned an additional INR160b capex over FY26-28 with a focus on enhancing VAP (INR57b), strengthening logistics and supply chain (INR45b), and ensuring operational sustainability (INR57b). With steady NSR and various cost-saving measures, EBITDA/t is expected to increase to INR15,000/t by FY27/28.

* The company has reduced its net debt from INR464b in FY16 to INR114b in FY25, maintaining a net debt/EBITDA ratio of 1.5x as of 1QFY26. Out of the INR310b of ongoing capex, over 75% has already been spent, and the remaining is expected to be deployed in FY26. Moreover, the company has proposed an additional INR160b of sustenance capex over FY26-28E. As a result, we expect it to generate an operating cash flow of ~INR340b over FY26-28, enabling it to comfortably fund its capex (ongoing + proposed) without breaching the net debt/EBITDA target of 1.5x.

Valuations

* The ongoing capacity expansion is expected to increase crude steel capacity by 65% to 15.6mtpa, primarily supporting topline growth. Additionally, the ramp-up of existing coal mines, the commencement of the Utkal block (C and B1 & B2), the slurry pipeline, and the ACPPII commissioning are expected to lower coal costs and support margins. Further, the company’s focus on improving the VAP share (CRM complex + VAP enhancement project) will support NSR.

* JINDALST has followed a prudent deleveraging policy, which has helped the company strengthen its balance sheet. With a strong FCF, we expect the company to maintain its net debt/EBITDA below ~1.5x, even while undertaking ongoing and proposed capex.

* At CMP, the stock trades at 6.9x EV/EBITDA and 1.7x P/B on the FY27 estimate. We reiterate our BUY rating on JINDALST with a TP of INR1,200, based on 8x EV/EBITDA on FY27 estimate.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412