Buy Hindalco Ltd for the Target Rs. 790 by Motilal Oswal Financial Services Ltd

Strong operating performance; lower tax outgo in Novelis leads to a strong beat on APAT

Consolidated performance

* Hindalco (HNDL)’s consolidated net sales stood at INR649b (+16% YoY and +11% QoQ) vs. our est. of INR588b, driven by a strong performance of its Indian operations, supported by favorable macros.

* Consolidated EBITDA stood at INR88.4b (+32% YoY and +17% QoQ) against our est. of INR78b, driven by lower costs and favorable macros.

* APAT was INR52.8b (+66% YoY/+40% QoQ) vs. our estimate of INR41.3b. This beat was mainly led by lower tax outgo in the Novelis operations.

* For FY25, HNDL’s revenue was up 10% YoY to INR2,385b, whereas its adj. EBITDA/PAT increased 33%/ 64% YoY to INR318b/INR166b.

* The Board recommended a dividend of INR5/share (+43% YoY) for FY25.

* Consol. net debt/EBITDA stood at 1.06x as of 4QFY25 vs. 1.21x in 4QFY24.

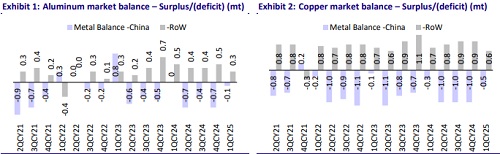

Aluminum business

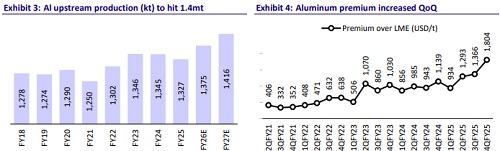

* Upstream revenue stood at INR103b in 4QFY25 (+22% YoY), led by higher average aluminum prices. Aluminum Upstream EBITDA stood at INR48.4b (+79% YoY; USD1,684/t) driven by lower input costs with favorable macro.

* EBITDA margin for the upstream business was 47% in 4Q vs. 42% in 3QFY25.

* Downstream revenue stood at INR36b (+23% YoY) on account of favorable pricing. Downstream EBITDA stood at INR2.2b (+52% YoY), led by better product mix, and translates into an EBITDA/t of USD240 (+46% YoY) in 4QFY25 vs. USD179 in 3QFY25 and USD186/t (+4% YoY) in FY25.

* Upstream aluminum sales stood at 332kt (-2% YoY), and downstream aluminum sales came in at 105kt (flat YoY) in 4QFY25.

Copper business

* Copper business revenue stood at INR146b (+8% YoY), on account of higher average copper prices.

* EBITDA for the copper business dipped 21% YoY to INR6.1b in 4QFY25, led by a sharp decline in TC/RCs.

* Copper metal sales came in at 135KT (flat YoY), while CCR sales stood at 109KT (+12% YoY) during the quarter.

Novelis’ 4QFY25 performance

* Shipment volumes stood at 957kt (flat YoY and 6% QoQ) against our estimate of 930kt. The growth was primarily fueled by higher beverage packaging, specialties, and aerospace, partially offset by lower automotive shipments.

* Novelis’ 4QFY25 revenue stood at USD4.6b (+13% YoY and +12% QoQ) against our estimate of USD4.4b, mainly driven by higher aluminum prices.

* Adjusted EBITDA stood at USD473m (-8% YoY and +29% QoQ) against our estimate of USD443m. EBITDA was primarily hit by higher aluminum scrap prices and operating costs, partially offset by higher product pricing.

* Adj. EBITDA/t stood at USD494 (-9% YoY and +22% QoQ) vs. our estimate of USD476 during the quarter.

* APAT stood at USD294m in 4QFY25 (vs. our estimate of USD162m), primarily driven by lower income tax outgo. Net Debt/EBITDA as of Mar’25 stood at 2.9x.

* For FY25, revenue grew 6% YoY to USD17.2b, while adj. EBITDA declined 3% YoY to USD1.8b and APAT dipped 1% to USD816m. Shipment stood at 3.76mt, registering a growth of 2% YoY during FY25.

Highlights from the management commentary

* Coal mix for FY25: linkage was 50%, e-auction was 47%, and the rest was from own mines. Management does not foresee any substantial change in FY26 and indicates the major changes to be seen post commissioning of Chakla and Bandha mines.

* The company expects alumina prices to remain range-bound in the range of USD350-400/t during FY26.

* Downstream EBITDA/t is expected to be USD250-300 for FY26.

* Alumina sales for FY26 are expected to be 700-800kt.

* Out of the 300MW of renewables capacity, HNDL commissioned 6.3MW of floating solar capacity at Mahan, bringing the total RE power to 189MW. Further, 100MW hybrid capacity (with storage) will be commissioned in H1CY25. 9MW of solar capacity is underway, and an additional 20MW of hybrid capacity (Solar + Wind) is expected to be operational by 2HFY26.

* The company hedged around 15% of the aluminum at USD2,695/t and 13% of the currency at INR86/USD.

Valuation and view

* HNDL posted a decent performance in 4QFY25. The earnings growth was driven by favorable pricing and lower input costs. Novelis' performance rebounded in 4Q, which was hurt by higher scrap prices and weak demand in 3Q.

* The ongoing capex in Novelis will establish HNDL as the global leader in the beverage can and automotive FRP segments. The capex is likely to be completed within the stated timeline, and management does not see any further capex increase.

* We expect a healthy consolidated performance for FY26/27E, mainly driven by the strong domestic operations. We increase our EBITDA estimates for FY26/27E by 3%/2%. At CMP, the stock trades at 5x EV/EBITDA and 1.2x P/B on FY27E. We reiterate our BUY rating on HNDL with a revised SoTP-based TP of INR790.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412