Buy Aditya Birla Sun Life AMC Ltd For Target Rs.850 by Motilal Oswal Financial Services Ltd

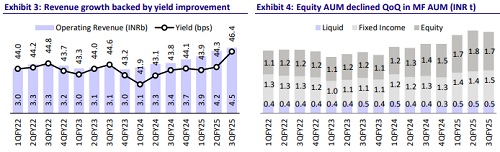

Yield improvement boosts revenue

* Aditya Birla Sun Life AMC’s (ABSLAMC) 3QFY25 operating revenue grew 30% YoY to ~INR4.5b (5% beat), leading to a ~250bp YoY improvement in yield on management fees to 46.4bp (vs. our est. of 44.3bp). For 9MFY25, revenue grew 27% YoY to INR12.6b.

* Total opex grew 16% YoY to INR1.7b (in line), with a cost-to-income ratio of 38.4% (vs. 43.1% in 3QFY24). Revenue growth and operational efficiency resulted in 41% YoY growth in EBITDA to INR2.7b (10% beat), with a 470bp YoY improvement in EBITDA margin to 61.6% (our est. 58.5%).

* A 20% miss in other income resulted in a largely in-line PAT of INR2.2b, up 7% YoY.

* The alternates business’s revenue contribution declined to 7-8% from 14- 15% earlier. The management aims to increase this back to 14-15%.

* We have increased our EPS estimates by 2% for FY25, considering yield improvement in 3QFY25. We have cut FY25/FY26 EPS estimates by 1%/2%, factoring in slower AUM growth and stable investment yield. We maintain our BUY rating with a TP of INR850, based on 28x Sep’26E core EPS.

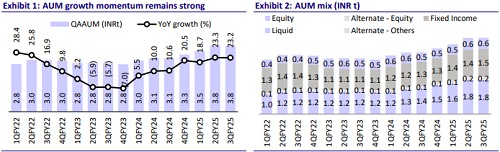

AUM growth flat QoQ; steep decline in other income dents PAT

* Total MF QAAUM grew 23% YoY to INR3.8t, led by 29%/16%/30%/38% YoY growth in equity/debt/ETF/ Hybrid funds (Index funds remained flat). Equity QAAUM contributed 37% to the mix in 3QFY25 vs. 35% in 3QFY24.

* The alternate and offshore business is gaining traction, with 33% YoY growth in AUM to INR162b in 3QFY25. PMS/AIF AUM grew 44% YoY to INR38b, while offshore AUM grew 28% YoY to INR127b. Multiple fundraising events are underway across AIF/PMS, offshore and real estate segments.

* SIP flows increased 38% YoY to INR13.8b (down 3% QoQ), driven by ~3x YoY growth in new SIP registrations to 670,000. About 95%/89% of total SIPs have a total tenure over 5/10 years.

* The distribution mix remained stable in overall AUM. The direct channel continued to dominate the mix with a 42% share, followed by MFDs (33%), national distributors (17%), and banks (8%). However, in equity AUM, MFDs contributed 54% to the distribution mix.

* Opex declined to 17.8bp of QAAUM in 3QFY25 from 18.9bp in 3QFY24 (our est. of 18.4bp). Employee costs grew 11% YoY to INR877m (in line), while other expenses grew 20% YoY to INR707m (in line).

* Other income at INR384m declined 52% YoY (20% miss), which resulted in PAT growth of 7% YoY to INR2.2b (in line) in 3QFY25. However, core PAT grew 34% YoY to INR2b (9% beat).

Key takeaways from the management commentary

* Jan’25 is witnessing similar trends as in 3QFY25, with net sales improvement in some schemes. SIP remains in focus and there has not been any significant deviation in SIP cancellations. However, lump-sum flows may get impacted considering the current market volatility.

* For 3QFY25, equity yields were at 70-71bp, debt at 25bp, liquid at 13bp and ETF at 7-8bp. Equity yields are likely to remain in the similar range. A marginal improvement is expected in fixed income yields with interest rate declining.

* Alternate growth is likely to be faster than MF growth. In the AIF fixed income business, ABSL expects AUM to reach INR50b over the next three years. Real estate fund is expected to reach INR50b from INR10.5b currently over the next three years on the back of global investor participation. Passives AUM is currently at INR320b and ABSL is planning to increase it to INR1t in the next three years.

Valuation and view

* Overall yields are expected to improve slightly, especially in the debt segment, driven by an increase in TER of a few schemes. Expansion of the alternate business, strong fund performance for equity schemes and debt mix shifting toward longer duration funds will be beneficial for the company’s profitability.

* We have increased our FY25 EPS estimate by 2%, considering yield improvement in 3QFY25. We have cut FY25/FY26 EPS estimates by 1%/2%, factoring in slower AUM growth and stable investment yield. We maintain our BUY rating with a TP of INR850, based on 28x Sep’26E core EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)