Buy Poonawalla Fincorp Ltd For Target Rs. 440 by Motilal Oswal Financial Services Ltd

Elevated opex and NIM compression lead to earnings miss

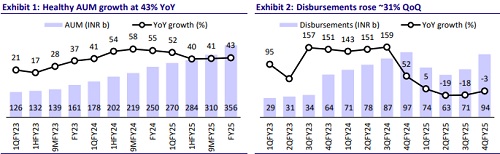

AUM rises ~43% YoY; opex intensity to remain elevated for two quarters

* Poonawalla Fincorp (PFL)’s 4QFY25 PAT declined ~81% YoY to ~INR623m (MOFSLe: INR1.8b). FY25 loss was INR983m (vs. PAT of INR10.3b in FY24).

* NII in 4QY25 grew ~8% YoY to ~INR6.1b (~12% miss). Other income rose ~34% YoY and ~80% QoQ to ~INR1b. The increase in other income is due to higher fee income and assignment income during the quarter.

* Opex rose 106% YoY to ~INR4.8b (~48% higher than MOFSLe), with the C/I ratio rising to ~67% (PQ: 45% and PY: ~36%). PPoP declined ~42% YoY to ~INR2.4b (~47% miss).

* Provisions stood at INR1.6b (MOFSLe: ~INR2.1b), translating into annualized credit costs of ~1.9% (PQ: 4.7% and PY: 0.4%).

* The company has successfully launched six businesses ahead of schedule. While the rollout of new businesses and plans to open 400 additional branches in 1QFY26 will keep operating expenses elevated over the next two quarters, however, the opex-to-AUM ratio is expected to start moderating from 2HFY26 onwards.

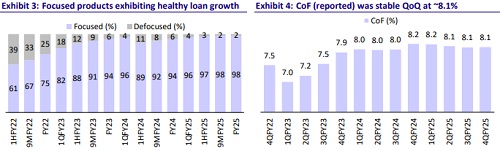

* Management highlighted that the erstwhile STPL book has declined to ~8% of the portfolio as of Mar’25 (from ~21% in Sep’24). Notably, ~80% of the STPL book is now 0dpd, and the company does not anticipate any further stress from this segment, supported by improving collection efficiencies.

* Management continued to guide an AUM growth of 35-40% in FY26, reaffirming its confidence in achieving these targets. We model AUM growth of ~44%/41% in FY26/FY27. Management also indicated that FY26 would be focused on driving AUM growth, with an emphasis on building sustainable profitability from FY27 onwards.

* We cut our FY26E/FY27E PAT by 17%/10% to factor in higher operating expenses. We model a CAGR of 42% in AUM over FY25-FY27E and expect PFL to deliver RoA/RoE of ~2.9%/~18% in FY27. Reiterate BUY with a TP of INR440 (premised on 3.2x Mar’27E BVPS).

Robust AUM growth of ~43% YoY; all six new businesses launched

* AUM grew ~43% YoY and ~15% QoQ to ~INR356b. The AUM mix consisted of ~36% in MSME finance, ~23% in personal and consumer finance, ~24% in LAP, and ~14% in pre-owned cars. Disbursements grew ~31% QoQ to ~INR94b in 4QFY25.

* The company has successfully launched all six businesses well ahead of its schedule. Each of the six new businesses follows a distinct distribution strategy – Gold Loans through dedicated branches (400 planned), Consumer Durables via 10,000–12,000 point-of-sale (PoS) outlets, Commercial Vehicles through dealership networks, Personal Loans through a DSA network/partnerships and a 24x7 digital platform for Prime PL targeting top corporates.

NIM contracts ~130bp QoQ due to ~110bp compression in yields

* NIM (calc.) dipped ~130bp QoQ to ~8%, led by ~110bp QoQ decline in yields to ~14.1%. The CoB (calc.) declined ~5bp QoQ to ~7.75%.

* With ~70% of total borrowings in variable rate instruments, the company is wellpositioned to benefit from a declining interest rate environment.

* We model a NIM of ~8%/8.2% in FY26/FY27 (vs. ~7.8% in FY25).

Credit costs dip sequentially; GS3 stable QoQ

* GS3 was largely stable QoQ at ~1.85%, while NS3 rose ~4bp QoQ to ~0.85%. PCR on S3 loans declined ~230bp QoQ to ~55% (PQ: ~57% and PY: ~49%).

* The company will be implementing AI-based support tools for its credit and risk functions by 4QFY26. Additionally, it will deploy suspicious transaction reporting with AI/ML by 3QFY26.

* We model credit costs of ~2.0%/1.6% in FY26/FY27 (vs. ~5.1% in FY25).

Highlights from the management commentary

* Collection processes have strengthened, driving a 9–10% improvement in forward collection efficiency, while early bucket flows have declined by >40%.

* The company recently raised INR15.25b through NCDs in Apr’25, increasing the share of NCDs in total borrowings to 12% (up from 6% in Mar’24).

* STPL credit costs declined to INR1.37b in 4QFY25 from INR2b in 3QFY25, which declined ~33% QoQ. Total write-offs for FY25 stood at INR15.5b, with 4QFY25 write-offs significantly lower compared to 2Q and 3Q.

Valuation and view

* PFL reported healthy AUM growth during the quarter, even as the earnings missed expectations due to higher operating expenses, partially offset by a sequential reduction in credit costs. The company remains focused on growth in FY26, with an emphasis on improving profitability metrics from FY27 onwards. We remain watchful of the situation and the on-ground execution of the company's stated strategy. Reiterate BUY with a TP of INR440 (premised on 3.2x Mar’27E BVPS).

* Key downside risks: a) inability to execute its articulated strategy despite a new management team and investments in technology, distribution, and collections; and b) aggressive competitive landscape leading to pressure on spreads and margins and/or deterioration in asset quality.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412