Buy ACC Ltd for the Target Rs. 2,400 by Motilal Oswal Financial Services Ltd

Earnings beat; group-level synergy yet to materialize

Land acquired in the western region for strategic growth

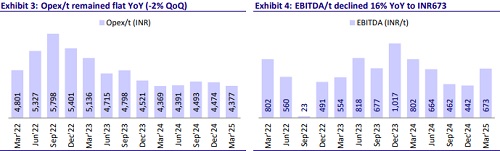

* ACC’s 4QFY25 EBITDA declined 4% YoY to INR8.0b (15% beat), led by higherthan-estimated volume and realization. EBITDA/t declined ~16% YoY to INR673 (est. INR608). OPM contracted 2.2pp YoY to ~13% (est. ~12%). Adj. PAT increased ~4% YoY to INR5.1b (26% beat).

* ACC acquired land parcels in the western part of India. Management plans to set up grinding units as well as acquire coal mines. This land is near to its Chanda plant in Maharashtra. The investment may be made by either ACC or ACEM, but the benefits are shared through the MSA. Further, ACC invested ~INR7.5b in GCFC wagons and ~INR5.0b in grinding units, apart from the WHRS units at Chanda and Wadi-2 line.

* We broadly retain our FY26/FY27 earnings estimates. ACC trades at 10x/8x FY26E/FY27E EV/EBITDA and USD82/USD78 EV/t. We value the stock at 10x FY27E EV/EBITDA to arrive at our TP of INR2,400. Reiterate BUY.

Sales volume above estimate; EBITDA/t at INR673 (-16% YoY)

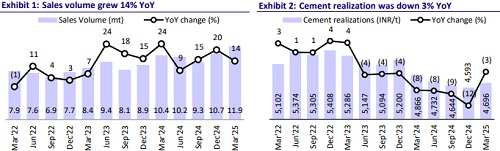

* Revenue/EBITDA/PAT stood at INR60.1b/INR8.0b/INR5.1b (+11%/-4%/+4% YoY and +6%/+15%/+26% vs. our estimates) in 4QFY25. Sales volumes were up 14% YoY at 11.9mt (+4% vs. our estimate). Cement realization was down 3% YoY (up 2% QoQ/+2% vs. estimate) at INR4,696/t.

* Variable cost/t increased ~5% YoY (-1% QoQ; +2% vs. est.), while freight cost/other expenses per ton declined ~8%/6% YoY. Overall opex/t remained flat YoY (+1% vs. estimate). OPM contracted 2.2pp YoY at ~13%, and EBITDA/t declined 16% YoY to INR673.

* In FY25, revenue/EBITDA/Adj. PAT stood at INR210.3b/INR23.8b/ INR13.4b (up 5%/down 22%/28% YoY). Sales volume rose ~14% YoY, while realization declined 8% YoY. EBITDA/t was down 32% YoY at INR565. OCF declined ~43% YoY to INR17.1b in FY25 due to an increase in WC. Capex stood at INR21.3b in FY25 vs INR13.6b in FY24. Free cash outflow stood at INR4.2b in FY25 vs free cash inflow of INR16.2b in FY24.

Key highlights from the management commentary

* Operations at a few old clinker units (Bargarh, Chaibasa, and Wadi-1) have been unfeasible, and hence, impairment has been provided. Further, these units are not being used for clinker production. Clinker capacity was 1mtpa each at Wadi-1 and Bargarh and 0.6mpta at Chaibasa. The Bargarh unit is now being used for grinding. It is in the process of dismantling the Wadi-1 clinker unit. These assets can still be operated based on the coal pricing scenario.

* The brownfield expansion at Sindri, Jharkhand (GU) of 1.6mtpa has been at an advanced stage and is likely to be commissioned in 1QFY26. Further, a greenfield expansion at Salai Banwa, Uttar Pradesh (GU) is likely to be commissioned in2QFY26.

* Fuel consumption cost stood at INR1.47/kcal vs. INR1.91/INR1.68 in 4QFY24/3QFY25. The WHRS share stood at 13.5% vs. 8.2%/10.0% YoY/QoQ. Overall green power share increased to 22.5% vs. 18.7% in 3QFY25. The AFR share increased to 11.0% vs. 9.6% in 3QFY25.

Valuation and view

* ACC reported higher-than-estimated operating performance. While it continued to post higher volume growth, aided by higher MSA volumes, lower realization vs. historical average weighed on margins. Synergies between the cement business and the group are yet to be played out. Further, we are closely monitoring the EBITDA/t trend of the company, as over the last few quarters reported earnings were more volatile vs. peers.

* We estimate a CAGR of 27%/30% for EBITDA/PAT over FY25-27, albeit on a low base. We estimate a volume CAGR of ~10% over FY25-27. Additionally, EBITDA/t is estimated to improve to INR650/INR760 in FY26/FY27 vs. INR565 in FY25. ACC trades inexpensively at 10x/8x FY26E/FY27E EV/EBITDA. We value the stock at 10x FY27E EV/EBITDA to arrive at our revised TP of INR2,400. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412