Neutral Swiggy Ltd for the Target Rs. 340 by Motilal Oswal Financial Services Ltd

Q-commerce continues to burn cash

But management indicates peak burn behind

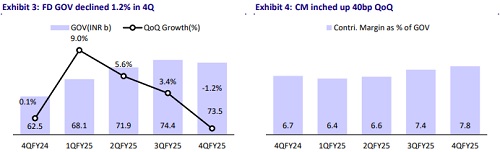

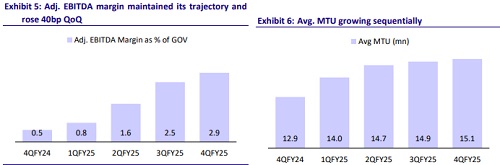

* Swiggy delivered a revenue of INR44.1b in 4QFY25 (up 10.4% QoQ) vs. our est. of INR42.2b. The food delivery (FD) business’s GOV grew 17.6% YoY, whereas the contribution margin (CM) expanded 40bp QoQ to 7.8%. FD’s adjusted EBITDA as a % of GOV margin improved 40bp QoQ to 2.9% vs. our est. of 2.7%.

* Instamart’s GOV was INR46.7b (up 101% YoY) vs. our estimate of INR 45.5b. The contribution margin dipped 100bp QoQ to -5.6%. Adjusted EBITDA as a % of GOV was -18.0% (-14.8% in 3Q), missing our estimate of -16.6%.

* Overall, Swiggy posted a net loss of INR10.8b, marking a growth of 94.9% YoY. ? For FY25, revenue/adj. EBITDA loss grew 35.4%/4.0% YoY vs. FY24. For 1QFY26, we expect revenue/adj. EBITDA loss to increase 11.3%/13.7% QoQ. Our DCF-based valuation of INR340 suggests a 9% potential upside. We reiterate our Neutral rating on the stock.

Our view: we remain on the sidelines

* EBITDA losses in quick commerce could have peaked, but we remain on the sidelines: Management indicated that it plans to sequentially improve CM from here, as CM drag is led by underutilisation of network and elevated customer incentives; further, a huge part of the CM costs are currently around marketing-related and could be pulled back. Accordingly, management indicated that CM will sequentially improve from here. Cash burn still makes staying on the sidelines, though. Irrational competition and cash burn intensity currently remain too high, and we remain on the sidelines.

* The 10-minute food delivery a clear differentiator: Zomato's decision to exit the 10-minute food delivery gives Swiggy a clear field to innovate and gain market share in the quick-food delivery market. It looks like the unit economics are favorable, and this could be a key differentiator for Swiggy. The company mentioned that Bolt now contributes 12% of the total FD orders and could be a meaningful weapon to gain market share.

* We will continue to monitor the megapod strategy: While Swiggy is admittedly behind competitors when it comes to the 20k+ SKU game, its megapod strategy has the potential to breach the e-commerce territory and could provide a meaningful push to AOV. We have argued earlier (“Quick” commerce, delayed gratification, page 27) that take rates and AOVs for Swiggy need to improve if CM is to improve meaningfully, and this is a step in the right direction.

Valuation and view

* We believe FD remains a stable duopoly; however, increased competition and aggressive dark store expansion have rebased profitability expectations for the QC sector in the near term. Despite this, our implied EV/GMV FY27e multiple for QC is at 0.4x, which we do not consider to be overly demanding, especially after the recent correction (the stock is down 47% from its peak). An acceleration in AOV and take rates in the medium term could prompt us to turn constructive on the stock.

* We expect food delivery orders to rise 11.7% annually with an AOV growth of ~1.0%, leading to a GOV growth of 12.6% over FY25-37 (18.5% GOV CAGR over FY25-29). QC is likely to grow faster, with orders increasing at 26.2% annually, AOV growth at 2.7%, and GOV growth at 29.5% (67% GOV CAGR over FY25-29).

* Swiggy is likely to report a PAT margin of -18.9%/-10.0% in FY26/FY27. Our profitability estimates for FY26/FY27 have been hit by intensive competition and dark store expansion. Our DCF-based valuation of INR340 suggests a 9% potential upside from CMP. We reiterate our Neutral rating on the stock.

FD GOV in line; Instamart’s adj. EBITDA misses our estimate

* Swiggy reported a 4QFY25 net revenue of INR44.1b (+10.4%/44.8% QoQ/YoY) vs. our estimate of INR 42.2b.

* FD GOV stood at INR73.4b (-1.2% QoQ and +17.6% YoY) vs. our estimate of INR 73.2b. The company maintains annual growth guidance of 18-22% over the medium term.

* Instamart’s GOV came in at INR46.7b (up 101% YoY) vs. our estimate of INR 45.5b. Dark store expansion accelerated with 316 new active dark stores added in 4Q alone (greater than the cumulative addition in the last eight quarters).

* For food delivery, adjusted EBITDA as a % of GOV margin improved 40bp QoQ at 2.9% vs. our estimate of 2.7%.

* Instamart’s adjusted EBITDA as a % of GOV was -18% (-14.8% in 3Q) vs. our estimate of –16.6%.

* Consol. Adj. EBITDA came in at negative INR7.3b due to growth investments in QC.

* Instamart delivered a contribution margin of -5.6% (-4.6% in 3Q) vs. our est. of - 5.2% due to growth investments in quick commerce for customer acquisition.

* Swiggy posted a net loss of INR10.8b (est. INR10.3b), an increase of 94.9% YoY.

Key highlights from the management commentary

* FD: 4Q is a seasonally weak quarter coming after the festive season, though it does benefit late in the quarter due to a popular sporting event in India. Bolt is for speed; a lot of work is happening in value. Swiggy One is for differentiation. It retains an annual growth guidance of 18-22% over the medium term. Currently, over 12% of FD platform orders are through Bolt. New users acquired through Bolt have shown 4-6% higher monthly retention than the platform average.

* Instamart The Quick-commerce industry is going through a phase of heightened consumer awareness and store rollouts. Mature cohorts do not need incentives. Incentives are for trials and value propositions, and these are ensuring customer stickiness. Over multiple quarters, retention has gone up. There shall be some gradation in the store addition. The decision to open a store and go live in 60 days.

* Maxxsaver will be a key value driver of the AOV expansion pathway, alongside megapods driving selection. Maxxsaver offers an additional discount for larger order values.

* Expect to reach a contribution break-even in 3-5 quarters from now for Instamart. The corporate adj. EBITDA breakeven timeline continues to remain in sync with the contribution breakeven for Quick-commerce (earlier guided for 3QFY26).

Valuation and view

* We expect food delivery orders to grow at 11.7% annually with an AOV growth of ~1.0%, leading to a GOV growth of 12.6% over FY25-37 (18.5% GOV CAGR over FY24-29). QC is likely to grow faster, with orders increasing at 26.2% annually, AOV growth at 2.7%, and GOV growth at 29.5% (67% GOV CAGR over FY25-29). Swiggy is likely to report a PAT margin of -18.9%/-10.0% in FY26/FY27. Our profitability estimates for FY26/FY27 have been hit by intensive competition and dark store expansion. Our DCF-based valuation of INR340 suggests a 9% potential upside from CMP. We reiterate our Neutral rating on the stock

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)