Neutral Senco Gold Ltd for the Target Rs. 400 by Motilal Oswal Financial Services Ltd

Steep cut in marketing spends boosts margins

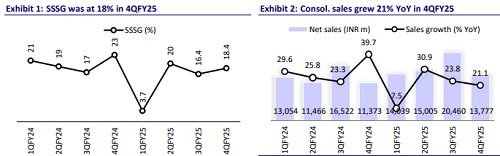

* Senco Gold (SENCO) delivered consolidated revenue growth of 21% YoY to INR13.8b (in line) in 4QFY25, with an SSSG of 18%. Management indicated that rising gold prices had an impact on volumes (-6%). Growth in Tier 3 and Tier 4 towns outpaced that of metros and Tier 2 cities. SENCO’s 4Q and FY25 revenue performance remained slower than other listed peers. The company expects revenue growth of 18-20% in FY26, driven by a strong focus on expansion in East and North India, with SSSG projected in the range of 15-16%.

* The company opened four stores (+10% YoY) during the quarter, bringing the total store count to 175 (102 COCO, 72 FOCO, 1 Dubai). Looking ahead, the company plans to open 8-10 COCO stores and 8-10 franchise outlets annually, with 70-80% of the new stores concentrated in North and East India and the remaining 20% in the West and South.

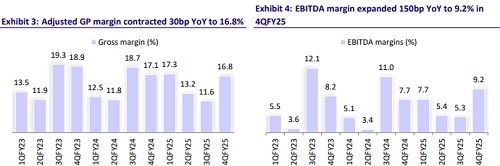

* Consolidated GM contracted 30bp YoY to 16.8%. (est. 15.6%), with inconsistency in gross margin remaining high on a quarterly basis. GM declined ~100bp to 14.4% in FY25. Employee expenses rose 27% YoY and other expenses increased 8% YoY. However, marketing spends were cut by 44% YoY, leading to a 150bp YoY expansion in EBITDA margin to 9.2% (est. 7.4%, 5.3% in 3QFY25). Studded Jewellery sales grew 39% YoY in 4Q, compared to 9% in 9MFY25, leading to a 14% growth in FY25. The stud ratio improved slightly to 10.9% in FY25 vs 10.5% in 9MFY25. The company has guided to increase the studded jewellery mix to 15% over the next 2-3 years, indicating a strategic push toward higher-margin products.

* For FY26, the company expects an EBITDA margin of 6.8-7.2% and an APAT margin of 3.5-3.7%. Return ratios (RoE/RoCE) are expected to improve to 17-18% over the next 3-4 years. Given the inconsistency in operating margins and slower SSSG compared to peers, we remain cautious on the company’s operating performance in the upcoming quarter. We reiterate our Neutral rating with a TP of INR400 at 25x FY27 EPS.

In-line sales; profitability beat on sharp cost control

* In-line sales growth: SENCO’s consolidated revenue grew 21% YoY to INR13.8b (est. INR13.5b). SSSG was healthy at 18.4% in 4Q. However, sales growth was slower than that of its peers. Titan (Jewelry standalone, exbullion), Kalyan, and P N Gadgil (retail) delivered revenue growth of 25%, 37%, and 50%, respectively. The company has opened four stores, bringing the total count to 175 (102 COCO, 72 FOCO, 1 Dubai). Old gold exchange stood at 39%.

* Operating margins expanded on cost control: Consolidated GM contracted 30bp YoY to 16.8%. (est. 15.6%, 11.6% in 3QFY25). Inconsistency in gross margin remains high on a quarterly basis. GM contracted ~100bp to 14.4% in FY25. Employee expenses were up 27% YoY and other expenses were up 8% YoY. However, marketing spends were cut by 44% YoY, leading to a 150bp YoY expansion in EBITDA margin to 9.2% (est. 7.4%; 5.3% in 3QFY25).

* Improvement in profitability: EBITDA grew 45% YoY to INR1.27b (est. 1b). APAT grew 94% to INR624m (est. INR438m).

* In FY25, net sales and EBITDA grew 21% and 13% YoY, while APAT grew 12% YoY.

Key takeaways from the management commentary

* In 4QFY25, gold jewellery reported a 21% value growth despite a 6% decline in volumes, driven by a sharp increase in gold prices. Diamond jewellery witnessed robust growth, with volumes rising 21% and value increasing 38% YoY.

* With diamond prices gradually beginning to rise, the company anticipates improved customer sentiment and plans to continue its focus on driving diamond jewellery sales. It expects 15-16% growth in diamond jewellery.

* Gold Metal Loan (GML) interest rates were 3.2% in Jan’25, 5.3% in Feb’25, and 6.6% in Mar’25 which has been reduced to 5.6% in Apr’25. The rate for May’25 is yet to be announced.

* For FY26, the company maintains its revenue growth guidance of 18-20%, with SSSG projected in the range of 15-16%. Additionally, it expects to record an EBITDA margin of 6.8-7.2% and an APAT margin of 3.5-3.7%.

* Looking ahead, the company plans to open 8-10 COCO stores and 8-10 franchise outlets annually, with 70-80% of the new stores concentrated in North and East India and the remaining 20% in the West and South.

Valuation and view

* We keep our EPS estimates for FY26 and FY27 unchanged, with operating margin assumptions remaining at ~6.7% for both years.

* Management has maintained its EBITDA margin guidance of 6.8-7.2% for the coming years. Return ratios (RoE/RoCE) are expected to improve to 17-18% over the next 3-4 years. Given the inconsistency around operating margins and slower SSSG compared to peers, we remain cautious on the company’s operating performance in the upcoming quarter. We reiterate our Neutral rating with a TP of INR400 at 25x FY27 EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412