Buy Cummins India Ltd for the Target Rs. 4,950 by Motilal Oswal Financial Services Ltd

Strong broad-based performance

Cummins India (KKC) once again reported a strong set of results with a beat on all parameters. Revenue growth was led by sharp growth in powergen and healthy growth in distribution and exports. The industrial segment was impacted by slow construction activity. KKC has grown its CPCB 4+-related portfolio by 20% YoY, which indicates a healthy YoY volume improvement. We expect KKC to continue to benefit from 1) demand improvement in the powergen segment as industry volumes have now improved back to pre-emission levels, 2) a fairly strong outlook for data centers, 3) improved penetration for the distribution segment, and 4) a gradual recovery in exports. KKC stands far ahead of the competition in terms of overall product offering and distribution reach. We tweak our estimates and roll forward our valuations to 42x Mar’28E earnings. We reiterate our BUY rating with a revised TP of INR4,950.

A strong set of results with an all-round beat

KKC reported a strong set of results with a beat across all parameters. Revenue was up 27% YoY to INR31.7b, beating our estimate by 10%. Domestic sales increased 28% YoY/10% QoQ to INR25.8b (9% above our estimates), whereas export sales increased 24% YoY/4% QoQ to INR5.5b (13% above our estimates). Exports have been continuously increasing since 4QFY24. Gross margin at 37.0% saw a 100bp YoY expansion. This led to an EBITDA margin expansion of 260bp YoY/50bp QoQ to 21.9%. This was higher than our expectation of 20.0%. Absolute EBITDA increased 44% YoY/11% QoQ to INR6.9b, a 21% beat to our estimate. Adj. PAT was up 42% YoY to INR6.4b (21% above our estimates). For 1HFY26, revenue/EBITDA/PAT grew 27%/39%/37%. For 1HFY26, OCF/FCF grew 7%/6% YoY to INR7.4b/INR6.3b.

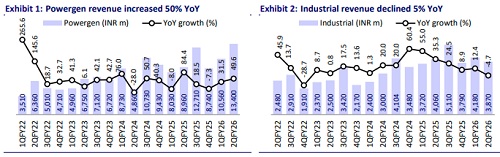

Powergen segment benefiting from strong demand

The powergen segment delivered a strong performance with revenue rising 50% YoY and 27% QoQ to INR13.4b, driven by broad-based demand across low, medium, and high horsepower gensets and the lumpy execution of data center orders. Data centers contributed around 40% of overall powergen sales in Q2FY26, supported by lumpy project execution. Excluding data centers, core powergen sales grew ~20% YoY, led by healthy demand from hospitals, real estate, and commercial buildings. Pricing has largely stabilized post the CPCB IV+ transition, though competitive intensity remains across all horsepower categories. Overall, we expect powergen demand to remain strong, while the data center contribution is likely to normalize over the next few quarters as project execution schedules even out. We expect the powergen segment revenue to clock a 17% CAGR over FY25-28.

Industrial segment hurt by monsoons

Industrial segment revenue stood at INR3.9b, down 5% YoY and 7% QoQ, hit by extended monsoons slowing down construction activity and limited mining tenders. Railways performed well with strong execution, while construction and mining remained soft. Within the portfolio, marine activity picked up on the back of government procurement interest, though it remains a small contributor. The company is also broadening its product portfolio, with the Hotel Load Converter in railways approved for serial production, and sales expected to commence over the next few quarters. We marginally cut our growth assumptions for the industrial segment and expect the segment revenue to clock a 12% CAGR over FY25-28.

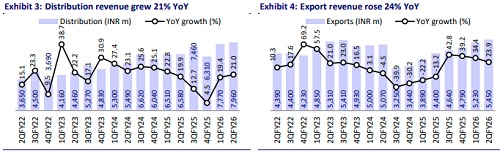

Distribution segment benefiting from strong aftermarket performance

The distribution segment reported revenue of INR8.0b, up 21% YoY and 2% QoQ, reflecting strong aftermarket performance driven by healthy demand across service and parts categories. The company continues to enhance its service capabilities and readiness to support CPCB IV+ compliant engines, which are expected to expand the addressable aftermarket base over time. We expect the distribution segment to record a CAGR of 19% over FY25-28.

Exports continuously improving on a sequential basis

Exports grew 24% YoY and 4% QoQ to INR5.5b, supported by strong demand from Europe and the Middle East across both high- and low-horsepower product lines. High-horsepower exports rose 40% YoY to INR2.8b, while low horsepower increased 11% YoY to INR2.2b. Exports during the quarter benefited from improved order execution and product placement, though channel inventory correction and muted order inflows could weigh on near-term performance. Data center-related exports remain limited, as production for such projects is concentrated near end markets such as the US and Europe. The company remains cautiously optimistic, focusing on regional diversification and operational efficiency to mitigate short-term volatility in global demand. We expect export revenue to clock a 17% CAGR over FY25-28

Financial outlook

We raise our estimates for FY26 and largely maintain our estimates for FY27/28. We expect KKC’s revenue/EBITDA/PAT CAGR of 16%/16%/17% over FY25-28 and build in an EBITDA margin of 21.2%/20.0%/20.1% for FY26/27/28. Our estimates factor in a gross margin of 36% in FY26 and 35% in FY27/28 vs. 36% in FY25, since we expect some gross margin contraction as price levels for CPCB 4+ normalize.

Valuation and view

The stock is currently trading at 49.0x/43.6x/37.4x on FY26/27/28E EPS. We reiterate BUY on the stock with a revised TP of INR4,950 based on 42x Mar’28E earnings.

Key risks and concerns

Key risks to our recommendation would come from lower-than-expected demand for key segments, higher commodity prices, increased competitive intensity, and lower-than-expected recovery in exports.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)