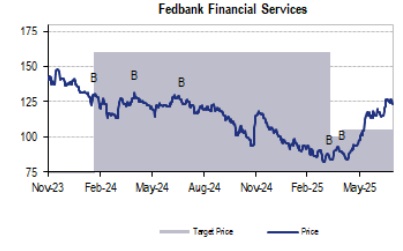

Buy Fedbank Financial Services Ltd For Target Rs. 140 By JM Financial Services

Fedbank Financial Services (Fedfina) reported PAT of INR 750mn (+7%/+5% YoY/QoQ) which was 14% above our estimates, leading to RoA/RoE of 2.3%/11.6% over the quarter. The beat was mainly driven by lower credit costs of ~71bps (vs 85bps QoQ). Operating performance however was weak on account of NIMs decline of -57bps mainly due to derecognition of its business loans (INR 7.7bn) leading to lower interest income. Opex declined - 9% QoQ due to lower originations which led to steady PPoP growth (flat YoY, -2% QoQ). Disbursements growth was healthy at +6% QoQ, +19% YoY, however AUM remained stable at -1% QoQ as growth in gold loans and MTLAP was offset by rundown in unsecured BL. GS3/NS3 remained largely stable (-3%/+9bps QoQ) led by INR 250mn sale of NPA to ARC while PCR declined to 46% (-503bps QoQ). The company opened 23 co-located branches where it offers LAP and gold loans both. Management have plans to open 150 branches in FY26 with increasing its presence of co-located branches which will offer strong tailwinds in terms of opex over the medium term. We expect normalization in NIMs from Q2 onwards and expect STLAP and gold book to contribute higher yields going forward while rate cuts will offer further tailwinds on CoFs. We maintain BUY with a revised target price of INR 140, valuing the stock at 1.6x FY27E BVPS.

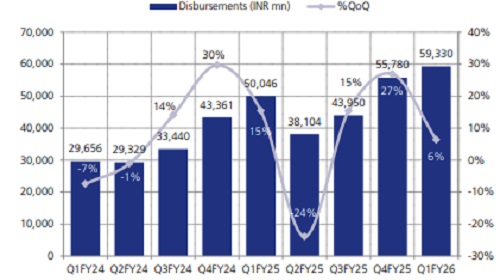

* Flat AUM growth led by sale of unsecured BL:

Fedfina reported healthy disbursements of INR ~59.3bn (+6% QoQ, +19% YoY), resulting in AUM of INR 157bn (-1 QoQ, +19% YoY). The de-growth was mainly due to sale of INR 7.7bn worth of business loans leading its mix to decline from 10% of total AUM to 4% QoQ in line with management’s strategy to recalibrate the portfolio towards higher-yielding and low risk segments. Other segments reported healthy growth with gold loans (+8% QoQ, +39% YoY), MTLAP (+10% QoQ, +49% YoY), and STLAP (+2% QoQ, +11% YoY). Management indicated demand to recover in STLAP over few quarters, with gold loans to have a healthy momentum (growth of FY26e at +25% YoY). We build in AUM growth of 19% CAGR over FY25-27E mainly led by gold loans.

* Lower provisions drive PAT beat:

Fedfina reported NII of INR 2.68bn (-5% QoQ, +7% YoY, -9% JMFe), supported by a sequential decline in cost of funds (-10bps QoQ to 8.5%). NIM compressed -57bps QoQ to 6.8%, driven by a -60bps QoQ decline in yields mainly due to de-recognition of its business loans (INR 7.7bn) leading to lower interest income. Opex reduced to INR 1.7bn (-9% QoQ, +9% YoY), which led cost to income ratio to decline to 57.6% (-160bps QoQ). This led to PPoP of INR 1.3bn (flat YoY, -2% QoQ). Lower provisions at INR 278mn (~71bps of AUM vs 85bps QoQ) led to a sharp beat of +14% on PAT at INR 750mn (+5% QoQ, +7% YoY). In the current quarter, company has started 23 co-located branches where it offers both LAP and gold loans. Further, company has guided for around 150 branches expansion in FY26 (100 of which being gold branches) which would lead to higher opex over near term, however leverage to flow in over medium term. (-3bps QoQ) while net stage 3 increased +9bps QoQ to 1.1% led by INR 250mn sale of NPA to ARC. PCR declined to 46% (-503bps QoQ). Mortgage GS3 declined to 3.4% (vs 3.3% QoQ) while gold GS3 also declined to 0.3% (vs 0.4% QoQ). 1+DPD increased +70bps QoQ to 8.0% (7.5% without business loan impact). Stage-2 assets also improved -12bps QoQ to 4.0%. Management guided for credit costs to be maintained at ~1% (+/- 10bps) as the company had taken elevated provisions in 3Q which led PCR to move up significantly from earlier 20% levels to now at 46% (-503bps QoQ). Thus the PCR is likely to go down while keeping its credit costs intact. Also, since ~40% of its book is gold loans, it requires lower provisions while 82.3% of the mortgage AUM is secured by selfoccupied residential/commercial property. Further, management has guided gold loan mix to be around 43-45% and balance to be mortgage business (STLAP and MTLAP). We build in ~1% avg credit costs over FY26-27E.

* Valuation and view: We expect normalization in NIMs from Q2 onwards and expect STLAP and gold book to contribute higher yields going forward while rate cuts will offer further tailwinds on CoFs. We maintain BUY with a revised target price of INR 140, valuing the stock at 1.6x FY27E BVPS.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)