Buy J K Cement Ltd for the Target Rs.7,300 by Motilal Oswal Financial Services Ltd

EBITDA in line; strong execution on expansions

Central and South regions fuel robust volume growth

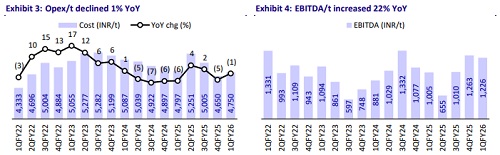

* JK Cement (JKCE) reported strong EBITDA growth, up ~41% YoY to INR6.9b (in line) in 1QFY26, led by robust volume growth (~+16%) and improvement in realization (~+3%). EBITDA/t surged ~22% YoY to INR1,226 (in line). Adj. PAT jumped ~75% YoY to INR3.2b (+19% vs. our estimate, fueled by lower depreciation and higher other income).

* Management highlighted that the Central and South regions propelled strong volume growth, while the North was weak. The average cement price was flat sequentially, as strong pricing in the South was offset by pressure in the Central and Northern regions. JKCE maintained its FY26 grey cement volume guidance of 20mt and aims to achieve cost savings of INR40–50/t. Capacity expansion is progressing on schedule, with Panna and Bihar projects (total clinker/grinding capacity of 4.0mtpa/6.0mtpa) expected to be commissioned by Dec’25.

* We broadly maintain our EBITDA estimates for FY26-28. We raise our EPS by ~6-7% for FY26/27E due to a lower depreciation estimate. We value JKCE at 18x Jun’27E EV/EBITDA (at a premium to its long-term average) to arrive at our TP of INR7,300. We reiterate our BUY rating on the stock.

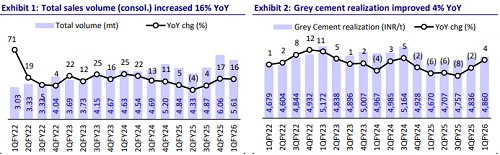

Sales volume up ~16% YoY; grey cement realization flat QoQ

* JKCE’s consol. revenue/EBITDA/PAT stood at INR33.5b/INR6.9b/INR3.2b (+19%/+41%/+75% YoY and +4%/+4%/+19% vs. our estimate). Its sales volume grew ~16% YoY (+7% vs. est.) as the grey cement volume was up ~17% YoY (+8% vs. est.) and white cement volume was up 9% YoY (in line).

* Blended realization increased 3%/1% YoY/QoQ (-3% vs. est.). Grey cement realization was up 4% YoY and remained flat QoQ. White cement realization was flat YoY/up 2% QoQ.

* Opex/t declined ~1% YoY (-3% vs. estimates), led by ~5%/2% YoY decline in variable cost/employee cost per ton. Freight cost per ton increased ~7% YoY, whereas other expenses/t stood flat YoY. Depreciation/interest costs declined ~1%/2% YoY, while other income increased ~26% YoY.

Highlights from the management commentary

* The grey cement volume growth in Central India was 30%+, followed by growth in the teens in the South, aided by a low base. However, volumes declined in the North due to weak demand in the region.

* Fuel consumption cost/kcal was INR1.53 vs. INR1.62/INR1.41 in 1QFY25/4QFY25. Green energy contributed ~52% of energy requirements in 1QFY26 vs. 57% in 1QFY25. The thermal substitution rate was 13.2% in 1QFY26 vs. 17.3% in 1QFY25.

* The company accrued INR850m in incentives in 2QFY25. The current run rate of incentives is expected to continue over the next few years. It estimates the full-year incentive to be at ~INR3.0b.

Valuation & View

* JKCE’s EBITDA was in line with our estimates, as the benefit of higher volume and lower opex/t than our estimates was offset by lower-than-estimated realization. In our recent update, we highlighted that the company is delivering on expectations, and the expansions would continue to drive growth. We expect its revenue/EBITDA/profits to post a CAGR of 13%/22%/34% over FY25-28E. We estimate EBITDA/t to reach INR1,280 in FY28E vs. INR1,194 in FY26E. We estimate RoE of JKCE to be at ~19-20% in FY26-28.

* In the past few years, JKCE has been re-rated given its strong capacity expansion and ramp-up capabilities, cost reduction initiatives, and strong return ratios. The stock trades at 19x/16x FY26E/27E EV/EBITDA. We value JKCE at 18x Jun’27E EV/EBITDA (at a premium to its long-term average) to arrive at a TP of INR7,300. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

.jpg)