Neutral Amara Raja Ltd for the Target Rs. 940 by Motilal Oswal Financial Services Ltd

Steady quarter

Medium-term margin guidance maintained

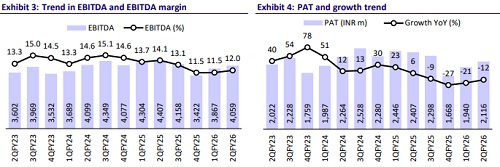

* Amara Raja’s (ARENM) 2QFY26 PAT at INR2.1b came in line with our estimates. Even at the operating level, EBITDA margin was in line with our estimates at 12% (+50bp QoQ).

* We cut our FY26/FY27 EPS estimates by 6%/8.5% to factor in continued margin pressure in 2Q. While the market is optimistic about ARENM’s Li-ion initiative, we are cautious about its potential returns. We believe the stock, trading at around 23.0x FY26E/19.6x FY27E EPS, appears fairly valued. We reiterate a Neutral rating with a TP of INR940, based on 15x standalone EPS and Investment in New Energy business valued at INR 131 per share.

2Q earnings in line with estimates

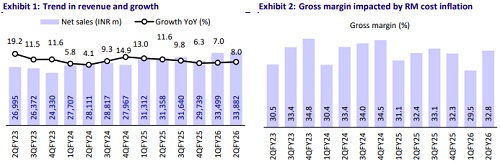

* ARENM’s revenue grew 8% YoY to INR33.9b, in line with our estimate. This growth was primarily driven by the new energy business (+68.9% to INR1.7b), while lead acid and allied products posted modest growth (+4.7% to INR33b).

* EBITDA margin expanded 50bp QoQ (-210bp YoY) to 12% and was in line with our estimate. EBITDA declined ~8% YoY to INR4.1b.

* During the quarter, ARENM received a reimbursement in response to claims against a fire accident at its Chittoor facility. This translated into a one-time extraordinary gain of INR1.2b.

* Hence, reported PAT grew 25.4% YoY to INR4.1b. However, adjusted for this gain, PAT declined 12.1% YoY to INR2.1b (in line with our estimate).

* The Board has approved an interim dividend of INR5.4 per equity share for this quarter.

* At a consolidated level, OCF for 1HFY26 came in at INR5.3b, with INR6.4b spent on capex. AMRJ posted a negative free cash of INR1.1b for 1HFY26.

* 1HFY26 Revenue/EBITDA/PAT grew 7.5%/ -9.0%/ -16.4%, respectively, to INR67b/7.9b/4.1b, respectively. For the remainder of FY26, we expect each of these metrics to grow ~11%/8%/-5%, respectively, to INR68b/INR8.1b/INR3.7b.

Highlights from the management commentary

* OEM volumes across both 4W and 2W grew ~30% YoY, supported by strong festive season demand and pre-buying following GST revisions. Management expects growth to normalize to industry levels in subsequent quarters.

* Management reiterated its confidence in sustaining high single-digit growth in the lead-acid business and scaling the new energy business to contribute 7-8% of total revenue by FY27.

* Management guided for further improvement in the coming quarters, as the tubular battery plant ramps up to full capacity in 3Q and the battery recycling facility commences operations in 4QFY26.

* The company aims to restore consolidated EBITDA margins to 13-14% over time, driven by operational efficiencies, backward integration through recycling, and cost normalization.

* FY26 outlay of INR13b is planned. Of this, about INR6b is likely to be invested in the lead acid battery business (including tubular plant and battery breaking operations) and another INR7b is likely to be invested in the cell manufacturing facility.

* The company is likely to incur capex of INR3.5-4b for its lead acid business in FY27E, and INR10b for its cell manufacturing facility.

Valuation and view

* ARENM’s venture into the lithium-ion business is strategically sound, given the opportunities in the segment and risks facing its core business. However, there are notable challenges: 1) market opportunities are limited by existing OEM partnerships; 2) the low-margin nature of the lithium-ion business is likely to dilute returns; and 3) the long-term viability of the technology remains uncertain despite the large capital investment.

* While the market is optimistic about ARENM’s Li-ion initiative, we are cautious about its potential returns. We believe the stock, trading at around 23.0x FY26E/19.6x FY27E EPS, appears fairly valued. Therefore, we reiterate a Neutral rating with a TP of INR940, based on 15x standalone EPS and Investment in New Energy business valued at INR 131 per share.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412