Accumulate Shree Cement Ltd For Target Rs.29,850 by Prabhudas Liladhar Capital Ltd

Market share pressure necessitates shifting gears

Quick Pointers:

* Good traction in non-trade segment in past 2 weeks; pricing to improve in coming months

* Rising competition may force a rethink about value over volume strategy

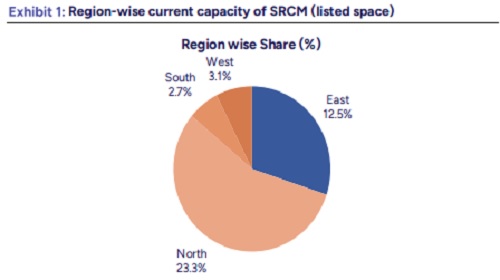

We met the management of Shree Cement (SRCM) to understand the current business dynamics, concerns of oversupply in the Northern region, and the company’s long-term strategy. The management highlighted good traction in non-trade segment in the past 2 weeks and expects pricing to improve. However, in trade, demand has not yet picked up pace as expected (on GST rationalization), and price recovery would be gradual from Q4FY26. With over 40mtpa capacities expected to get commissioned in the Northern region over the next 2 years, the management reiterated its focus on achieving efficiencies across units. This would have some impact on the Northern market share (panIndia market share is 9% and North is 21-22%), which would be compensated by improving volumes in rest of India and shift in its year-old ‘value over volume’ strategy. SRCM reiterated continued focus on efficiencies and delivery of EBITDA/t.

Since inception, SRCM has been a pioneer in achieving cost efficiencies. With the industry having replicated SRCM’s strategies, the latter may have to recalibrate its approach by capitalizing on own strengths and drive volume growth. Over the last few quarters, SRCM has lost market share, a cause of concern, and regaining volume momentum amid rising competitive intensity will be the key for SRCM to outperform. We cut our FY27/28E EBITDA estimates by ~4%/6% on lower pricing assumptions. The stock is trading at EV of 15.6x/13.8x of FY27/FY28E EBITDA. Maintain ‘Accumulate’ with revised TP of Rs29,850 (earlier Rs31,769) valuing at 17x EV of Sep’27E EBITDA.

Near-term demand and pricing outlook:

* The management highlighted that regional demand trends remain mixed. North will remain a core market for SRCM but rising competition from both listed and unlisted players could impact its market share. East remains structurally attractive, but continues to see intermittent demand softness. The company has not been chasing volumes in recent quarters, which has resulted in some market share loss. The management indicated it may revisit the approach to achieve the desired volume growth. SRCM’s pan-India market share, estimated at ~9%, is expected to increase over the next few years with increasing capacities in rest of the regions.

* Infrastructure spending remains a key demand driver, though the management noted that government capex is skewed toward defense and large strategic projects, limiting broader construction momentum. The management highlighted good traction in non-trade segment in the past 2 weeks and expects pricing to improve. SRCM expects overall industry demand to improve from FY27, with industry volume growing by 7–8%.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271