Neutral Indus Tower Ltd for the Target Rs. 390 by Motilal Oswal Financial Services Ltd

Risk reward uncompelling despite potential relief for Vi

We recently interacted with Indus Towers’ (Indus) senior management to understand the company’s growth outlook and execution strategy. Key takeaways are as follows:

* Indus has been gaining market share in new tower builds as well as benefiting from the shift from other towercos in recent quarters, driven by its operational efficiencies and network uptime.

* Management remains confident of securing most of RJio’s upcoming tenancy renewals (~12-13% revenue share), given the renewal track record in the past and attractive rentals. Most of these are 2nd or 3rd tenancies, with sharing benefits built in.

* The Africa foray is still at an initial stage, and concrete investment plans have not been finalized. However, management believes Africa is a good growth market, with presence of a strong anchor tenant in Airtel Africa (AAF). Further, the company’s scale, along with Bharti’s knowledge of African markets, would help Indus deliver lower capital and operating costs, which should aid incremental tenancy additions.

* There is no change in Indus’ policy on shareholder returns, and management remains intent on reinstating dividends soon. However, it is awaiting clarity on potential relief measures for Vi to avoid any unforeseen cashflow constraints.

* Our FY27-28 EBITDA estimates are optically higher as we no longer assume ~INR20b bad debt provisions from Vi over FY27-32. However, on an adjusted basis, our estimates are lower by ~1-2% due to a moderation in our tenancy growth assumptions.

* Our TP remains unchanged at INR390, as the boost from the removal of bad debt provisions (~INR31/share NPV impact) is largely offset by continued elevated capex.

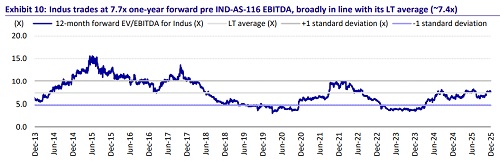

* We reiterate our Neutral rating with a DCF-based TP of INR390, premised on DCF-based 6.5x Dec’27 EV/EBITDA. While any potential relief for Vi is sentimentally positive for Indus, we believe risk reward is uncompelling at the CMP (bull case: INR435; bear case: INR345).

Growth remains a key priority; no change in policy or intent on boosting shareholder returns

* Indus continues to gain market share in new tower builds of its key customers and has recently benefited from the tenancy shift from other towercos, driven by its operating efficiencies.

* Management does not expect significant churn in the upcoming renewal of RJio tenancies, given that RJio is typically the second or third tenant on Indus’ towers and, thus, benefits from lower rentals (sharing discounts). However, we assume a churn of ~5k tenancies in FY27 (~10% of the total).

* Indus has garnered ~70%+ share in Vi’s rollout over the last six quarters. While Vi’s rollouts slowed in 1HFY26, management remains optimistic about a pickup in its network rollout following the recent favorable judgment on its AGR petition. We already bake in ~30k tenancies and ~45k 5G loadings for Indus over FY25-28.

* Indus’ overall focus remains on driving growth and it will selectively explore inorganic acquisitions in the tower infra space. However, it is not willing to overpay to consolidate the tower industry in India.

* Further, management noted that there is no change in either shareholder return policy or intent, and the company may plan to reinstate dividends once there is clarity on potential relief measures for Vi.

Africa foray at an initial stage, but business case compelling

* Indus’ Africa expansion remains at an initial stage, with investment plans yet to be finalized. Its teams are currently on the ground assessing opportunities and awaiting regulatory approvals.

* Management believes the opportunity is attractive, given Africa’s strong growth potential, rising data penetration, and the presence of a strong anchor tenant.

* Further, management believes Indus’ scale and Bharti group’s knowledge of the African market will enable the company to deliver lower capital and operating costs, which should aid incremental tenancy additions (beyond AAF) over the medium term.

Valuation and view

* Given a likely relief for Vi on AGR dues, we no longer assume bad debt provisions for Indus over FY27-32 (vs. ~INR20b or ~25% of Vi’s service rentals earlier).

* With a potential AGR relief, we believe visibility on the closure of Vi’s fund raise should improve. However, we do not expect any meaningful upside to our assumption of ~30k tenancies and ~45k 5G loadings from Vi over FY25-28.

* While management remains confident on the renewal of RJio’s expiring tenancies (~12-13% of revenue), we now build in ~5k tenancy exits (~10% of overall in FY27) and believe there could be risks of higher exits and/or higher renewal discounts.

* Our FY27-28 EBITDA estimates are optically higher as we no longer assume ~INR20b bad debt provisions from Vi over FY27-32. However, on an adjusted basis, our estimates are lower by ~1-2% due to a moderation in our tenancy growth assumptions.

* Our TP remains unchanged at INR390 as the boost from the removal of bad debt provisions (~INR31/share NPV impact) is largely offset by continued elevated maintenance capex.

* We reiterate our Neutral rating with an unchanged DCF-based TP of INR390, premised on DCF-based 6.5x Dec’27 EV/EBITDA. While any potential relief for Vi is sentimentally positive for Indus, we believe risk reward is uncompelling at the CMP (bull case: INR435; bear case: INR345).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412