Buy VRL Logistics Ltd for the Target Rs. 350 by Motilal Oswal Financial Services Ltd

In-line quarter with steady margins; volume recovery expected ahead

Healthy margins amid volume weakness; recovery likely in 2HFY26

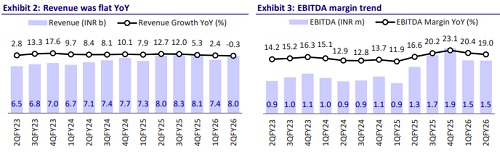

* VRL’s revenue was flat YoY at INR8.0b (+7% QoQ) in 2QFY26, in line with our estimate.

* Volume dipped 11% YoY to 0.97m tons, while realization grew by 12% YoY to INR 8,079/ton, driven by a price hike. Volume drop was mainly due to contract restructuring and the voluntary exit from certain low-margin contracts. However, volume rose 4% sequentially on the back of a strong festive season and customer recovery from new branch addition.

* EBITDA margins stood at 19% (+240bp YoY and -140bp QoQ), in line with our estimate. EBITDA margin continued to be robust despite volume pressure, driven by cost rationalization efforts. However, it was lower QoQ on account of increased employee cost, which was expected after the salary revision w.e.f Aug’25. Fuel costs stood at ~25.6% (vs. 28.6% in 2QFY25) of total income in 2QFY26. Lorry charges fell to 4.4% from ~5.7% of total income YoY. EBITDA grew ~14% YoY to INR1.5b (in line).

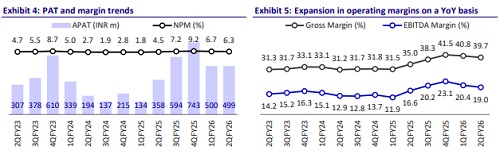

* Aided by strong operating performance, APAT increased 40% YoY to INR499m (in line). Capex stood at INR430m in 2QFY26.

* In 2QFY26, VRL reported a stable performance, supported by disciplined pricing and a continued focus on profitability, despite lower volumes following its strategic exit from low-margin contracts. Effective cost management through improved fuel procurement and reduced dependence on hired vehicles helped the company maintain healthy margins. We retain our FY26 and FY27 estimates and roll forward our valuation to FY28. We expect volume to recover and margin to stabilize in 2HFY26, aided by festive demand and GST rate cuts. We expect VRL to deliver 5% volume growth and a CAGR of 8%/9%/16% in revenue/EBITDA/PAT over FY25-28. Reiterate BUY with a TP of INR350 (based on 22x FY28E EPS).

Highlights from the management commentary

* Volume is expected to grow ~4% QoQ in 3QFY26 with improved volumes after GST rate cuts.

* Overall, management expects revenue to grow ~4-5% in FY26.

* Capex stood at ~INR1b in 1HFY26 largely for branch expansion and transhipment hubs funded through internal accruals. Capex is being aligned with tonnage trends, with additional branch/hub expansion as planned.

* VRL’s consistent 100% hub-to-hub efficiency, low attrition rate, and in-house tech infrastructure (ERP, barcoding, GPS) reinforce its position as a highservice-quality logistics player.

* Door-to-door revenue share has increased to ~40%, reflecting a gradual shift toward express PTL offerings. Network optimization continues, with rationalized fleet size and selective branch closures.

Valuation and view

* VRL is well-positioned for long-term growth, supported by its strategic focus on profitable contracts, operational efficiency, and strong service reliability. The company’s investment in technology, disciplined cost management, and robust hub-to-hub network create a strong foundation to scale operations as demand recovers.

* While near-term headwinds persist, VRL’s focus on profitability through the addition of quality customers, expansion into under-penetrated areas, a healthy pricing strategy, and strong internal execution positions it well to benefit from the structural growth in India’s organized surface logistics sector.

* We retain our FY26 and FY27 estimates and roll forward our valuation to FY28. We expect volume to recover and margin to stabilize from 2HFY26, aided by festive demand and GST rate cut. We expect VRL to clock 5% volumes and a revenue/EBITDA/PAT CAGR of 8%/9%/16% over FY25-28. Reiterate BUY with a TP of INR350 (based on 22x FY28E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)