Buy Ellenbarrie Industrial Gases Ltd for the Target Rs. 610 by Motilal Oswal Financial Services Ltd

Commissioning and ramp-up of new plants to drive growth

EBITDA in line, PAT beats estimates due to higher other income

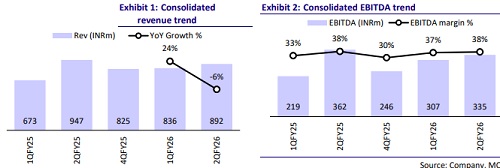

* Ellenbarrie (ELLEN) delivered a muted performance in 2QFY26 as EBITDA declined 8% YoY to INR335m. YoY growth was impacted by a one-time revenue of INR150m from Project Engineering in 2QFY25.

* Going forward, the ramp-up of the Kurnool (360 TPD) and Tata Steel Metaliks (154 TPD) divisions, along with the commissioning of the Merchant Plant (East) in 3QFY26 and the East Onsite Plant in 4QFY26, is expected to accelerate the growth momentum in 2H.

* We maintain our FY26 earnings estimates and reduce our FY27/FY28 earnings estimates by 13%/9% due to the delay in the commissioning of the North India plant from 2QFY27 to 2HFY27 caused by delays in project execution. We reiterate our BUY rating with a TP of INR610 (based on 40x Sep’27E EPS).

Muted operating performance due to one-off in base quarter.

* ELLEN reported total revenue of INR892m (est. in line) in 2QFY26, down ~6% YoY, impacted by one-time revenue of INR150m from Project Engineering in 2QFY25.

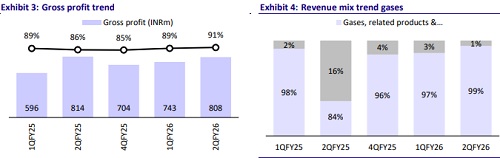

* EBITDA margin contracted 70bp YoY to 37.5% (est. 37.8%). EBITDA stood at INR335m (est. in line), down 8% YoY. Adj. PAT grew 24% YoY to INR367m (est. INR254m), led by higher other income (up 74% YoY).

* Gases, related products & services revenue grew 10% YoY to INR879m, EBIT declined 8% YoY to INR362m, and EBIT margin was 41% (vs. 49% in 2QFY25).

* Project engineering revenue stood at INR12m vs. INR150m in 2QFY25 (one-off revenue), EBIT stood at INR3m, and EBIT margin was 28% (vs. 79% in 2QFY25).

* For 1HFY26, revenue/EBITDA/adj. PAT grew 7%/10%/21% to INR1.7b/ INR642m/INR554m.

* Gross debt stood at INR1.1b as of Sept’25 vs INR2.5b as of Mar’25. ELLEN generated CFO of INR659m in Sep’25 compared to INR221.6m in Sep’24.

* The board has approved the acquisition of the manufacturing facilities of Truair Industrial Gases (a partnership concern) in Bengaluru (Karnataka) as a going concern on a slump sale basis, pursuant to a business transfer agreement dated 5th Aug‘25, for total purchase consideration of INR54m. As per Ind AS 103 - Business Combination, the purchase price allocation for the acquisition is still under process, and management expects it to be concluded by 31st Mar’26.

Highlights from the management commentary

* Expansion plans: ELLEN is on track for its pan-India expansion, with the Uluberia-2 bulk plant scheduled to open by 3QFY26 and the East India onsite plant by 4QFY26. The North India project has faced a slight commissioning delay due to execution-related issues. Although this may cause a modest short-term impact, it does not alter the company’s strong long-term growth outlook or its commitment to expanding national coverage.

* Argon gas: Argon gas prices remained stable QoQ in 2Q, while the YoY decline was primarily due to an abnormal spike in the prior year. The company maintains a positive long-term outlook, supported by structural demand tailwinds that are expected to outpace supply.

* New-age industries: The solar cell segment is witnessing strong traction with significantly higher margins, supported by the company’s enhanced capability in ultra-high-purity gases. With India’s value chain expanding rapidly, the company has already secured three solar cell contracts in the last quarter and continues to see robust inquiry momentum. The semiconductor industry is expected to scale up gradually.

Valuation and view

* Looking ahead, we expect margins to improve through higher contributions from argon, green energy initiatives, capacity ramp-up leading to operating leverages, and lower power consumption in the new plants.

* ELLEN’s medium- to long-term growth story will be led by 1) capacity expansion across India, 2) demand for argon gas outpacing supply, 3) increasing enquires in solar cell segment, 4) the growing semiconductor value chain, and 5) stable demand from well-diversified core industries (such as steel, pharmaceuticals, chemicals, and healthcare).

* We build in a CAGR of 33%/40%/42% in revenue/EBITDA/adj. PAT over FY25- 28E. We maintain our FY26 earnings estimates and reduce our FY27/FY28 earnings estimates by 13%/9% due to the delay in the commissioning of the North India plant from 2QFY27 to 2HFY27 caused by delays in project execution. We reiterate our BUY rating with a TP of INR610 (based on 40x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)