Buy Max Healthcare Ltd For Target Rs.1,300 by Motilal Oswal Financial Services Ltd

Volume and realization drive earnings

Addition of Thane is a new growth driver

* Max Healthcare (MAXH) delivered a better-than-expected performance for the quarter. Despite 3Q being typically a soft quarter due to the festival period, the EBITDA from the existing hospitals has been stable QoQ, largely due to steady demand and better operating efficiency. Further, MAXH continues to deliver steady progress in newer units as well.

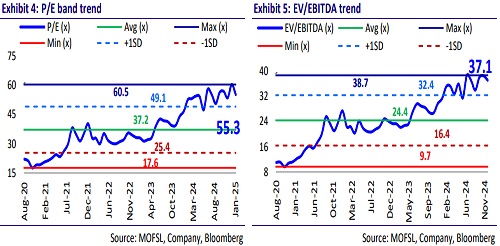

* We raise our earnings estimate by 3%/5%/3% for FY25/FY26/FY27 factoring in: 1) a faster scale-up in acquired hospitals, b) consistent improvement in case mix across existing hospitals, and c) the addition of beds at newer hospitals. We value MAXH on an SoTP basis (premised on 35x 12M forward EV/EBITDA, 30x 12M forward EV/EBITDA for Maxlab, and 10x EV/sales for Max@home) to arrive at our TP of INR1,300.

* We remain positive on MAXH on the back of: 1) superior execution of its operational centers and b) a robust plan to sustain growth momentum through bed additions. Notably, MAXH would have the maximum expansion of beds through brownfield expansion, implying the scope of achieving a faster EBITDA break-even. Reiterate BUY.

Records 7% ARPOB/9% IP volume growth at existing centers;scale-up of newer centers drives EBITDA on a YoY basis

* For 3QFY25, MAXH’s network revenue (including the Trust business) grew 34.9% YoY to INR22.7b (our est. INR21.2b).

* EBITDA margin contracted 45bp YoY to 27.2% (our est. 26.0%) owing to higher other expenses (+390bp YoY as a % of revenue), offset by lower employee expenses (-470bp YoY as a % of revenue).

* EBITDA grew 32.7% YoY to INR6.2b (our est. INR 5.5b) driven by revenue.

* Adjusted PAT grew 16.5% YoY to INR4b (our est. INR3.7b), led by other income, offset by higher interest and depreciation expense.

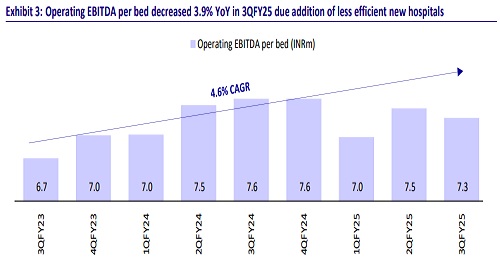

* EBITDA per bed (annualized) stood at INR7.3m (-4% YoY and -2% QoQ).

* Lucknow hospital revenue/EBITDA margin stood at INR930m/33%. Nagpur Hospital's revenue/EBITDA margin stood at INR540m/20% for the quarter.

* Max Dwarka, a 303-bed greenfield hospital launched on 2 nd Jul’24, reported an EBITDA breakeven in Dec’24.

* Revenue/EBITDA/PAT for 9MFY25 grew 26%/22%/8% to INR63.2b/ INR16.8/INR10.8b.

Highlights from the management commentary

* Max Dwarka recorded INR590m revenue and a loss of INR50m in 3QFY25. It achieved breakeven within six months of launch in Dec’24.

* MAXH plans to commission its 500-bed "built-to-suit" Thane hospital by CY28, with an investment of INR3m per bed. ARPOB is expected at INR80- 85K, with a 15-year lease agreement.

* Max Lucknow added 128 beds, with 64 commissioned in Jan’25 and the rest in Feb’25. Further, the company plans to add another 140 beds in FY26.

Efforts underway for a sustainable growth momentum

Plans to substantially increase bed capacity over the next 3-4 years

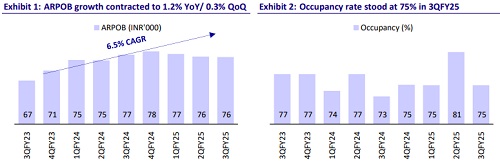

* In 9MFY25, occupancy came in at 76% (vs. 75% in 9MFY24) despite bed capacity expansion. The occupancy rate has remained robust.

* In 3QFY25, MAXH received Board approval to build a 500-bed hospital in Thane; and also increase the bed capacity at Zirkapur (Mohali) to 400 (vs 250 beds currently)

* In Sep’24, MAXH acquired a 64% stake in Jaypee Hospital, which owns and operates a 500-bed super specialty hospital in Noida, and a 200-bed secondary care hospital in Bulandshahr for INR3.4b.

* MaxH is undertaking capex to add another 2,600 brownfield beds over the next two to three years. Further, MAXH has acquired land parcels with the potential to add 1,000 beds in Gurgaon and ~550 beds in Lucknow.

* Accordingly, we expect the hospital segment to grow due to bed additions and ARPOB growth, leading to a sales CAGR of 17% over FY25-27 to reach INR120b.

Scope to improve patient realization

* In 9MFY25, ARPOB grew 1.3% YoY to INR76.4k. Excluding new centers, the ARPOB grew 6.9% YoY for 9MFY25. ARPOB growth was driven by: a) price revisions, including those in the Institutional (CGHS) segment, b) improved share of oncology in IPD, and c) increased OPD footfalls.

* The payor mix improved with a) the self-pay revenue share improving 7bp YoY to 33.4% of revenue, and b) the insurance share declining 130bp YoY to 37.7%. In contrast, the international patients' share dropped 40bp YoY to 9%.

* We expect the momentum to sustain with a 5% CAGR in ARPOB to INR87.4k over FY25-27

.Increased penetration to drive growth in the Diagnostic business

* In 9MFY25, MaxLab’s revenue/EBITDA grew 22.9/133%% YoY to INR1.3b/ INR184m, largely led by an increase in the number of footfalls (+11.4% YoY) and average realization (+9.5% YoY). MaxLab had 1,205 partners at the end of 3QFY25 and has expanded its reach across 48 cities.

* We expect MaxLab revenue to reach INR2.9b at a 24% CAGR over FY25-27.

* Moreover, Max@Home revenue grew 24.6% YoY to INR1.6b in 9MFY25, led by critical care, medical rooms, and physio@home services lines. We expect a 21% revenue CAGR in this segment over FY25-27.

Reiterate BUY

* We raise our earnings estimate by 3%/5%/3% for FY25/FY26/FY27 factoring in: 1) a faster scale-up in acquired hospitals, b) consistent improvement in case mix across existing hospitals, and c) the addition of beds at newer hospitals. We value MAXH on an SoTP basis (premised on 35x 12M forward EV/EBITDA, 30x 12M forward EV/EBITDA for Maxlab, and 10x EV/sales for Max@home) to arrive at our TP of INR1,300.

* We remain positive on MAXH on the back of: 1) superior execution of its operational centers and b) a robust plan to sustain growth momentum through bed additions. Notably, MAXH would have the maximum expansion of beds through brownfield expansion, implying the scope of achieving a faster EBITDA break-even. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)