Neutral Shree Cement Ltd for the Target Rs. 29,300 by Motilal Oswal Financial Services Ltd

Performance above estimates; focus remains on profitability over volume

Brand-led premium push narrowing the price gap with peers

* Shree Cement (SRCM)’s 4QFY25 EBITDA was above our estimates, driven by higher-than-estimated realization. EBITDA increased ~6% YoY to INR14.1b (~7% beat). EBITDA/t increased 3% YoY to INR1,435 (est. INR1,314). OPM was up 80bp YoY to ~27% (in line). Adj. PAT dipped ~13% YoY to INR5.8b (~34% beat, led by higher other income and lower interest cost than estimated).

* Management indicated that over the last several months, it focused on improving the realization through enhancing sales of premium products, raising brand equity, and geo-mix optimization. Consequently, its average cement realization growth stood at ~4% QoQ in 4QFY25, higher than its peer. It believes that going forward, the strategy will also help in lifting volumes. It deferred the 3.0mtpa GU commissioning at Jaitaran, Rajasthan (North). However, management reiterated its capacity target of over 80mtpa by FY28 vs. the current capacity of 62.8mtpa.

* We raise our EBITDA estimates by 5%/2% for FY26/27 to factor in better realization growth. Our EPS estimates increased ~12%/6% for FY25/26, aided by higher other income. SRCM trades fairly at 22x/18x FY26E/FY27E EV/EBITDA. Reiterate Neutral with a TP of INR29,300 (earlier INR28,000).

Volumes rise 3% YoY; opex/t dips 1% YoY

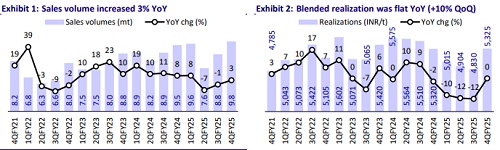

* Standalone revenue/Adj. EBITDA/PAT stood at INR52.4b/INR14.1b/INR5.8b (up 3%/6%/down 13% YoY and up 6%/7%/34% vs. our estimate) in 4QFY25. Sales volumes increased 3% YoY to 9.84mt. Cement realization grew 1% YoY (+5% QoQ) at INR4,758/t.

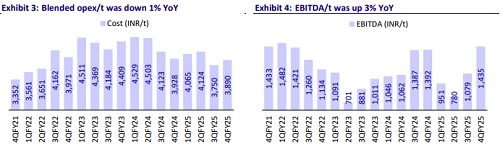

* Opex/t declined 1% YoY (up 4% QoQ) in 4QFY25. Variable cost/t declined 7% YoY. However, freight costs/other expenses per ton grew 7%/3% YoY. OPM surged 80bp YoY to ~27%, and EBITDA/t increased 3% YoY to INR1,435. Depreciation increased 19% YoY, and interest costs declined 36% YoY. Other income grew 9% YoY. ETR was at 25.1% vs. 14.3% in 4QFY24.

* In FY25, revenue/EBITDA/Adj PAT stood at INR180.4b/INR38.7b/INR12.2b (was down 8%/11%/51% YoY). Volumes were flat YoY. Cement realization declined 7% YoY. EBITDA/t declined 12% YoY to INR1,080. OCF increased to INR50.6b vs. INR33.0b in FY24, led by working capital release. Capex stood at INR34.7b vs. INR28.1b in FY24. FCF stood at INR16.0b vs. INR5.0b in FY24.

Highlights from the management commentary

* Clinker capacity utilization stood at 70%/68% in 4QFY25/FY25. The overall grinding capacity utilization was ~72% in 4QFY25, with ~74% in the North, ~79% in the East, and ~51% in the South.

* Fuel costs declined to INR1.48/Kcal vs. INR1.82/INR1.55 in 4QFY24/3QFY25. Green power share stood at 60.2% (highest in the industry) vs. 55.1% in 3Q.

* In Apr’25, SRCM commissioned two grinding units (GU) - 1) 3mtpa in Etah, Uttar Pradesh, and 2) 3.4mtpa at Baroda Bazar, Chhattisgarh. It will commission two more GUs of 3.0mtpa (each) at Jaitaran, Rajasthan, and Kodla, Karnataka, in 1HFY26, which will raise its cement capacity to 68.8mtpa. The next phase of expansion will be announced in due course.

Valuation and view

* SRCM once again reported industry-leading profitability, led by strong growth in realization and maintaining cost leadership. The company’s sustained efforts in brand building and premiumization over the past one year started to deliver, reflected in above-industry realization growth. However, its capacity utilization continued to lag behind peers. We continue to believe low capacity utilization, lack of geographical distribution, disproportionate mix of split grinding units and integrated cement plants, and rising industry supply (expect higher capacity additions in its core markets in the North and East) may constrain any capacityled re-rating in the stock.

* We estimate a revenue/EBITDA/PAT CAGR of 9%/19%/19% over FY25-27. We estimate the company’s volume CAGR at ~8% over FY25-27 and EBITDA/t at INR1,250/INR1,325 in FY26/FY27 vs. INR1,080 in FY25 (average INR1,280 over FY20-24). The stock trades fairly at 22x/18x FY26E/FY27E EV/EBITDA. Reiterate Neutral with a TP of INR29,300 (earlier INR28,000).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412