Neutral KFin Technologies Ltd For Target Rs.1,300 by Motilal Oswal Financial Services Ltd

Revenue in-line; elevated tech costs impact EBITDA

* KFin Technologies (KFINTECH) reported 33% YoY growth in operating revenue to INR2.9b in 3QFY25 (in-line), driven by 37%/17%/52% YoY growth in domestic MF solutions/issuer solutions/international solutions. For 9MFY25, revenue grew 33% YoY to ~INR8.1b.

* Total operating expenses grew 32% YoY to INR1.6b (in-line), resulting in 33% YoY growth in EBITDA to INR1.3b (in-line). While employee costs were in-line, elevated tech costs resulted in a 4% miss on other expenses. EBITDA margin expanded to 45% in 3QFY25 vs. 44.8% in 3QFY24 (our est. of 45.9%).

* KFINTECH reported a net profit of INR902m, up 35% YoY (6% miss) in 3QFY25. Apart from higher-than-expected other expenses, the miss was also due to a 14% miss on other income. For 9MFY25, PAT rose 44% YoY to INR2.5b.

* Recent trends indicate that MF investors have been cautious due to weak market sentiment, which is likely to impact industry flows. This, along with the MTM hit, could reduce KFINTECH’s revenues by 4-5%.

* We have cut our earnings estimates by 4%/5% for FY25/FY26 to factor in the slowdown in net flows and MTM correction. We expect revenue/PAT to post a CAGR of 22%/31% over FY24-27 and maintain a Neutral rating on the stock with a one-year TP of INR1,300, premised at a P/E multiple of 45x on Sept’26E earnings.

Strong performance across business segments

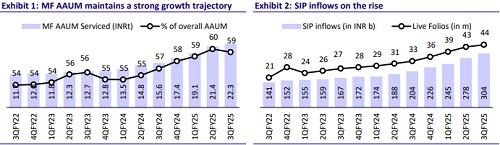

* Equity MF AAUM serviced during the quarter grew 50% YoY to INR13.3t, reflecting a market share of 33.4% (33.5% in 3QFY24) and contribution of 59% to overall AAUM.

* Strong net flows and a healthy yield of 3.7bp (in-line) in 3QFY25 resulted in a 37% YoY growth in revenue from the domestic MF business, reaching INR2.1b (in-line). This segment contributed 72% to the overall revenue.

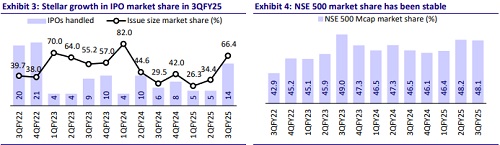

* In the issuer services business, KFINTECH’s market share (in terms of issue size) doubled YoY to 66.4% in 3QFY25, as the company managed 14 main board IPOs during the quarter (6 in 3QFY24). This led to a 17% YoY growth in revenue from issuer solutions to INR439b (in-line) in 3QFY25.

* In the international investor solutions business, the number of clients reached 70, bringing the total AUM serviced to INR823b. Revenue from this segment grew 52% YoY to INR329m (in-line). A further rise in deal size, from INR30-35m, is expected to boost revenue from this segment.

* In the alternates and wealth business, market share stood at 36.7% with an AUM of INR1.4t. The NPS market share continued to rise, reaching 9.4% in 3QFY25 (7.8% in 3QFY24), with an AUM of INR500b. Revenue from global business services declined 38% YoY to INR50m (40% miss). Revenue from this segment will remain lumpy but is expected to contribute to the overall topline starting next quarter.

* Employee expenses grew 25% YoY to INR1,040m (in-line) and other expenses grew 47% YoY to INR555m (4% higher than est.). The cost-toincome ratio at 55% (55.2% in 3QFY24) was slightly above our expectations (54.1%).

* Other income grew 41% YoY (down 14% QoQ) to INR91m (14% miss), resulting in a 6% miss in PAT, which was reported at INR902m (+35% YoY).

Key takeaways from the management commentary

* A sequential MTM correction of 4% in 3QFY25 offset the higher inflows in the domestic MF business. In Jan’25, there was an additional 4% correction, and net flows have slowed down as well.

* For the overseas MF business, KFINTECH is focusing on Malaysia, Philippines, and Thailand due to strong MF opportunities in these markets. Meanwhile, Singapore and Hong Kong present greater opportunities for alternates.

* KFINTECH handled the top five IPOs (in terms of issue size) during the quarter, and this trend is expected to continue, with IPOs of IGI India and LG Electronics in the pipeline.

Valuation and view

* Structural tailwinds in the MF industry will drive absolute growth in MF revenue. With its unique ‘platform-as-a-service’ business model offering comprehensive end-to-end solutions enabled by proprietary technology solutions, KFINTECH is well positioned to benefit from strong growth in large markets both in India and globally. The increasing traction for non-market-linked revenue streams will further boost revenues, particularly during a volatile market environment.

* We have cut our earnings estimates by 4%/5% for FY25/FY26 to factor in the slowdown in net flows and MTM correction. We expect revenue/PAT to post a CAGR of 22%/31% over FY24-27 and maintain a Neutral rating on the stock with a one-year TP of INR1,300, premised at a P/E multiple of 45x on Sept’26E earnings.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412