Neutral Oberoi Realty Ltd for the Target Rs. 1,726 by Motilal Oswal Financial Services Ltd

Subpar operational performance; valuation capped

Operational highlights

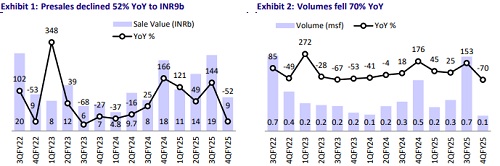

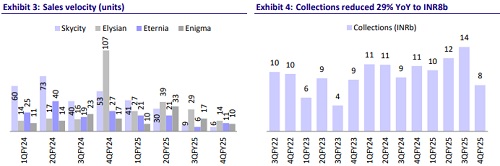

* Oberoi Realty’s (OBER) presales were down 52% YoY to INR8.5b (49% lower than estimate) in 4QFY25, due to no new residential launches in the quarter. 360-West contributed up to ~62% of sales, while Jardin, which was launched in 3QFY25, contributed barely 6%.

* SkyCity and Elysian presales plunged 88-90% and accounted for 16% of total presales. Other projects also performed poorly.

* Collections declined 29% YoY to INR7.6b, which was 54% below our estimates. OBER generated OCF (post WC) of INR2.85b. The net debt-toequity ratio stood at 0.01x vs. 0.09x in 4QFY24 (flat QoQ).

* P&L performance: In 4QFY25, revenue declined 13% YoY to INR11.5b (6% above estimates), EBITDA fell 22% YoY to INR6.1b (9% beat), and the margin contracted by 6.2% YoY to 54%. Consequently, PAT declined 45% YoY to INR4.3b, in line with our estimate. The company declared its fourth interim dividend of INR2/share for FY24-25.

* In FY25, revenue rose 18% YoY to INR52.8b, EBITDA grew 29% YoY to INR31.0b, and the margin expanded by 5% YoY to 59%. Consequently, PAT was up 16% YoY at INR22.3b. Reported FY25 revenue, operating profit and PAT were all in line with our estimates.

Commerz III’s incremental occupancy boosts rentals; mall revenue up; hospitality rates increase

* Following the Commerz III augmentation in 1QFY25, occupancy rose to 81% in 4QFY25 from 77% in 3QFY25, resulting in revenue growth of 10% QoQ to INR1.2b. Occupancy at Commerz II declined 1% to 96%, while Commerz I is close to being fully leased with 96% occupancy. OBER reported total office revenue of INR1.7b (+7% QoQ), with an EBITDA margin of 82%.

* Oberoi Mall continued to deliver good performance with a 13% YoY increase in revenue. On a blended basis, the commercial segment generated EBITDA of INR1.9b (134% up YoY), indicating a 6% QoQ decline in margin to 85%.

* Hospitality: Occupancy at Westin Goregaon was stable at 79%. ARR rose 19% YoY to ~INR17,610. Hence, revenue was up 10% YoY to INR533m. EBITDA margin expanded to 44% (up 126bp YoY and ~202bp QoQ), leading to EBITDA of INR235m

Key concall highlights

* Launches: 4QFY25 did not see new launches after the phenomenal response to recent mixed-use Jardin Project in Thane, which was launched in 3QFY25. One tower in Elysian will be launched in 1QFY26. In FY26, OBER expects to launch one tower in Borivali, one tower in Goregaon, and two towers in Forestville Thane. Additionally, it will also launch projects in Gurugram, Adarsh Nagar, Worli, and Tardeo in FY26. Alibaug is currently in the design phase and may be pushed to FY27.

* Annuity portfolio: The company is witnessing strong leasing traction across all three office assets. Commerz I and Commerz II are nearly fully leased out following an increase in occupancy in Commerz III to 81% in 4QFY25. Accordingly, all three office assets are expected to be fully leased out by the end of FY25.

* OBER recently commenced the soft launch of Sky City Mall in Borivali East.

* I-Ven Realty entered into an agreement for a private equity investment of ~INR12.5b for a 21.74% equity stake.

* OBER is appointed as developer for a redevelopment project at Bandra Reclamation, with a free sale potential of 0.32msf of RERA carpet area.

Valuation and view

* While OBER's current valuation doesn't suggest significant near-term gains, we foresee a strong 46% CAGR in its presales over FY25-27. The key to a future rerating lies in the company's ability to reinvest the substantial cash flow derived from its completed and near-completion projects.

* OBER's residential segment is presently valued at INR285b. This valuation accounts for recent business development activities and incorporates a future outlay of INR30b towards prospective land acquisitions. Reiterate Neutral with a revised NAV of INR627b or INR1,726 per share (earlier INR748b or INR2,056 per share)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412