Buy Eternal Ltd for the Target Rs.330 by Motilal Oswal Financial Services Ltd

Quick commerce losses bottoming out

Subject to competition

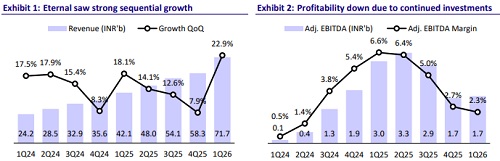

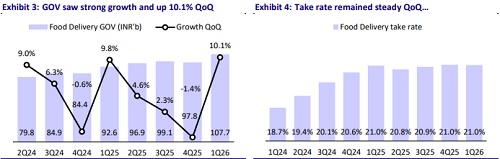

* Eternal reported 1QFY26 revenue of INR72b, up 70% YoY, above our estimated growth of 62% YoY. Growth was led by Blinkit as its gross order value (GOV) increased 26% QoQ/140% YoY. The food delivery business delivered 16% YoY growth in GOV.

* The company expects that in FY26, net order value (NOV) growth in food delivery is unlikely to exceed 20% but should remain above 15%, with momentum building toward 20% YoY growth in FY27. PAT came in at INR250m (est. INR2.7b), down 90% YoY. For 1QFY26, revenue grew 70%, whereas adj. EBITDA declined 42% YoY.

* For 2QFY26, we expect revenue/adj. EBITDA to grow 66%/15% YoY. Our TP of INR330 implies a 21% upside from the current price. We reiterate our BUY rating on the stock, supported by Eternal’s market leadership in both quick commerce and food delivery, and the long-term potential of Blinkit as a generational opportunity in retail, grocery, and e-commerce disruption.

Our view: Margin improvement likely even with ongoing expansion

* Quick commerce losses have peaked; margins to improve despite aggressive expansion: Blinkit’s adjusted EBITDA margin improved to -1.8% of NOV in 1QFY26 (from -2.4% in 4QFY25), despite adding 243 new dark stores. Management believes absolute losses have peaked and margins will continue to improve as recently opened stores mature. There is already 2.5%+ margin in some cities, reinforcing long-term guidance of 5-6% EBITDA margins. The store count is expected to increase from ~1,550 currently to 2,000 by Dec’25, with visibility up to 3,000.

* Shift to inventory-led model to lift margins; working capital to rise: Zomato will move its quick commerce model from marketplace (3P) to inventory ownership (1P) over the next 2-3 quarters. This is expected to improve margins by ~100bp through better assortment control and supplier terms, while increasing net working capital intensity from ~1% to ~5% of NOV. As of 1Q, 3% of NOV was already on owned inventory, driving faster revenue growth vs. NOV.

* Food delivery margin matures; focus shifts to growth over expansion: Food delivery adjusted EBITDA margin stood at 5.0% of NOV in 1Q, up from 3.9% YoY but slightly down QoQ due to seasonal factors (delivery partner shortages during festivals and weather). While long-term margin expansion is possible, the near-term focus will be on demand recovery and reinvesting in growth. FY26 NOV growth is expected to exceed 15%, with potential to return to ~20% in FY27. We believe food delivery margins will now trend at 4.5-5% (of GOV), and we shift our valuation methodology to EV/EBITDA multiple.

* Going-out business scaling up well, but will drive INR1.5b in losses in FY26: The “District” (going-out) vertical is now an INR80b annualized NOV business, growing 30%+ YoY, with ARPO of INR160+ (higher than food delivery/quick commerce). However, investments in Bistro (10-minute food) and Nugget will result in ~INR 1.5b of FY26 losses in the “Others” segment

Valuation and change in estimates

? Eternal’s food delivery business is stable, and Blinkit offers a generational opportunity to participate in the disruption of industries such as retail, grocery, and e-commerce. We lower our FY26/FY27 estimates by ~14%/~18%, factoring in continued dark store expansion and ~INR1.5b in FY26 losses from newer initiatives such as Bistro (10-minute food delivery) and Nugget under the “Others” segment. Eternal should report PAT margin of 3.1%/6.5% in FY26E/FY27E. Our TP of INR330 implies a 21% upside from the current price. We reiterate our BUY rating on the stock.

Quick commerce/food delivery GOV in line with our estimates; guides for margins bottoming out in quick commerce

* Eternal reported 1QFY26 net revenue of INR72b (23% QoQ/70% YoY), above our estimate of +62% YoY.

* Food delivery GOV came in at INR107.6b, in line with our estimate of INR107.5b. Blinkit GOV came in at INR118.2b (up 140% YoY) vs. our estimate of INR117.8b.

* For food delivery, adjusted EBITDA as % of GOV margin was down 20bp QoQ at 4.2%, missing our estimate of 4.5%.

* This was the first quarter where quick commerce NOV (INR92b) exceeded food delivery NOV (INR89b) for the full quarter.

* Blinkit reported contribution margin of 3.0% (3.1% in 4Q). Adj. EBITDA margin was -1.4% (vs. -1.9% in 4QFY25), largely in line with our expectation of -1.2%. It added 243 net new stores in 1QFY26 and is on track to reach 2,000 by Dec’25.

* Consol. reported EBITDA came in at INR1,150m (1.6% reported EBITDA margin vs. 1.2% in 4Q).

* Food delivery revenue increased 10% QoQ/16% YoY (est. 10% QoQ), whereas contribution margin declined to 8.2% from 8.6% in 4Q.

* Quick commerce revenue grew 40% QoQ/155% YoY (est. 25% QoQ growth).

* PAT stood at INR250m, down 90% YoY (est. INR2.7b).

* YoY adj. revenue grew by 67%. For FY26, Eternal expects to deliver over 15% NOV growth, with a positive bias toward 20% YoY growth in FY27.

Key highlights from the management commentary

* Food Delivery: For FY26, management expects NOV growth to be above 15% YoY, although achieving over 20% growth appears unlikely. The company anticipates NOV growth to trend toward 20% in FY27. Growth in MTC (monthly transacting customer) was healthy and aligned with NOV growth. Eternal believes YoY growth has bottomed out and expects stronger growth in the upcoming quarters. 2QFY26 is expected to be better than 1Q.

* Blinkit: This was the first quarter where Blinkit's NOV (INR 92bn) surpassed that of food delivery (INR89b) for a full quarter. The customer base is valueconscious rather than price-sensitive. The company focuses on speed, assortment, support, and price to drive customer satisfaction. Over the next 2-3 quarters, Blinkit will gradually transition from a marketplace model to an inventory-ownership model. This will reduce administrative costs (e.g., licensing).

* As NOV grows, operating leverage is expected to drive improvement in adjusted EBITDA margins. While marketing costs (reported below contribution margins) may not reduce, they are expected to remain stable if competition levels remain unchanged.

* A majority of the business is concentrated in 20 cities. New stores are currently loss-making due to lower throughput.

* IOCC inventory model: Under the inventory model, NWC is expected to be ~18 days of NOV, compared to 3-4 days under the marketplace model. Current productivity is INR700,000 daily NOV per store. Management expects a 100bp expansion in contribution margin over time as a result of this transition.

Valuation and view

* Eternal's food delivery business is stable, and Blinkit offers a generational opportunity to participate in the disruption of industries such as retail, grocery, and e-commerce. We value the QC business using a DCF methodology with a 12.5% cost of capital and assign a 30x EV/EBITDA multiple to the FD business. Additionally, we ascribe a combined value of ~USD1b to Hyperpure, Going-out, and other residual businesses. We reiterate our BUY rating with a TP of INR330, implying 21% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)