Neutral IDFC First Bank Ltd For Target Rs.70 by Motilal Oswal Financial Services Ltd

Elevated provisioning/opex drive earnings miss

Deposit growth progressing well; CD ratio eases to ~94%

* IDFC First Bank (IDFCFB) reported a 3QFY25 PAT of INR3.4b (53% YoY decline, 32% miss to MOFSLe) due to an increase in opex (5% vs. our est) and elevated provisions.

* NII grew 14% YoY to INR49b (in line), while NIM moderated 14bp QoQ to 6.04%, amid a decline in MFI business, an increase in the composition of wholesale business, and an increase in CoF.

* Opex grew 16% YoY/8% QoQ to INR49.2b, while the C/I ratio increased to 73.7% from 69.9% in 2QFY25.

* Net advances grew 20.3% YoY/3.7% QoQ, while deposits rose 29.8% YoY/ 5.9% QoQ.

* GNPA ratio increased 2bp QoQ to 1.94%, while NNPA rose 4bp QoQ to 0.52%. Credit costs were elevated at 2.6% amid continued stress in MFI.

* We reduce our earnings by 26%/10% for FY25E/FY26E amid higher opex and estimate FY26 RoA/RoE at 0.8%/8.1%. Reiterate Neutral with a revised TP of INR70 (premised on 1.2x Sep’26E ABV).

Deposit growth steady; margin moderates 14bp QoQ

* IDFCFB reported a 3QFY25 PAT of INR3.4b (53% YoY decline, 32% miss) due to elevated opex. In 9MFY25, earnings dipped 45% YoY to INR12.2b, and we estimate 4QFY25 earnings to decline 50% YoY to INR3.6b.

* NII grew 14% YoY to INR49b (in line), while the margin moderated 14bp QoQ to 6.04%. Provisions increased 104% YoY to INR13.4b (in line).

* Other income grew 17% YoY to INR17.8b (in line). Opex grew 16.1% YoY to INR49.2b (5% higher). C/I ratio, thus increased to 73.7%, highest amongst the past 10 quarters. PPoP grew 13% YoY to INR17.6b (13% miss). The management expects a C/I ratio of ~65% by FY27.

* On the business front, net advances grew 20.3% YoY/3.7% QoQ, led by 21% YoY growth in retail finance and 34% growth in SME & Corporate Finance. Within retail, growth was led by housing (3.1% QoQ), VF (6.6% QoQ), and consumer & education (4% QoQ). The share of consumer & rural finance was ~68.5% as of 3QFY25.

* Deposit growth remained robust at 29.8% YoY/5.9% QoQ, with the CASA mix declining 120bp QoQ to 47.7%. CD ratio dipped 199bp QoQ to 94.2%.

* GNPA ratio increased 2bp QoQ to 1.94%, while the NNPA ratio increased 4bp QoQ to 0.52%. PCR ratio declined 168bp QoQ to 73.6%. SMA book stood at 1.03% vs. 0.97% in 2QFY25.

* Opex continues to remain elevated with a growth rate of 16% YoY, resulting in a very high C/I ratio of 73.7%. Bank expects the opex growth to moderate helping ease C/I ratio to ~65% by FY27.

Highlights from the management commentary

* Income growth is expected to slow, but opex growth will moderate due to the reduced pace of the MFI business. The bank is targeting a C/I ratio of 65% by FY27E. 27 January 2025 36

* Management anticipates opex growth to decline to 13% YoY, compared to the current run rate of 16-17% YoY.

* IDFCFB projects loan growth of 20-21% and deposit growth of 24-25% for FY26.

* MFI credit costs would peak in 4QFY25 and remain elevated. However, with improved collection trends observed in Dec’24, stress levels are likely to decline.

Valuation and view: Reiterate Neutral with a revised TP of INR70

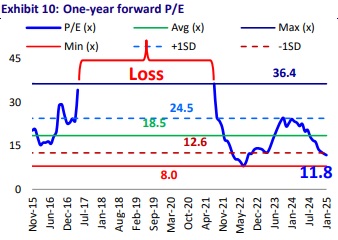

IDFCFB reported a weak quarter amid elevated opex, resulting in a higher C/I ratio, while NIM moderated 14bp QoQ to 6.04%. Provisions continue to remain elevated amid higher stress in MFI and management suggested credit cost to peak in 4Q25. On the business front, deposit traction continued to remain robust, while the CASA mix moderated to 47.7%. Advances growth also remained healthy, led by steady traction across Retail, SME, and Corporate Finance. We estimate the C/I ratio to remain elevated at 70% by FY26 and at 67% by FY27, primarily as the bank will continue to mobilize deposits at a healthy run rate to further bring down the CD ratio. We reduce our earnings by 26%/10% for FY25E/26E amid higher opex and estimate FY26E RoA/RoE of 0.8%/8.1%. Reiterate Neutral with a revised TP of INR70 (premised on 1.2x Spe’26E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Buy Indian Bank Ltd for Target Rs.800 by Elara Capitals