Sell Fine Organic Industries Ltd for the Target Rs. 3,820 by Motilal Oswal Financial Services Ltd

Earnings remain subdued as margin headwinds continue

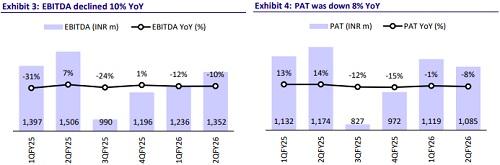

* Fine Organic Industries (FINEORG) reported a muted operating performance, with an EBITDA decline of 10% YoY. Gross margin contracted 120bp YoY to 41.6%, while employee/other expenses increased 100bp/40bp YoY to 6.3%/12.7%.

* FINEORG has been expanding its global reach by entering new geographies and strengthening its strategic partnerships. The company incorporated a wholly-owned subsidiary, Fine Organics Americas LLC, in the US to set up a manufacturing plant. Moreover, it acquired ~159.9 acres of land in Jonesville, Union County, South Carolina, to support future expansion and manufacturing capabilities.

* We broadly maintain our earnings estimates for FY26/FY27/FY28 and estimate a revenue/EBITDA/PAT CAGR of 9% for each over FY25-FY28. FINEORG currently trades at ~32x FY27E EPS and ~25x FY27E EV/EBITDA. We value the stock at 27x FY27E EPS to arrive at our TP of INR3,820. Reiterate Sell.

Soft quarter with margin pressure despite stable demand

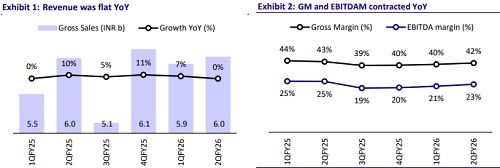

* FINEORG reported revenue of INR6b in 1QFY26, flat YoY, with overall demand remaining stable in 1HFY26.

* Exports revenue declined 10% YoY to INR3.3b, while domestic revenue grew 16% YoY to INR2.7b, driven by improved domestic demand in 2Q.

* Gross margin stood at 41.6% (down 120bp YoY), while EBITDA margin contracted 270bp YoY to 22.6% in 2QFY26, primarily due to higher raw materials costs in 2HFY26.

* EBITDA stood at INR1.3b, down 10% YoY, and PAT dipped 8% YoY to INR1b in 2QFY26.

* In 1HFY26, revenue grew 4% YoY to INR11.9b, while EBITDA/Adj. PAT declined 11%/4% to INR2.6b/INR2.2b

* Cash flow from operations stood at INR1.6b in Sep’25 vs INR1.1b in Sep’24.

Highlights from the management presentation

* Gross debt stood at INR92m in Sep’25 (the company was gross debt-free in Mar’25).

* During the quarter, its wholly-owned subsidiary, WOS Fine Organic Industries (SEZ) Private Limited, issued INR650m of preference shares as part of its equity capital structure.

Valuation and view

* The company remains focused on strengthening its global presence through investments in overseas subsidiaries, capacity expansion in the US for future expansion, and manufacturing capabilities. These initiatives are expected to support long-term growth.

* The long-term prospects for FINEORG remain healthy, as the company operates within the oleochemicals industry and has consistently driven growth through R&D innovations over the years. However, we anticipate that its performance may be adversely affected in the near-to-medium term by the following factors: 1) longer-than-expected delays in the commissioning of new capacities for expansion, and 2) existing plants operating at close to optimum utilization with no potential for debottlenecking.

* We broadly maintain our earnings estimates for FY26/FY27/FY28 and estimate a revenue/EBITDA/PAT CAGR of 9% for each over FY25-FY28. FINEORG currently trades at ~32x FY27E EPS and ~25x FY27E EV/EBITDA. We value the stock at 27x FY27E EPS to arrive at our TP of INR3820. Reiterate Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

More News

Buy Emami Ltd for the Target Rs. 750 by Motilal Oswal Financial Services Ltd