Neutral Indian Energy Exchange Ltd for the Target Rs. 150 by Motilal Oswal Financial Services Ltd

Robust volume growth; upside risk if coupling delays

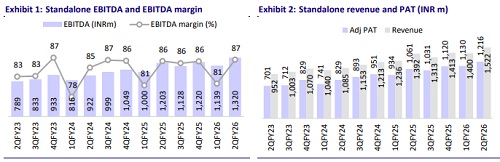

* In-line result; robust volume growth trends continue: Indian Energy Exchange (IEX) reported 2QFY26 standalone revenue of INR1.5b and EBITDA of INR1.3b, both in line with estimates, supported by traded electricity volumes of 35.2BUs, which were also in line with expectations. Standalone PAT was 5% above our estimate at INR1.2b, primarily due to higher other income. IEX’s electricity volumes increased 16% YoY, while renewable energy certificate (REC) volumes saw a dip of 30%.

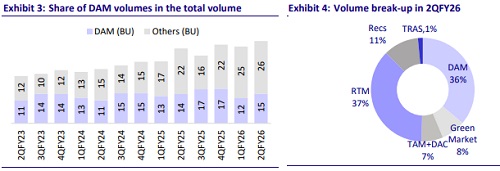

* Risk of earnings upside if market coupling implementation delayed: In light of the Central Electricity Regulatory Commission’s (CERC) announcement of the phased implementation of market coupling in India, starting with the day-ahead market (DAM) (~45% of IEX volumes in FY25) by Jan’26, we had lowered our FY27 earnings estimates by 17% (at the time of the market coupling announcement), factoring in a 30% volume decline and a 10% reduction in transaction fees in the DAM segment. We are now building in volume CAGR of only 7% (ex-REC) over FY26-28. The delayed implementation of market coupling/lower than anticipated market share loss can lead to significant upside risks to our earnings estimates.

* Strong franchise, experienced management: We continue to like IEX for its competitive technological platform, robust new product leadership, and strong management. We expect near-term stock performance to remain under pressure as competitive dynamics (fight for market share, redefining of transaction fees) unfold in the sector.

* Key monitorables in the coming months include: 1) any legal recourse initiated by IEX, 2) practical challenges in operationalizing market coupling in DAM, 3) whether the timeline for market coupling in DAM extends beyond Jan’26, and 4) the roadmap for market coupling implementation in the real time market (RTM) segment.

* Valuation: We value IEX at a 28x FY27E EPS, in line with its long-term average, and reiterate our Neutral rating on the stock with a TP of INR150.

Revenue/EBITDA in line; PAT beats on higher-than-expected other income

* Financial performance:

* IEX reported standalone revenue of INR1.5b in 2QFY26, in line with our estimate (+9.3% YoY, +8.8% QoQ), with traded electricity volumes of 35.2BUs, also in line with our estimate.

* EBITDA stood at INR1.3b, reflecting a 9.7%/15.9% uptick YoY/QoQ, in line with our estimates. EBITDA margin stood at 86.7% (vs. 81.4% in 1QFY26, 86.4% in 2QFY25).

* Standalone PAT was 5% above our estimate at INR1.2b (+14.6% YoY, +7.6% QoQ), mainly on account of higher-than-expected other income.

* IGX recorded a PAT of INR96m, up 57% YoY from INR61m.

* Operational performance:

* Electricity volumes rose 16% YoY to 35.2BUs in 2QFY26.

* In the electricity segment, DAM and term ahead market (TAM) volumes were flat YoY, whereas RTM volumes registered a growth of 39% YoY in 2QFY26.

* REC volumes saw a dip in 2QFY26, declining 30% YoY to 4.4m certificates.

* DAM and RTM prices dropped to INR3.93/unit (-12.5% YoY) and INR3.51/unit (- 16% YoY), respectively, on account of increased liquidity due to higher generation from hydro, wind, and sustained coal-based generation.

* Indian Gas Exchange (IGX) traded gas volumes of 16.1m MMBtu in 2QFY26 (+37% YoY).

* International Carbon Exchange (ICX) issued over 3.8m I-RECs in 2QFY26 and reported revenue of INR19m.

Highlights of IEX’s 2QFY26 performance

* The company’s electricity market share stood at 84%, while its certificate market share was slightly above 50%, resulting in an overall market share of ~75%.

* IEX has filed an appeal before APTEL challenging the market coupling framework; the next hearing is scheduled for November 28, 2025.

* Operational and procedural details regarding the implementation of market coupling are yet to be clarified.

* IEX holds a 47.5% equity stake in IGX, which, as per PNGRB regulations, must be reduced to 25% by December 2025. The company has sought a 1.5-year extension, citing slower growth and prevailing market challenges in the gas exchange segment; PNGRB is expected to support the request.

Valuation and view

* Our TP of INR150 for IEX is based on the following:

* We value the business at 28x FY27E EPS of INR5.4, in line with the long-term average P/E of 28x.

* We have not assumed any value for IGX's stake in our valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412