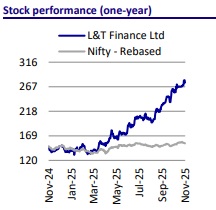

Buy L&T Finance Ltd for the Target Rs. 330 by Motilal Oswal Financial Services Ltd

Engineering resilience and digital engagement

Deep-dive into LTF’s strategy for risk-calibrated growth and profitability

We attended the L&T Finance (LTF) Investor Digital Day 2025, where the company showcased the progress of its digital lending model, AI-driven underwriting platform Cyclops, automated portfolio management engine Nostradamus, Planet 3.0 and Helios (AI underwriting co-pilot). Below are the key takeaways:

* The central theme was LTF's drive to become a "risk first, tech first, multiproduct, retail financier of choice". The event highlighted significant achievements in core business acceleration, the scale-up of proprietary AI systems, cultural transformation, and key financial metrics, particularly strong disbursement growth and improved asset quality indicators.

* LTF demonstrated tangible improvements in credit outcomes, superior customer selection, and better risk-adjusted returns across key businesses. The company outlined strong growth momentum across retail businesses, strategic scaling of digital partnerships, full integration of the newly acquired gold loan business, and strengthening organizational culture with better talent stability and execution accountability at branch levels.

* The company shared that Nostradamus is now live in the 2W business, and the company plans to push Cyclops in personal loans through Nov/Dec’25 while laying the foundation for implementation in rural business loans and mortgage segments.

* Digital partnership disbursements stood at INR11.4b in 2QFY26 and are currently growing at 7-10% monthly, driven by mega partnerships with PhonePe, CRED, Amazon, Google Pay and SuperMoney. The company has also entered the gold loan segment after observing that its microfinance customers had cumulatively borrowed ~INR170b of gold loans from external lenders. The integration of the acquired gold portfolio was completed within three months, and the company now operates ~130 branches, with plans to expand by an additional ~200 by year-end. The strategic intent is to scale a high-yield secured product in a market that is expanding at over 20% CAGR.

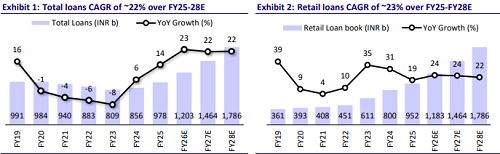

* LTF indicated that its priorities over the next 12-18 months are to announce the Lakshya 2031 goals in 1QFY27, drive 20-25% risk-calibrated AUM growth, improve RoA to 2.8-3% by 4QFY27, develop the Service Intelligence layer, roll out an AI-enabled next-generation collections stack and progressively bring down credit costs toward ~2%.

Integrated digital architecture driving structural RoA expansion

LTF is building a unified, intelligence-led digital and risk architecture that connects customer acquisition, underwriting, portfolio monitoring and servicing into one scalable framework. Proprietary engines such as Cyclops for underwriting and Nostradamus for portfolio surveillance are central to this transformation, enabling the company to lower credit costs, accelerate decision-making, and reduce cost-toserve. In SME, the Helios AI co-pilot automates data extraction and preliminary assessment, sharply reducing underwriter workloads and enabling materially faster TATs—critical in higher-quality, speed-sensitive segments. With AI models increasingly influencing risk selection, collections, field efficiency, and customer servicing across businesses, the technology stack is structurally improving return ratios, allowing the company to expand into better-yielding yet controlled-risk segments without compromising growth momentum.

Cyclops and Nostradamus-led risk interventions delivering measurable asset-quality gains

LTF’s deployment of agentic AI across underwriting and collections is yielding visible improvements in delinquency and credit-cost outcomes. Under Cyclops, gross nonstarters are now less than two-thirds of pre-Cyclops levels, while 30+ dpd rates on Cyclops-underwritten loans have dropped to ~34% of earlier levels—implying potential credit-cost reduction to roughly one-third of previous run-rates. Farmer Finance shows particularly strong traction, with Cyclops-led originations reporting net non-starters (NNS) eight times lower than non-Cyclops pools. Nostradamus is driving higher collections productivity, with pan-India 30+ dpd at 6 MOB in the twowheeler book improving by ~221bp over 12 months. These interventions are reinforcing portfolio stability across retail, farm, and SME segments, underpinning sustained RoA expansion.

Diversified retail engines scaling up with superior operating metrics

Across rural and urban retail businesses, LTF is leveraging its calibrated digital and analytics framework to scale up profitably while maintaining high-quality asset performance. The Micro-Finance and Micro-LAP businesses continue to gain market share, supported by fully digital customer journeys, disciplined underwriting, and consistently superior collection efficiencies (JLG CE ~99.5%, 96% 0-dpd mix). Farmer Finance is witnessing steady improvement as indexed NNS declines sharply to ~35%, while a supportive macro and strong dealer network enhance origination quality. In Urban Finance, stronger Cyclops-led underwriting has reduced GNS to ~57% of Dec’24 levels, improved bounce rates by 41% and delivered higher self-cure rates and improved X-bucket behavior. Mortgages and two-wheelers are also benefitting from better TATs, prime customer mix enrichment, and digital-first governance mechanisms like Project Nostradamus.

Emerging growth vectors: Partnerships, SME and gold finance scaling well

High-quality sourcing partnerships in the unsecured business (PhonePe, CRED, Amazon, Google Pay and SuperMoney) have scaled up rapidly, contributing ~43% of sourcing vs. ~2% a year ago, and significantly improving customer mix and portfolio behavior. Cross-selling now forms ~25% of the unsecured book, supported by enhanced policy frameworks, digital-led collections, and an upgraded onboarding journey. In SME, paperless operations and 200+ automation workflows are improving scalability and risk selection, with cyclops-led pools showing ~160bp better GNS performance. The Gold Finance foray provides a high-yield, secured growth vector within a large addressable market, supported by rigorous asset verification, AI-enabled surveillance, and a planned expansion from 130 to 200 branches by end-FY26. With ambitions to grow gold AUM 10x over two years and roll out integrated Sampoorna branches, LTF is adding a strong, capital-efficient profit engine to its diversified retail franchise.

Valuation and View

* LTF has invested in process automation and customer journeys. This, along with large partnerships with digital behemoths, should lead to stronger and more sustainable retail loan growth. While there is industry-wide stress in non-MFI retail segments like unsecured business loans and micro-LAP, we expect the stress to subside within the next few quarters.

* LTF's relatively better navigation of the MFI credit cycle and diversification into non-leveraged MFI markets demonstrate its resilience and adaptability. Supported by digital partnerships with major players, LTF is poised for sustainable earnings growth in the years ahead.

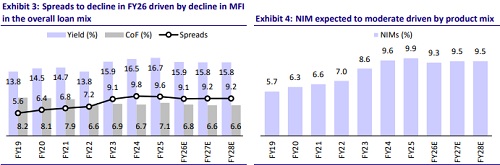

* LTF can deliver a PAT CAGR of ~24% over FY25-28E, which will result in RoA/RoE of 2.7%/15% in FY28E. Reiterate our BUY rating on the stock with a TP of INR330 (based on 2.5x Sep’27E P/BV). Key risks: 1) stress in microfinance lingering beyond the next 3-4 months, 2) asset quality deterioration in relatively vulnerable retail segments such as 2W, unsecured business loans and micro-LAP and 3) any near-term pressure on NIM and fee income

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412