Buy HDFC Life Insurance Ltd for the Target Rs. 910 by Motilal Oswal Financial Services Ltd

Performance in line; a 0.5% impact of GST on VNB margin

* HDFC Life Insurance (HDFCLIFE) reported an APE of INR41.9b (in line) in 2QFY26, up 9% YoY. This was led by a 9%/7% YoY growth in individual/ group APE. For 1HFY26, APE grew 10% YoY to INR74.1b.

* HDFCLIFE’s VNB grew 8% YoY to INR10.1b in 2QFY26 (in line), resulting in a VNB margin of 24.1% (vs. our estimate of 24%). For 1HFY26, VNB grew 10% YoY to INR18.2b, leading to a VNB margin of 24.5% (flat YoY).

* For 2QFY26, HDFCLIFE reported a 3% YoY growth in shareholders’ PAT to INR4.5b (6% miss), supported by a 14% increase in back-book profits. For 1HFY26, its PAT grew 9% YoY to INR9.9b while EV at the end of 1HFY26 was at INR595.4b (RoEV of 14.2%).

* Going forward, management expects mid-teens growth, which should be better than the industry. VNB growth should normalize from FY27, supported by operational adjustments and distribution realignments over the next 2-3 quarters to mitigate the loss of input tax credit. The expectation is to end 4QFY26 with a stable VNB margin.

* We trim our VNB margin assumptions by 70bp for FY26, considering the impact of the loss of input tax credit. We have factored in a 0.5% EV hit on the back book, leading to a 0.6% decline in our FY26/FY27/FY28 EV estimates. We roll over to Sep'27E EV to arrive at our TP of INR910 (based on 2.4x Sep'27E EV). Reiterate BUY.

Improving trends in the protection segment

* For 2Q, HDFCLIFE posted a 14% YoY growth in gross premium to INR192.9b (in line), led by 17%/11% YoY growth in renewal/single premium.

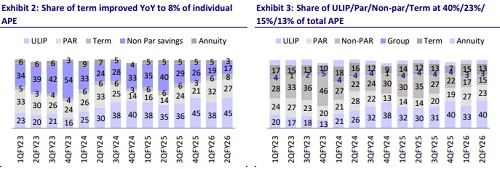

* Overall APE growth of 9% YoY was driven by an 82%/44%/20% YoY growth in Par/ULIP/Term business, while non-par and group business reported a YoY decline of 53%/10%. Individual APE witnessed a YoY increase in contribution from ULIP/Par/Term to 45%/27%/8%.

* The share of ULIPs in total APE increased to 40%, reflecting the rising demand for ULIPs. However, the gradual shift towards higher sum assured ULIPs with rider attachments has helped in maintaining the VNB margin despite rising ULIP contributions.

* The share of the par segment increased to 24% from 14% in 2QFY25 on account of new product offerings. The share of the non-par segment dipped to 15% (35% in 2QFY25) but is expected to improve going forward, with attractiveness increasing owing to declining interest rates and rising demand for guaranteed solutions.

* The protection segment is experiencing traction as the share of total APE has grown from 12% in 2QFY25 to 13% in 2QFY26. In terms of new business premium, the share of term has increased to 28.2% from 26.6% in 2QFY25. The segment witnessed ~3x growth compared to overall company growth, contributing positively to VNB margin. Retail protection grew 50% post-GST exemption from 22nd Sep’25.

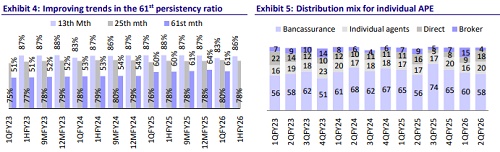

* On an individual APE basis, the banca/agency/direct channels witnessed a YoY growth of 12%/25%/19%. HDFC’s counter share remained stable, while wallet share among other banks is improving compared to 1QFY26, according to the management.

* HDFCLIFE’s persistency ratios have declined YoY across all cohorts except 49th - month persistency, which improved to 70.1% from 69.2% in 2QFY25.

* As of Sep’25, total AUM increased by 11% YoY to INR3.6t.

* Embedded Value (EV) grew 14.2% YoY to INR595.4b as of Sep’25, with operating RoEV for 1HFY26 at 15.8%. The solvency ratio for the quarter stood at 175% and is expected to improve to 180-185% post-debt raising in 2HFY26.

* HDFCLIFE’s commission ratios have seen an increase YoY to 12% (10.9% in 2QFY25), offset by operational efficiencies, resulting in a rise in overall expense ratio to 21.3% from 20.9% in 2QFY25.

Highlights from the management commentary.

* Around 80% of September’s new business was issued post-GST changes, showing early signs of stronger growth post-GST changes.

* HDFCLIFE plans to raise INR7.5b of debt in 2HFY26, which is expected to enhance solvency by around 7%. Solvency levels dipped due to 1) dividend payout – 4.5%, 2) subordinated debt repayment – 6%, 3) GST impact – 1.5%, and 4) new business strain. Management aims to maintain solvency within the 180–185% range.

* About 50% of the input tax credit loss arises from distributor commissions, with the remainder stemming from technology and outsourcing expenses. Management is actively engaging with vendors and distributors to share costs and optimize efficiency.

Valuation and view

* HDFCLIFE maintains an industry-leading growth trajectory along with a stable VNB margin driven by a diversified product mix, rising sum assured (especially in ULIPs), and improving rider attachments. While the impact of input tax credit loss will dampen the profitability in the short run, a strong growth trajectory, improving product-level margin, and cost optimization measures should help normalize its VNB margin.

* We trim our VNB margin assumptions by 70bp for FY26, considering the impact of the loss of input tax credit. We have factored in a 0.5% EV hit on the back book, resulting in a 0.6% decline in our FY26/27/28 EV estimates. We roll over to Sep'27E EV to arrive at our TP of INR910 (based on 2.4x Sep'27E EV). Reiterate BUY

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412