Neutral Can Fin Homes Ltd for the Target Rs. 870 by Motilal Oswal Financial Services Ltd

Early green shoots in core markets; NIM to remain in focus

Gradual revival in key states; digital transformation also a monitorable

* Can Fin Homes (CANF) is showing early signs of revival, with business momentum gradually improving across its key markets of Karnataka and Telangana. Disbursements in these states are witnessing steady growth, supported by stronger housing demand, improved customer sentiment, and stabilizing policy conditions, particularly for e-Khata issuances (in Karnataka) and Project Hydra (in Telangana).

* The company’s ongoing digital transformation remains on track, targeting process efficiency, automation, and enhanced customer engagement, albeit with some near-term pressure on operating costs.

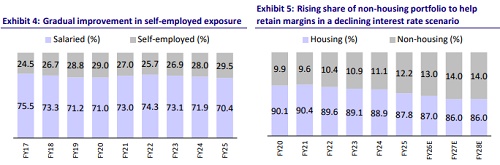

* NIM is expected to benefit from declining borrowing costs and a gradual shift toward higher-yielding segments (self-employed and LAP), even as the impact of annual resets continues to play out over the next few quarters.

* Asset quality remains strong, reflecting the company’s high-quality, predominantly salaried borrower base and its disciplined underwriting approach.

* While near-term profitability is likely to be impacted by elevated opex arising from technology investments and staff salary revisions, the mediumterm outlook remains constructive, supported by expectations of gradual improvement in loan growth and stable credit metrics. We expect CANF to deliver NII/PPOP/PAT CAGR of 13%/12%/13% over FY25-28, with RoA/RoE of 2.2%/17% in FY28. We reiterate our Neutral rating, as loan growth is expected to remain muted in the near term, and business volumes could face disruptions amid the ongoing technology transformation.

Revival momentum building gradually in Karnataka and Telangana

* Business activity in CANF’s key states, Karnataka and Telangana, has started to rebound after a period of softness. Disbursements in Karnataka are expected to exceed INR2.5b in Sep’25, aided by improving housing demand and supportive government measures. Telangana, too, is witnessing renewed traction following the formation of a new government and the cessation of demolitions under Project Hydra, which has significantly restored customer confidence.

* CANF anticipates monthly disbursements to cross INR1b in Telangana, recovering from the low base of INR700m earlier. With momentum likely to strengthen in 2HFY26, the company has guided for disbursement growth of ~20% in FY26. This recovery will be underpinned by contributions from newly opened branches, a stronger sales team, and improved housing activity in its core southern markets. We estimate CANF to deliver an AUM CAGR of 13% and disbursement CAGR of ~18% over FY25-28.

Tech transformation plan on track

* CANF’s digital transformation program remains a key strategic focus, aimed at building operational scalability and customer centricity. The transformation is being executed in two phases, with Phase I covering ALM and treasury systems (was planned to be completed by Oct’25) and Phase II covering core LOS, LMS, DOS, and deposit modules (by Nov’25). The initiative seeks to digitize key workflows, automate processes, strengthen risk controls, and enhance user experience through secure and integrated platforms.

* While the rollout may temporarily disrupt operations, management remains confident of minimizing the transitional impact and achieving its guided disbursement growth of 20% for FY26. Over time, these technology upgrades are expected to enhance efficiency, reduce turnaround times, and improve longterm cost productivity.

Impact of annual interest rate reset yet to be realized in yields and spreads

* Around 67% of CANF’s borrowers are on an annual interest rate reset cycle, implying that the full impact on portfolio yields will materialize over the next six to nine months.

* CANF has already passed on partial rate benefits (~25bp) to one-third of its customers under the quarterly interest rate reset regime. However, with a large portion of the loan book still on annual reset, downward revision in yields (which, in turn, is linked to the company’s PLR) is still a few quarters away. Consequently, the impact on NIM will have to be closely monitored. Near-term profitability will remain sensitive to the pace of reset pass-through and the reduction in CoF.

E-khata progress continues, though operational challenges persist

* The e-khata initiative in Karnataka continues to progress well, providing longterm structural benefits for housing demand and property formalization. The government’s push to digitize property records under the “Eswathu to Doorsteps” campaign has resulted in the creation of ~9.7m e-khatas, improving transparency and credit access for property owners.

* In Karnataka, Mysuru, Belagavi, and Vijayapura have led adoption, reflecting growing digitization beyond metro markets. However, operational challenges, such as document mismatches, data discrepancies, and limited digital literacy in rural areas, continue to hinder seamless implementation. Despite these issues, the e-Khata initiative remains a structural tailwind for organized housing credit, particularly for lenders like CANF with a deep presence in the state.

* The Karnataka government has introduced services such as the conversion of BKhata properties to A-Khata, issuance of e-Khata through Seva Kendra for a nominal fee, and a self-help tool to assist with online e-Khata registration. Additionally, the government plans to make e-Khatas mandatory for property registration from Oct/Nov’25.

* Although there have been positive developments post the rollout of e-Khatas, some challenges have emerged. In Bengaluru, property owners face issues such as document mismatches (mismatch between full names and initials across sale deeds, Aadhar, and passports), errors in jointly-owned properties (issuance of eKhata only in the name of one co-owner), discrepancies in built-up areas and parking details, and inaccuracies in property size declarations that trigger surprise tax notices. Due to the system’s strict data-matching protocols and software limitations, owners often have to visit government offices to resolve these issues.

Declining CoF and higher-yielding segments to support near-term margins

* CANF’s NIM is expected to improve in the near term, supported by declining borrowing costs, portfolio mix optimization, and a lag in passing on lower CoB to the customers. The company aims to increase the share of higher-yielding nonhousing loans to ~20% by FY28 (from 11% in FY23), alongside a higher proportion of self-employed non-professional (SENP) borrowers.

* Incremental CoF has already declined to <7.3%, driven by cheaper bank borrowings and NCD issuances. Further rate cuts on NHB borrowings could add to the benefit. While smaller affordable housing peers have not yet passed on the rate benefits, CANF’s conservative approach to transmission will provide interim support to spreads in the near term.

* With ~67% of the total portfolio being on annual reset as of Jun’25 (down from ~72% in Mar’25) and only 5% of overall customers (including new customers) shifting to quarterly reset in 1QFY26, the full impact on NIM will remain a key monitorable. We expect NIM to expand ~10bp YoY to ~3.8% in FY26, aided by a declining CoF, lagged PLR transmission, and higher-yielding portfolio shift.

* Management has guided for a cost-to-income ratio (CIR) of 18% for FY26 and ~19% by FY27 (vs the earlier guidance of 17-18%). We expect CIR to remain elevated in the 18-19% over FY26-28, due to: a) investments in branch expansion and employee headcount, and b) tech transformation expenses. However, the growing share of direct business (as DSA dependence declines further) and digitization benefits are expected to support cost rationalization in the medium term.

Stable asset quality; outlook positive

* Asset quality remains healthy, with delinquencies declining to the lowest level in five quarters. The stability in credit performance is driven by CANF’s high-quality borrower base, with over 80% of customers having CIBIL scores of over 700 and minimal exposure to high-risk categories.

* Management has guided for credit costs of ~15bp for FY26, in line with our estimate of 14–16bp, reflecting disciplined underwriting and stable collections. With improved disbursement quality and tightening of sourcing norms, we expect asset quality to remain resilient for the company.

Valuation and view: Recovery taking root, but NIM trajectory warrants monitoring

* We believe the business momentum in Karnataka and Telangana marks the beginning of a broader revival for CANF, supported by branch expansion, strengthening of sales capability, and a well-executed digital transformation strategy. While operating costs are likely to remain elevated in the near term, long-term benefits from efficiency gains and lower CoF are expected to support profitability.

* With stable asset quality and moderate loan growth, CANF remains a steady compounder, though near-term valuation upside appears capped until margin normalization plays out and steady-state normalized loan growth improves to ~14-15%. We expect CANF to deliver a NII/PPOP/PAT CAGR of 13%/12%/13% over FY25-28 and RoA/RoE of 2.2%/17% in FY28. Reiterate a Neutral rating on the stock with a TP of INR870 (based on 1.6x Sep’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412