Buy Aditya Birla Capital Ltd for the Target Rs. 380 by Motilal Oswal Financial Services Ltd

Operating performance strengthens in both NBFC and HFC

Lending (HFC+NBFC) book grew ~29% YoY; asset quality improves

* Aditya Birla Capital’s (ABCAP) 2QFY26 consolidated revenue grew 4% YoY to ~INR124.8b, and consolidated PAT (excl. one-off items in 2QFY25) grew ~3% YoY to ~INR8.55b.

* Overall lending book (NBFC and Housing) grew 29% YoY/7% QoQ to ~INR1.78t. Total AUM (AMC, Life insurance, and Health insurance) grew ~10% YoY to INR5.5t. Mutual fund quarterly average AUM grew 11% YoY to INR4.25t.

* Life insurance individual first year premium (FYP) grew ~19% YoY to INR18.8b in 1HFY26, and health insurance GWP grew ~31% YoY to INR28.4b in 1HFY26.

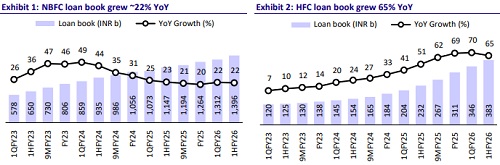

NBFC: AUM up ~22% YoY; NIM expands ~10bp QoQ

* NBFC Loan book grew ~22% YoY and 6% QoQ to ~INR1.4t. Disbursements grew ~14% YoY to ~INR220b. NIM rose ~10bp QoQ to 6.1%.

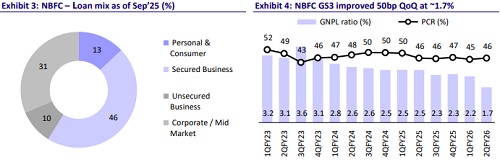

* The company reported a sequential improvement in asset quality, with GS2 + GS3 assets declining ~70bp QoQ to ~3%. Reduction in Stage 3 assets was also driven by an ARC sale of INR7.4b, of which ~INR5b consisted of unsecured business loans, while the balance was secured MSME loans.

* Management highlighted that asset quality remains robust, with consistent improvement across product segments. Bounce rates and forward flows are well contained. The company guided for FY26 credit costs in the range of 1.2-1.3%.

* The credit environment across the unsecured loans and Personal & Consumer (P&C) segment has stabilized, enabling the company to cautiously reaccelerate growth. Disbursements in the P&C segment grew 26% QoQ, supported by improved branch productivity and healthy traction in direct digital sourcing. With improving product mix from higher proportion of P&C loans, management guided for a gradual improvement in yields and NIMs in the subsequent quarters.

* PBT grew ~13% YoY and ~3% QoQ to INR9.6b. 2QFY26 RoA stood at ~2.2%

HFC: Robust growth in HFC AUM; asset quality improves

* HFC loan book grew 65% YoY to ~INR383b, and disbursements in 2QFY26 grew 44% YoY to ~INR58b.

* NIM declined ~15bp QoQ to ~4.02%. PBT grew ~87% YoY and 26% QoQ to INR1.9b RoA/RoE stood at ~1.8%/14%. Asset quality improved, with GS2+ GS3 declining ~25bp QoQ to ~1.1%. PCR rose ~5.2pp QoQ to ~57.6%.

* Management expects to sustain the current business momentum in HFC and has guided for a significant improvement in RoA to ~2-2.2% over the next 6-8 quarters. This improvement is expected to be driven by better operating leverage, partially offset by a decline in NIMs, while credit costs are expected to remain broadly stable

Asset Management: QAAUM rose ~11% YoY

* Quarterly average MF AUM (QAAUM) rose 11% YoY to INR4.25t. Monthly average individual AUM grew 2% YoY to INR2.07t as of Sep’25.

* The equity mix stood at ~45.3% (PQ: ~44.6%). Equity QAAUM grew ~7% YoY to INR1.92t. Operating profit grew by 13% YoY to INR2.7b.

Life Insurance: Individual FYP grew ~19% YoY; 13M persistency at 86%

* Individual FYP grew 19% YoY to ~INR18.8b, while renewal premium grew 18% YoY in 1HFY26.

* Net VNB margin stood at ~11.6% in 2QFY26. 13M persistency stood at ~86% in Sep’25. Value of new business (VNB) grew 74% YoY to INR2.4b.

* Management has guided for a ~20-22% CAGR in individual FYP over the next three years, with a continued focus on expanding the VNB margin to >18%.

Health Insurance: GWP grew 31% YoY; market share stood at 13.6%

* GWP in the health insurance segment grew 31% YoY to ~INR28.4b in 1HFY26. The combined ratio stood at 112%.

* ABHI’s market share among standalone health insurers stood at 13.6% in 2QFY26.

Highlights from the management commentary

* The company infused equity capital of INR2.5b into the housing subsidiary in 2Q, which takes the total infusion to INR5b for FY26.

* Management indicated that the sale of stage 3 assets was primarily undertaken to address cash flow mismatches under government guarantee schemes; however, the company intends to continue leveraging the CGTSME scheme going forward.

* The ABCD platform continued to receive a robust response, while Udyog Plus scaled well, contributing 32% of unsecured loan disbursements.

Valuation and view

* ABCAP’s operational metrics continued to improve during the quarter. Loan growth remained healthy in both HFC and NBFC segments, accompanied by a further improvement in asset quality. NIMs have started improving in the NBFC business and management expects further improvement in NIM, aided by an increase in the share of unsecured loans.

* We expect a consolidated PAT CAGR of ~25% over FY25-28. The thrust on crossselling, investments in digital, and leveraging ‘One ABC’ should drive healthy profitability, resulting in RoE of ~16% by FY28E. Reiterate BUY with an SoTP (Sep’27E)-based TP of INR380.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412