Neutral ALKEM Laboratories Ltd for the Target Rs. 4,950 by Motilal Oswal Financial Services Ltd

Falls short on profitability despite steady sales growth

Progressing well on investments in CDMO/medtech segments

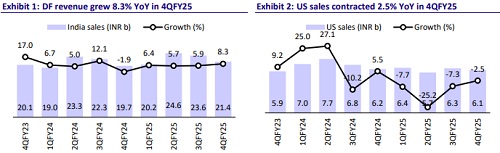

* Alkem Laboratories (ALKEM) delivered in-line revenue in 4QFY25, though EBITDA/PAT came in lower than expected (15%/16% miss). Muted performance in certain acute therapies in the domestic formulation (DF) and US segments dragged down the overall performance.

* High operational costs related to new ventures also affected 4Q profitability.

* ALKEM is implementing efforts to enhance its offerings and improve efficiency in DF segment, with an aim of outperforming the industry.

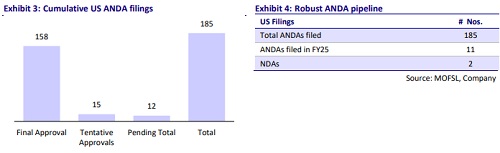

* The company is incurring R&D costs for the expansion of its product pipeline for international markets as well.

* We maintain our earnings estimates for FY26. However, we cut earnings estimates by 15% for FY27, factoring in a sharp increase in the tax rate due to the exhaustion of tax benefits at its Sikkim plant. We value ALKEM at 26x 12M forward earnings to arrive at a price target of INR4,950.

* With a large MR base (13,000) and established presence in DF segment, ALKEM is set to outperform the industry in chronic therapies. It is investing in biologics-based CDMO and medtech segments to add new levers of growth. Further, it has a considerable cash surplus of INR46b for strategic acquisitions. However, considering a gestation period for new initiatives and steady earnings over FY25-27, we maintain Neutral stance on the stock.

Adverse segmental mix/higher opex lead to EBITDA decline YoY

* 4QFY25 revenues grew 7.5% YoY to INR31.4b (our est: INR31.3b).

* DF business grew 8.1% YoY to INR21.3b (68% of sales).

* International business grew 7.2% YoY to INR9.7b. In international business, US sales declined 2% YoY to INR6.1b (19% of Sales). Other International sales grew 28% YoY to INR3.6b (12% of sales).

* Gross margin contracted by 300bp YoY to 59.3% due to higher raw material prices and an change in product mix.

* EBITDA margin contracted at lower rate of 130bp YoY to 12.4% (our est: 14.6%) as lower GM and higher employee expenses (+240bp YoY as % of sales) were offset by lower other expenses (-410bp YoY as % of sales).

* Accordingly, EBITDA declined 3% YoY to INR3.9b (vs. est. of INR4.5b).

* PAT was stable YoY at INR3b (our est: INR3.6b).

* For FY25, revenue/EBITDA/PAT grew 2.3%/12%/13.5% to INR129b/INR25b/ INR21.6b.

Highlights from the management commentary

* Alkem aims to outperform IPM by 100bp in FY26. IPM growth is expected to be 7-8% for FY26.

* US business is expected to grow in mid-single digits YoY in FY26.

* Alkem guides for EBITDA margin to remain stable YoY at 19-19.5% in FY26.

* ETR would be 13-15% in FY26, which would rise to 35% in FY27 as its Sikkim plant would be out of tax benefits.

* Operating loss from CDMO (US) and medtech business would be INR1bINR1.1b in FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)