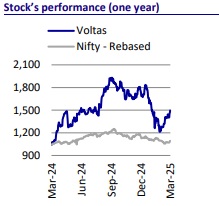

Buy Voltas Ltd For Target Rs. 1,710 by Motilal Oswal Financial Services Ltd

Focus on market share improvement

Volume to be prioritized over margins; growth to be higher than peers

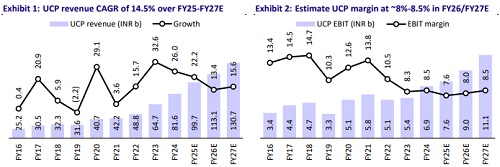

We interacted with the management of Voltas (VOLT) to gain insights into current demand trends, as well as its views on compressors, margins, market share, and more. Management believes that current demand trends for RAC remain strong, and its focus will be on growing faster than its peers. While market share will be prioritized over margins, it aims to increase value engineering to save costs and protect margins, rather than opting for price hikes, which could impact margins. The government has relaxed import norms for compressors above 2 tons (~10% of the industry's volumes) and the industry is awaiting approvals for compressors below 2 tons. We expect VOLT to benefit from a strong start to the summer season and anticipate the UCP segment's margin to be ~7.5% in 4QFY24. We reiterate Buy on the stock with a TP of 1,710 based on SOTP.

Managing compressors for ongoing season; tie-up needed to set up capacity

* Amid concerns over a decline in compressor imports from China during 3QFY25, management has indicated that it has successfully managed the situation for the ongoing summer season through alternate sources. It believes that the government will allow imports to continue until domestic capacities are sufficient to meet the demand.

* VOLT had previously planned to set up compressor manufacturing capacity through a technological collaboration with a Chinese player; however, this plan did not materialize. Under PLI 3.0, the company has announced investments of ~INR2.6b to establish compressor capacity and is currently evaluating potential partners for technological collaboration. If the demand for RAC continues to grow strongly, as seen in FY25, the company will need to fast-track its plans.

* Recently, the government relaxed import norms for compressors of 2 tons or more from China, but this accounts for only ~10% of the industry size. A notification is still awaited for compressors below 2 tons.

Strong RAC demand; focus on protecting market share

* Demand for RAC has started strong in the ongoing summer season of CY25, and the current inventory, along with the tie-up for compressors, will support the company's growth in 4QFY25. The competition is projecting ~30% YoY growth in 4Q, and the company aims to outperform its peers. During Apr'24-Jan'25, the industry grew 30% YoY, while VOLT's RAC volumes grew 35% YoY.

* There have not been material price increases since May-Jun'24. As a mass category player, the focus will be on balancing revenues and profitability (with an emphasis on higher volumes and absolute EBITDA). While some peers have recently implemented price hikes due to cost inflation and rupee depreciation, VOLT will evaluate whether a price hike is necessary. The company will prioritize value engineering and internal cost-saving measures over price hikes.

* Although there was some market share loss in Jan'25, it remains better on a YTD basis. VOLT traditionally has a lower market share in 4Q. The company is working to recoup some of the lost market share and expects to see gains as the Chennai plant ramps up production.

* The Chennai plant is currently operating at 40-45% capacity and is expected to reach optimum levels in FY26. Its Pant Nagar, Uttarakhand plant is operating at 100% capacity (installed capacity is 1.5m units).

* Demand for air coolers grew 80-85% in 9MFY25. The company is aiming for 70- 80% YoY growth in the future and has made several strategic tie-ups. Demand for commercial ACs remained strong throughout the year, with a 12-15% YoY growth in 9MFY25. This segment is expected to record a 15-18% CAGR going forward.

Competitive intensity and view on margins

* There is ample growth opportunity for all players, as current demand remains strong in the South, North, and West markets. Inventory depletion is occurring at a faster pace. VOLT is well-positioned to outperform peers in distribution channels, insourcing, and servicing, which will help improve its market share.

* Copper prices have increased 10-11%, and some compressors are also being sourced at higher prices this summer. The company is working to mitigate the cost impact through value engineering rather than relying on price hikes. The UCP segment's margin is expected to remain in the high single digits.

* Demand for commercial refrigerators remains better in 4Q; however, it is still on the lower side. Margins are also expected to be lower than historical levels and remain in single digits (lower than 8%-9%).

BG encashment for Qatar entity

* Volt informed the stock exchanges in Feb'25 of an expected financial loss of INR4.0b due to an order passed by Qatar Court regarding the encashment of bank guarantees for damages claimed by a party named Joint Venture of OHL International, Spain, and Contrack (Cyprus).

* This order was passed by the lower court, and the company plans to appeal to higher courts against this order. It will decide later whether any provision has to be made for this amount but believes it has strong grounds and that the bank guarantee should not be encashed.

View on VoltBeko

* VoltBeko had envisaged a target market share of 10% and EBITDA break-even by FY26; however, this will be slightly delayed. The company has already achieved a market share of ~15% in semi-automatic washing machines and has a presence in automatic washing machines. Its products are available across various geographies.

Valuation and view

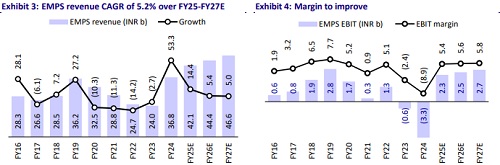

* We expect a CAGR of 12%/20%/23% in Volt’s revenue/EBITDA/adj. PAT over FY25-27. While we estimate the UCP segment’s margin to be in the high single digits, higher volume growth could surprise positively. The company focuses on absolute profitability, sales growth, and optimization of production facilities.

* We reiterate our BUY rating on the stock with an SoTP-based TP of INR1,710, with 50x FY27E EPS for the UCP segment, 25x FY27E EPS for the PES and EMPS segments, and INR22/sh for Voltbek.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412