Buy Ashok Leyland Ltd for the Target Rs. 165 by Motilal Oswal Financial Services Ltd

Improved mix drives margin expansion

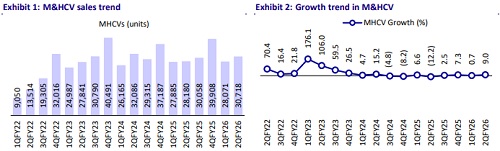

LCV demand revival visible, MHCV likely to follow

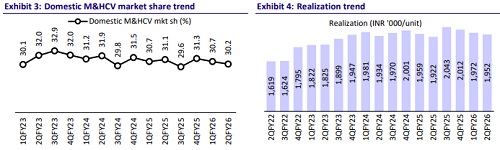

* Ashok Leyland (AL)’s 2QFY26 PAT stood at INR8b. It was 8% ahead of our estimate, primarily driven by a higher-than-expected other income, even as EBITDA came in line. AL’s margin improved 50bp YoY to 12.1% and was a function of improved mix and industry pricing discipline.

* While LCV demand is already showing signs of revival, we expect MHCV truck demand to recover in the coming quarters, aided by a pick-up in consumption pan-India, induced by the recent GST rate cuts. Over the years, AL has effectively reduced its business cyclicality by focusing on nontruck segments. Its continued emphasis on margin expansion and prudent control of capex is expected to help improve returns in the long run. Further, a net cash position will enable AL to invest in growth avenues in the coming years. We reiterate our BUY rating with a TP of INR165 (based on 12x Sep27E EV/EBITDA + ~INR10/sh for NBFC).

Improved mix fuels margin expansion

* AL’s revenue grew 9.3% YoY to INR95.8b (1.5% lower than our estimates) due to lower-than-expected ASP growth. ASP was marginally lower QoQ.

* EBITDA margins expanded 50bp YoY and 100bp QoQ to 12.1% (largely in line with estimates).

* EBITDA margin was supported by a favorable shift in the mix, driven by higher non-CV sales, with spare parts growing 11% YoY, defense business growing 25% YoY, and the power solutions business growing 14% YoY. Within the CV segment, the mix improved with an increase in MAV sales, while exports also recorded strong growth of 35% YoY.

* As a result, EBITDA grew 14.2% YoY to INR 11.6b and was in line with our estimates.

* Overall, Adj PAT (adjusted for litigation expense of INR400mn) grew 16% YoY to INR8b (8% above our estimates) on account of higher than expected other income.

* AL has undergone significant deleveraging over the past 12 months, moving to a net cash position of INR10b vs. a net debt of INR5b in 1HFY25.

Highlights from the management commentary

* While LCV demand is already seeing signs of a pick-up for last-mile distribution, management expects the MHCV demand also to pick up in the coming quarters on the back of a pick-up and expectation of continued pick-up in consumption across the country, which is likely to, in turn, drive higher freight demand.

* The Saathi (LCV) model has been very well accepted and now accounts for 22–25% of total LCV volumes.

* New product introductions in 2H include 1) new tipper models in the MHCV segment, with 320 and 360 HP and higher peak torque, which will help AL recover back its lost share in the segment, 2) in the bus segment, a new 13.5- meter ICE bus along with a 15-meter bus, and 3) in the 2-4T segment, AL would look to launch a bi-fuel product to serve regions such as NCR, Mumbai, etc.

* Exports have grown at 45% in Q2 and 35% in H2. AL targets to export 18k units in FY26E (from 15k units in FY25) and targets to sustain 20% volume CAGR over the next 2-3 years in exports.

* Aided by new product launches and an improving mix towards non-truck sales, management has retained its medium-term guidance of achieving mid-teen margins.

* Switch India has now achieved EBITDA and PAT break-even in 1HFY26, and AL has kept a target for this business to be FCF positive by FY27. Switch India will look to participate in the upcoming 10k+ bus order under the PM-e drive scheme, which will open up soon.

* Capex guidance for FY26E stands at ~INR10b, and investments in as

Valuation and view

While LCV demand is already showing signs of revival, we expect MHCV truck demand to recover in the coming quarters on the back of a pickup in consumption pan-India led by the recent GST rate cuts. Over the years, AL has effectively reduced its business cyclicality by focusing on non-truck segments. Its continued emphasis on margin expansion and prudent control of capex is expected to help improve returns in the long run. Further, a net cash position will enable AL to invest in growth avenues in the coming years. We reiterate our BUY rating with a TP of INR165 (based on 12x Sep27E EV/EBITDA + ~INR10/sh for NBFC).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)